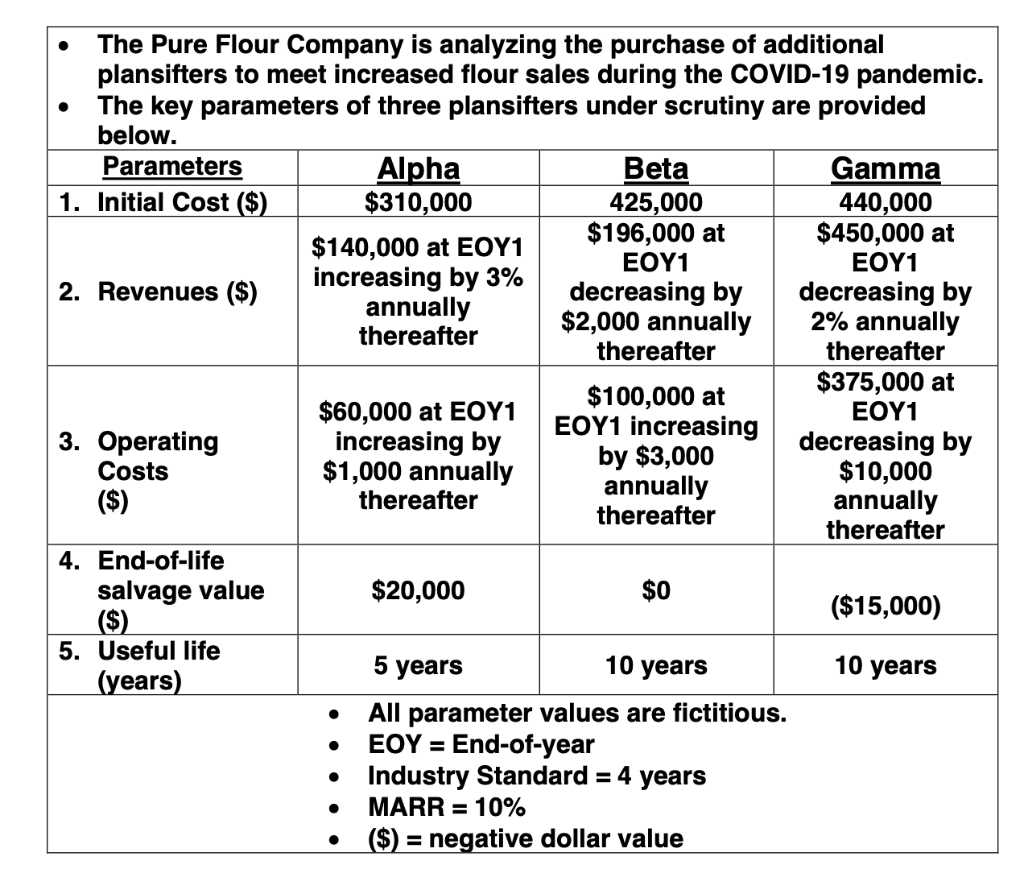

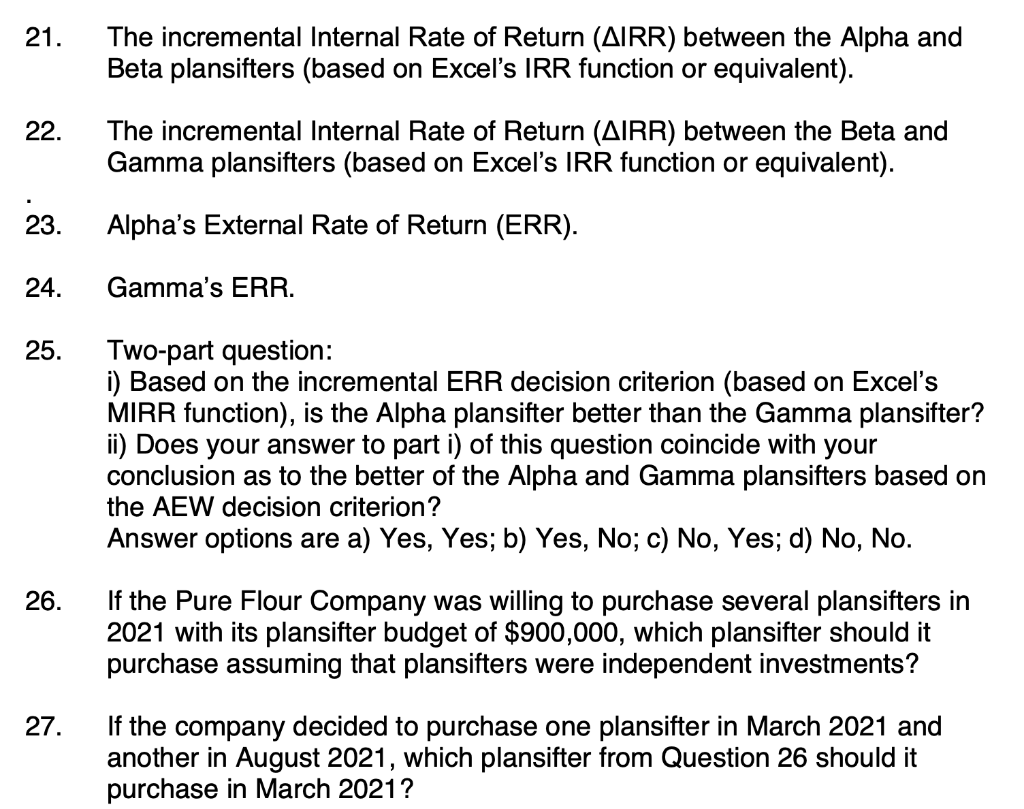

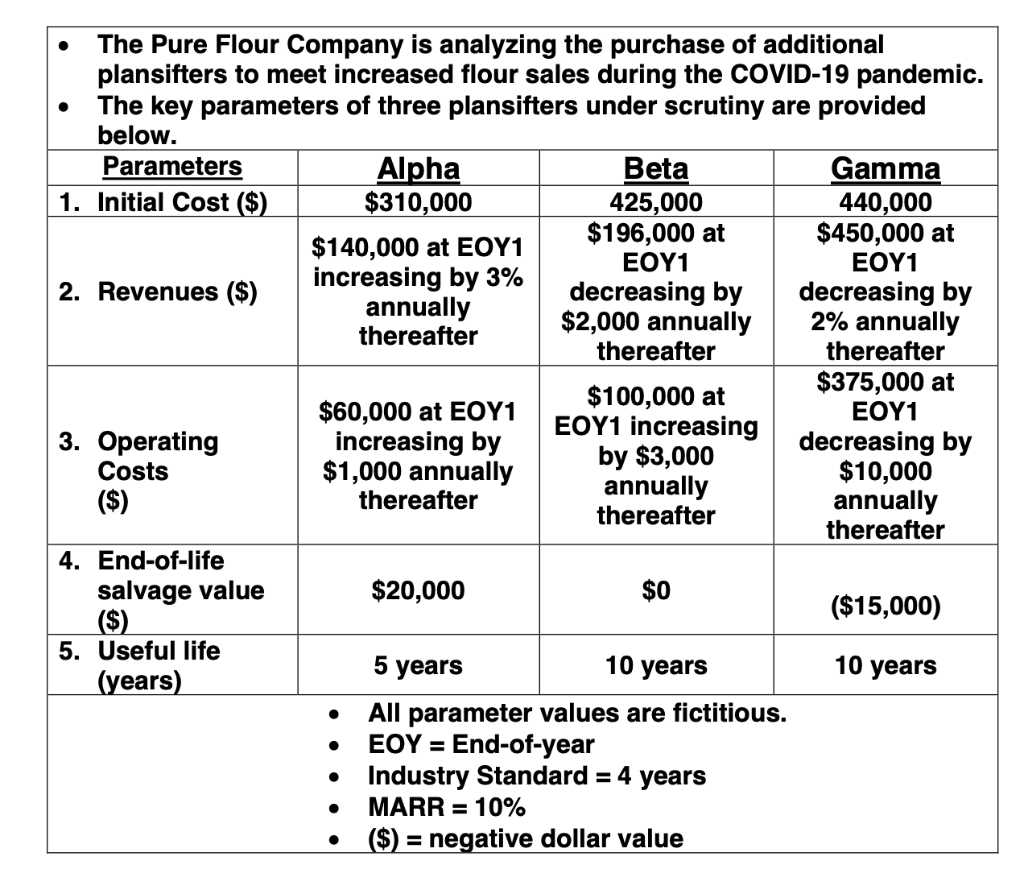

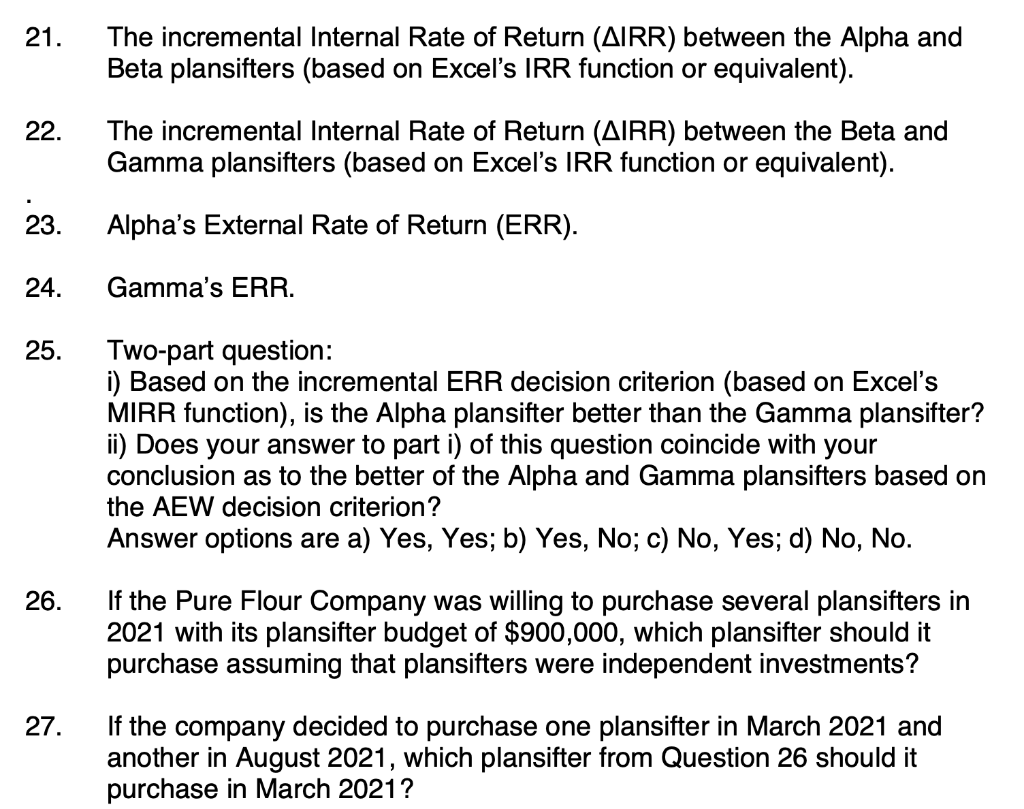

. The Pure Flour Company is analyzing the purchase of additional plansifters to meet increased flour sales during the COVID-19 pandemic. The key parameters of three plansifters under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $310,000 425,000 440,000 $196,000 at $450,000 at $140,000 at EOY1 EOY1 EOY1 2. Revenues ($) increasing by 3% decreasing by decreasing by annually $2,000 annually 2% annually thereafter thereafter thereafter $375,000 at $100,000 at $60,000 at EOY1 1 EOY1 increasing 3. Operating increasing by decreasing by Costs $1,000 annually by $3,000 $10,000 annually ($) thereafter annually thereafter thereafter 4. End-of-life salvage value $20,000 $0 ($15,000) ($) 5. Useful life 5 years 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% ($) = negative dollar value 10 years . . = . O . 21. The incremental Internal Rate of Return (AIRR) between the Alpha and Beta plansifters (based on Excel's IRR function or equivalent). 22. The incremental Internal Rate of Return (AIRR) between the Beta and Gamma plansifters (based on Excel's IRR function or equivalent). 