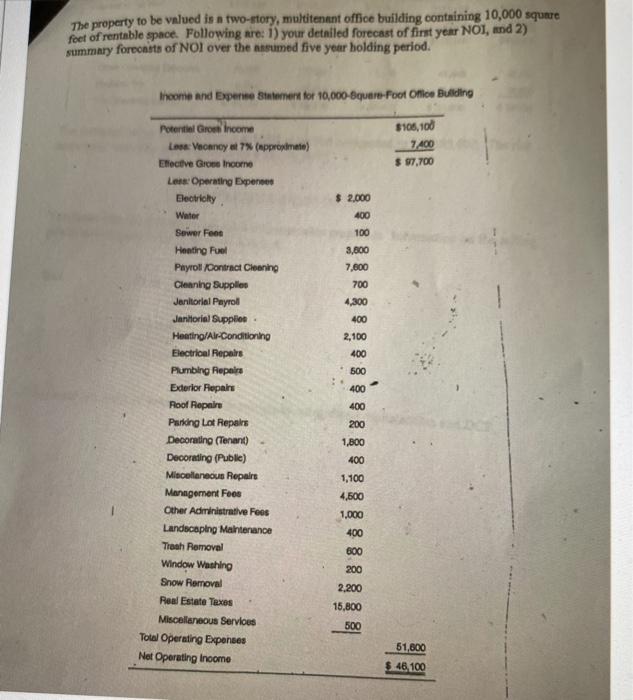

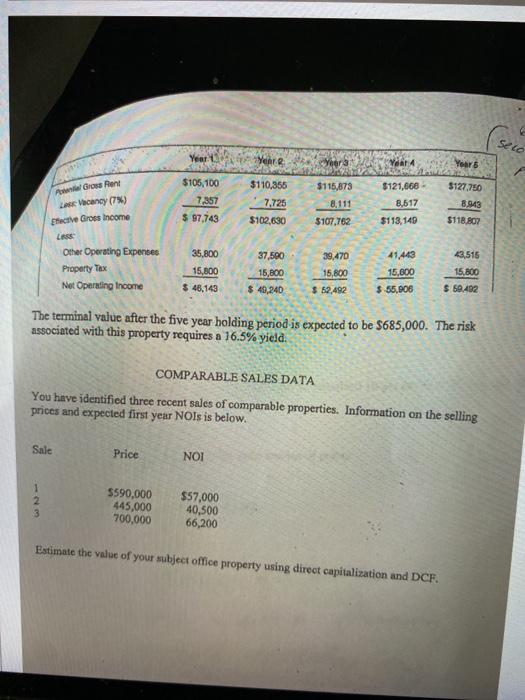

The property to be valued is a two-story, multitenant office building containing 10,000 square foet of rentable space. Following are: 1) your detailed forecast of first year NOI, and 2) summary forecasts of NOI over the assumed five year holding period. thome and Experte Stemer for 10,000 Square Foot Office Building $106,100 7400 $ 87,700 $ 2.000 400 100 3,800 7,600 700 4,800 400 Potential Grow Income Los Vacancy et 7% (approximate) Effective Give Income Lees Operating Expenses Electroly Water Sewer Feet Heating Fuel Payroll Contract Cleaning Cleaning Supplies Janitorial Payroll Janitorial Supplies Heatino/Air-Conditioning Electrical Repairs Plumbing Repair Exterior Repairs Roof Repair Parking Lot Repairs Decorating (Tenant) Decorating (Publie) Miscellaneous Repairs Management Focs Other Administrative Fees Landscaping Maintenance Trash Removal Window Washing Snow Removal Real Esta Teen Miscellaneous Services Total Operating Expenses Net Operating Income 2,100 400 500 400 400 200 1,800 400 1,100 4,500 1,000 400 600 200 2,200 15,800 500 51,600 $ 46.100 Selo Year 12 "Mere Woer Year 4 Years Gross Rent $105,100 7,357 $ 97,743 LA Vancy (79) Efecte Gross Income LARS $110,355 7.725 $102,630 $115,873 8.111 $107,762 $121,668 8,517 $113, 149 $127.750 8.943 $118.807 37,500 41.443 Other Operating Expenses Property Tax Net Operating Income 35,800 15,800 $ 46,143 39,470 15,800 $ 52,492 15,800 $ 40,240 15.000 13,516 15,800 $ 50.492 $ 55,008 The terminal value after the five year holding period is expected to be $685,000. The risk associated with this property requires a 16,5% yield. COMPARABLE SALES DATA You have identified three recent sales of comparable properties. Information on the selling prices and expected first year NOIs is below. Sale Price NOI 2 3 5590,000 445,000 700,000 $57,000 40,500 66,200 Estimate the value of your subject office property using direct capitalization and DCF. The property to be valued is a two-story, multitenant office building containing 10,000 square foet of rentable space. Following are: 1) your detailed forecast of first year NOI, and 2) summary forecasts of NOI over the assumed five year holding period. thome and Experte Stemer for 10,000 Square Foot Office Building $106,100 7400 $ 87,700 $ 2.000 400 100 3,800 7,600 700 4,800 400 Potential Grow Income Los Vacancy et 7% (approximate) Effective Give Income Lees Operating Expenses Electroly Water Sewer Feet Heating Fuel Payroll Contract Cleaning Cleaning Supplies Janitorial Payroll Janitorial Supplies Heatino/Air-Conditioning Electrical Repairs Plumbing Repair Exterior Repairs Roof Repair Parking Lot Repairs Decorating (Tenant) Decorating (Publie) Miscellaneous Repairs Management Focs Other Administrative Fees Landscaping Maintenance Trash Removal Window Washing Snow Removal Real Esta Teen Miscellaneous Services Total Operating Expenses Net Operating Income 2,100 400 500 400 400 200 1,800 400 1,100 4,500 1,000 400 600 200 2,200 15,800 500 51,600 $ 46.100 Selo Year 12 "Mere Woer Year 4 Years Gross Rent $105,100 7,357 $ 97,743 LA Vancy (79) Efecte Gross Income LARS $110,355 7.725 $102,630 $115,873 8.111 $107,762 $121,668 8,517 $113, 149 $127.750 8.943 $118.807 37,500 41.443 Other Operating Expenses Property Tax Net Operating Income 35,800 15,800 $ 46,143 39,470 15,800 $ 52,492 15,800 $ 40,240 15.000 13,516 15,800 $ 50.492 $ 55,008 The terminal value after the five year holding period is expected to be $685,000. The risk associated with this property requires a 16,5% yield. COMPARABLE SALES DATA You have identified three recent sales of comparable properties. Information on the selling prices and expected first year NOIs is below. Sale Price NOI 2 3 5590,000 445,000 700,000 $57,000 40,500 66,200 Estimate the value of your subject office property using direct capitalization and DCF