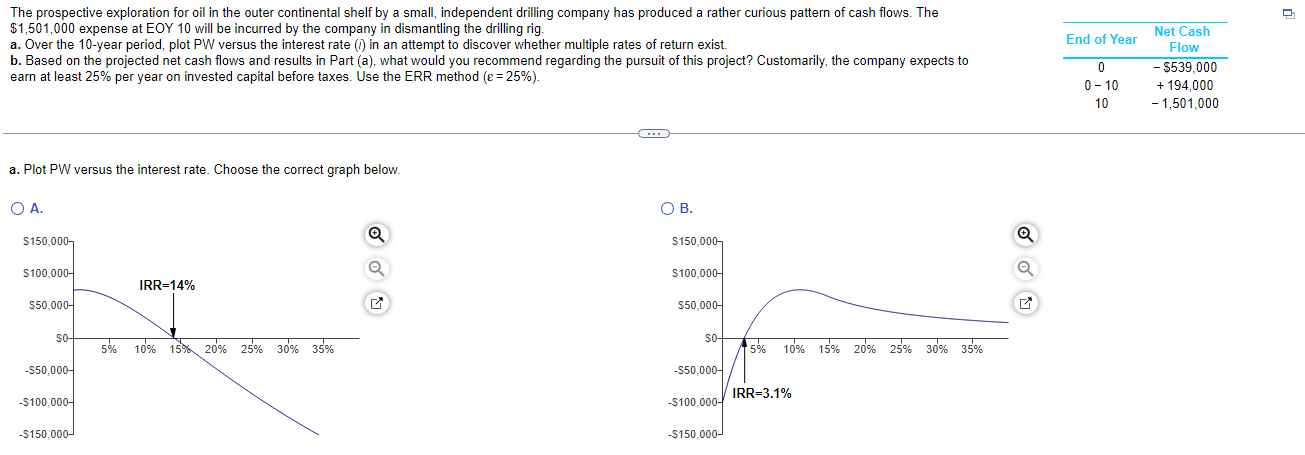

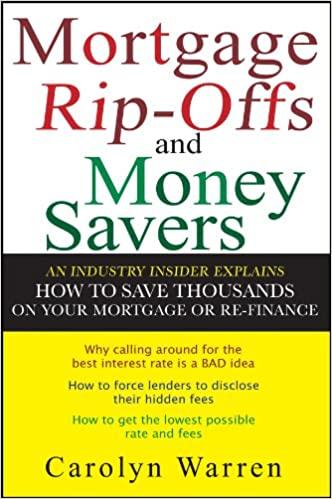

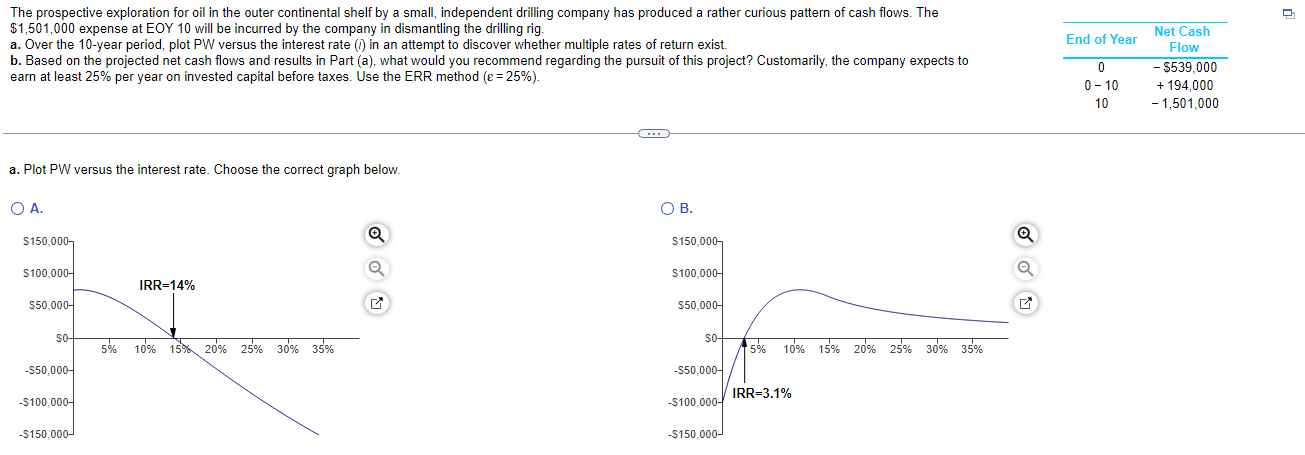

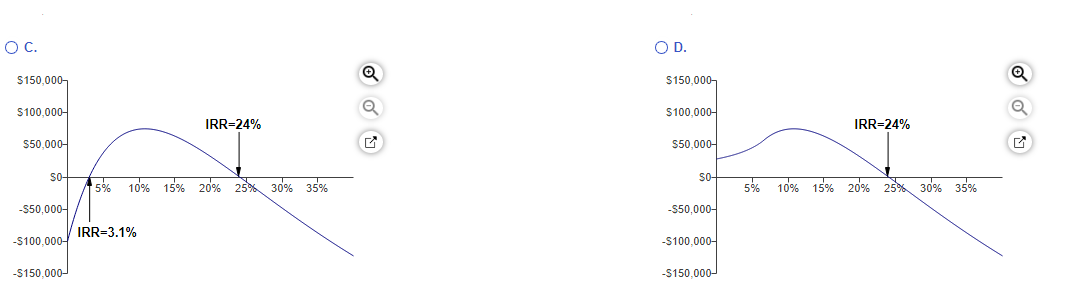

The prospective exploration for oil in the outer continental shelf by a small, independent drilling company has produced a rather curious pattern of cash flows. The $1,501,000 expense at EOY 10 will be incurred by the company in dismantling the drilling rig. a. Over the 10-year period, plot PW versus the interest rate (1) in an attempt to discover whether multiple rates of return exist. b. Based on the projected net cash flows and results in Part (a), what would you recommend regarding the pursuit of this project? Customarily, the company expects to earn at least 25% per year on invested capital before taxes. Use the ERR method ( =25%). a. Plot PW versus the interest rate. Choose the correct graph below. O A. $150,000 $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- IRR=14% 5% 10% 15% 20% 25% 30% 35% Q Q () O B. $150,000- $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- 5% 10% 15% 20% 25% 30% 35% IRR=3.1% Q Q End of Year 0 0-10 10 Net Cash Flow - $539,000 + 194,000 - 1,501,000 O C. $150,000- $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- IRR=24% 5% 10% 15% 20% 25% 30% 35% IRR=3.1% O