Question

The purpose of a financial ratio analysis is to explain the changes on the financial statements using ratio analysis supported by the numbers in the

The purpose of a financial ratio analysis is to explain the changes on the financial statements using ratio analysis supported by the numbers in the financial statements. This interactive web-based financial simulation will reinforce your understanding of financial ratios using a real world exercise. This case explores six hypothetical business decisions that managers at Dell Computer might make and each decisions impact on the financial statements and resulting financial ratios. As with any writing assignment in this course, APA format is required, and proofread carefully as your writing quality is part of the grading rubric.

CASE ANALYSIS: Select ONE of the six hypothetical business decisions and using the attached rubric, analyze the decision and its impact on the related financial statements and overall organization using the financial ratios from Chapter 3 (not necessarily the ratios inside the assignment). There is no minimum number of words; rather, use the grading rubric to be certain you are comprehensive in your analysis.

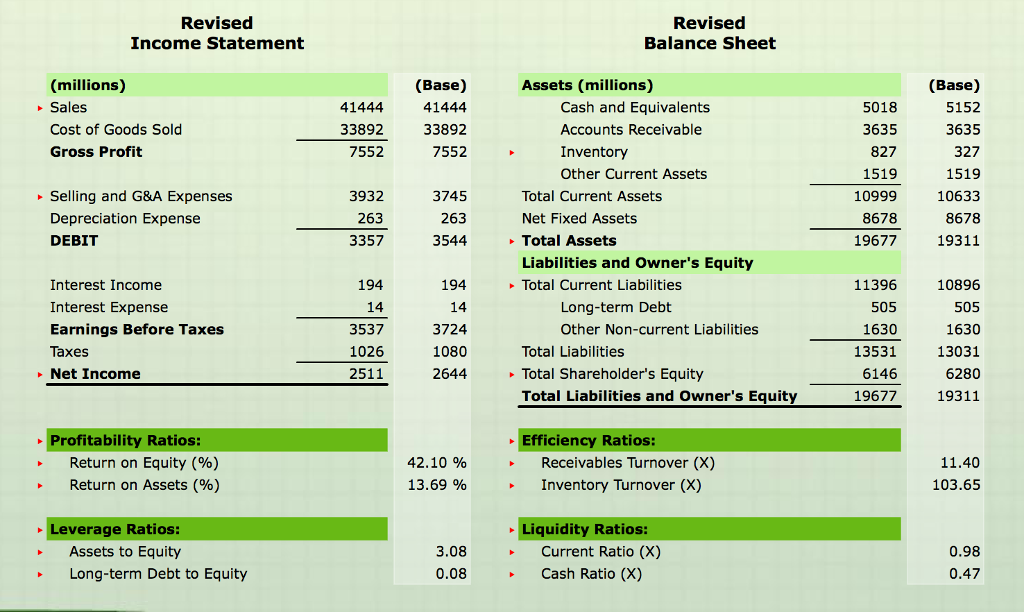

Complete the revised ratios after the business decision to determine which ratios are affected the most.

Be sure to select the important ratios affected by the business decision, calculate the ratios and the change in the numbers and the ratio between the base statements and the revised statements.

Incorporate those ratios (base and revised) into your case analysis to demonstrate your point(s). Support the changes in the ratio by explaining WHY they increased/decreased. What specifically on the balance sheet or income statement caused the change? Do not include your opinion. A financial analysis should only address facts: what you know to be true. "I think sales dropped because..." is not appropriate in a financial analysis.

Include percent increases/decreases to benchmark your measurements as to what changes are significant or insignificant. (Review this formula from previous courses if necessary: "NO/O" formula = (New value - Original Value) / Original Value = Percent Increase/Decrease.

BE SURE TO:

Embed the financial ratios into the narrative. Tables are great tools, but they shouldnt tell the story; the narrative (paragraph form) does that.

Label all ratios appropriately: times or X or with a %. Numbers, if currency, must be labeled with a $.

All numbers greater than 999 MUST have commas in the appropriate places.

If numbers are stated in thousands, then you must state that. If I see a number, $45,000 then I assume its forty-five thousand, but the tables are in 000s so the number is really $45 million.

If a ratio increased from 50% to 60%, the increase is represented as 10 (percentage) points for an increase of 20% (50-60/50). Its NOT a 10% increase.

PROOFREAD, PROOFREAD, PROOFREAD: Some of the basic writing errors are improper pronoun/antecedent agreement, misuse of punctuation especially commas and apostrophes, random verb tense changes that are without cause or reason, proper nouns that are not capitalized and common nouns that are capitalized. Please pay close attention to your writing quality and use the Writing Center or the polishmywriting.com website.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started