23. Alpha's External Rate of Return (ERR). 24. Gamma's ERR. 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Alpha plansifter better than the Gamma plansifter? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Alpha and Gamma plansifters based on the AEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. If the Pure Flour Company was willing to purchase several plansifters in 2021 with its plansifter budget of $900,000, which plansifter should it purchase assuming that plansifters were independent investments? 27. If the company decided to purchase one plansifter in March 2021 and another in August 2021, which plansifter from Question 26 should it purchase in March 2021? . The Pure Flour Company is analyzing the purchase of additional plansifters to meet increased flour sales during the COVID-19 pandemic. The key parameters of three plansifters under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $310,000 425,000 440,000 $196,000 at $450,000 at $140,000 at EOY1 EOY1 EOY1 2. Revenues ($) increasing by 3% decreasing by decreasing by annually $2,000 annually 2% annually thereafter thereafter thereafter $375,000 at $100,000 at $60,000 at EOY1 1 EOY1 increasing 3. Operating increasing by decreasing by Costs $1,000 annually by $3,000 $10,000 annually ($) thereafter annually thereafter thereafter 4. End-of-life salvage value $20,000 $0 ($15,000) ($) 5. Useful life 5 years 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% ($) = negative dollar value 10 years . . = . O . 21. The incremental Internal Rate of Return (AIRR) between the Alpha and Beta plansifters (based on Excel's IRR function or equivalent). 22. The incremental Internal Rate of Return (AIRR) between the Beta and Gamma plansifters (based on Excel's IRR function or equivalent). 23. Alpha's External Rate of Return (ERR). 24. Gamma's ERR. 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Alpha plansifter better than the Gamma plansifter? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Alpha and Gamma plansifters based on the AEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. If the Pure Flour Company was willing to purchase several plansifters in 2021 with its plansifter budget of $900,000, which plansifter should it purchase assuming that plansifters were independent investments? 27. If the company decided to purchase one plansifter in March 2021 and another in August 2021, which plansifter from Question 26 should it purchase in March 2021