Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The purpose of Comprehensive Problem 1 is to review and reinforce your understanding of the accounting cycle. The number of transactions included in this comprehensive

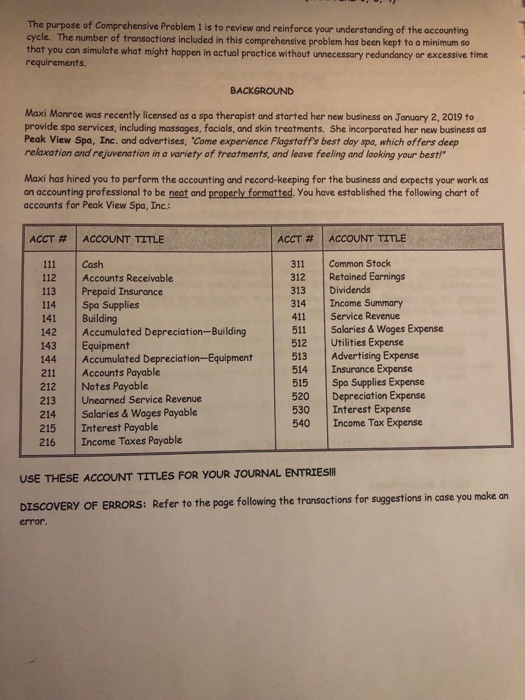