D. $150,000- $100,000- $50,000- SO- -$50,000- -$100.000- -$150,000- IRR=24% 5% 10% 15% 20% 25% 30% 35% a The prospective exploration for oil in the outer continental shelf by a small, independent drilling company has produced a rather curious pattern of cash flows. The $1,501,000 expense at EOY 10 will be incurred by the company in dismantling the drilling rig. a. Over the 10-year period, plot PW versus the interest rate (1) in an attempt to discover whether multiple rates of return exist. b. Based on the projected net cash flows and results in Part (a), what would you recommend regarding the pursuit of this project? Customarily, the company expects to earn at least 25% per year on invested capital before taxes. Use the ERR method ( =25%). a. Plot PW versus the interest rate. Choose the correct graph below. O A. $150,000 $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- IRR=14% 5% 10% 15% 20% 25% 30% 35% Q Q () O B. $150,000- $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- 5% 10% 15% 20% 25% 30% 35% IRR=3.1% Q Q End of Year 0 0-10 10 Net Cash Flow - $539,000 + 194,000 - 1,501,000 O C. $150,000- $100,000- $50,000- SO- -$50,000- -$100,000- -$150,000- IRR=24% 5% 10% 15% 20% 25% 30% 35% IRR=3.1% O D. $150,000- $100,000- $50,000- SO- -$50,000- -$100.000- -$150,000- IRR=24% 5% 10% 15% 20% 25% 30% 35% a