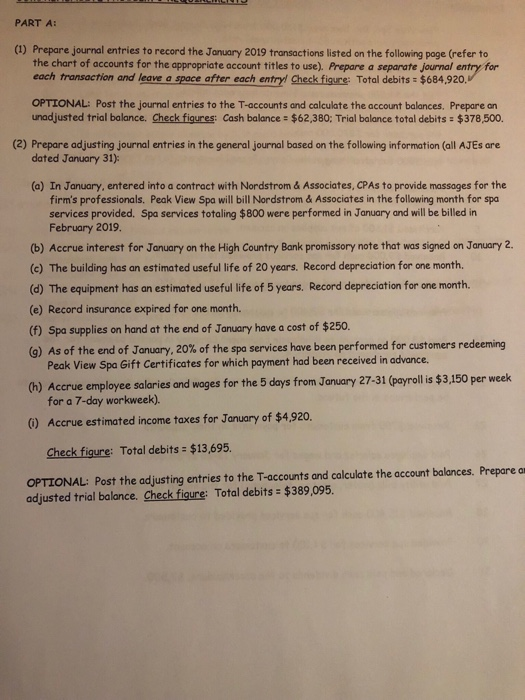

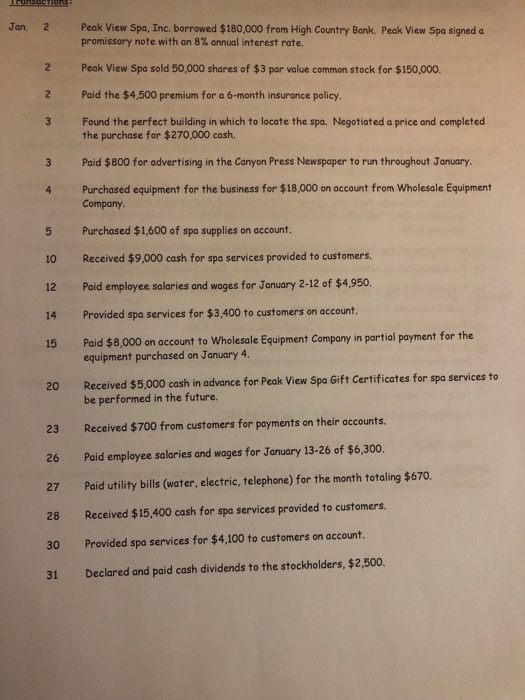

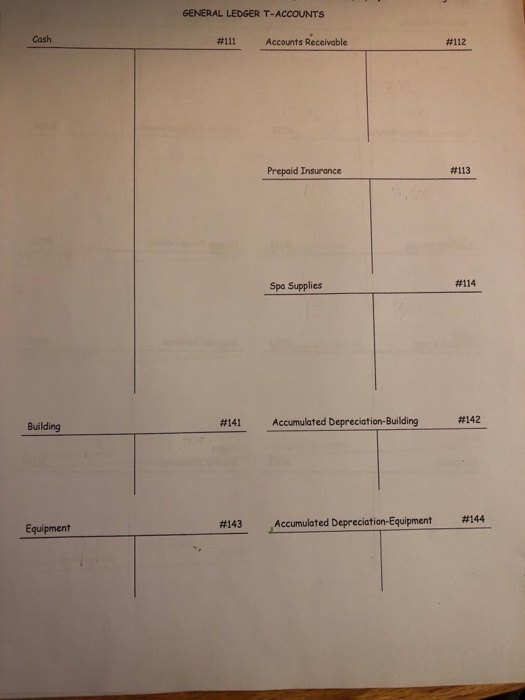

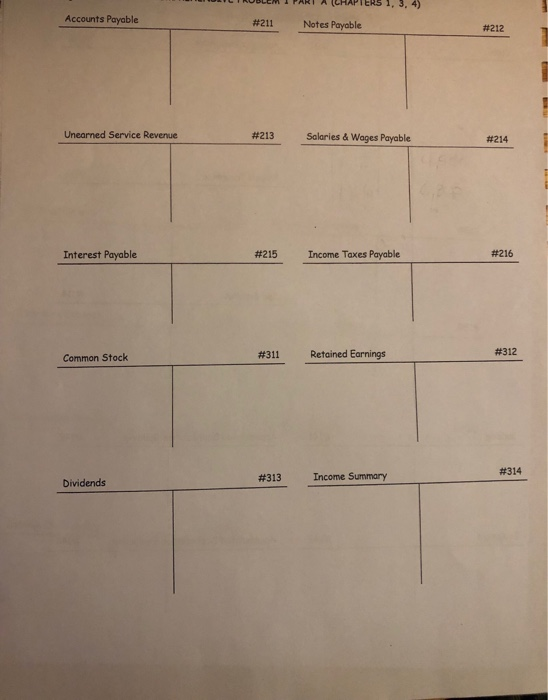

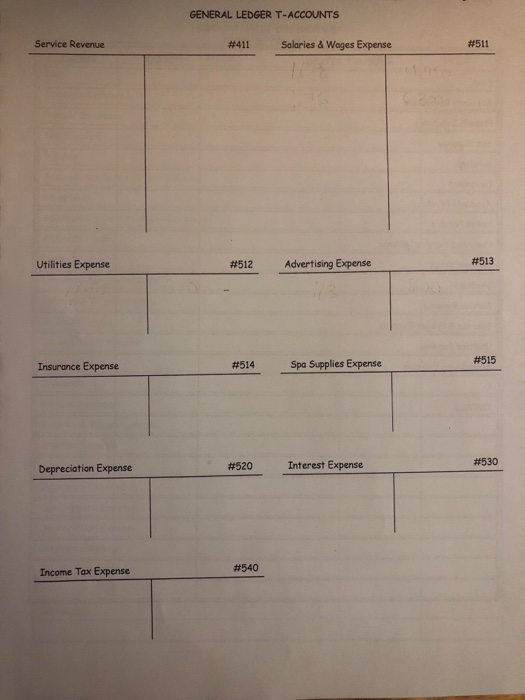

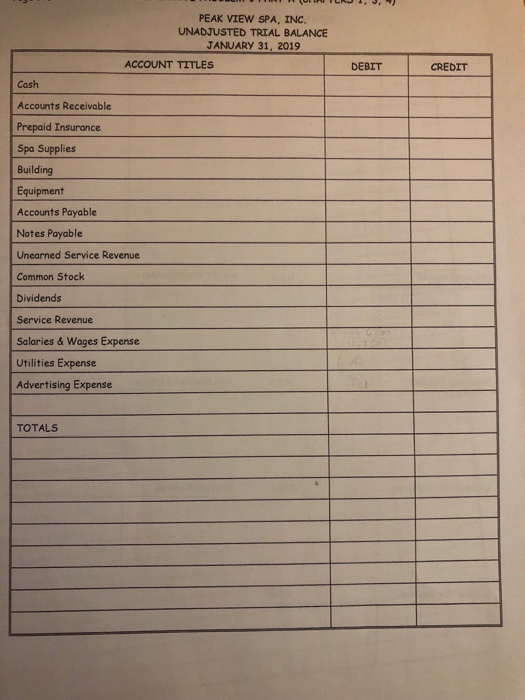

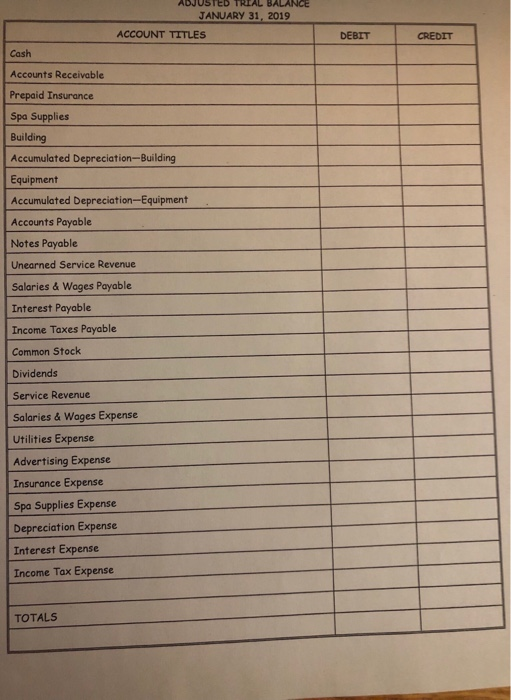

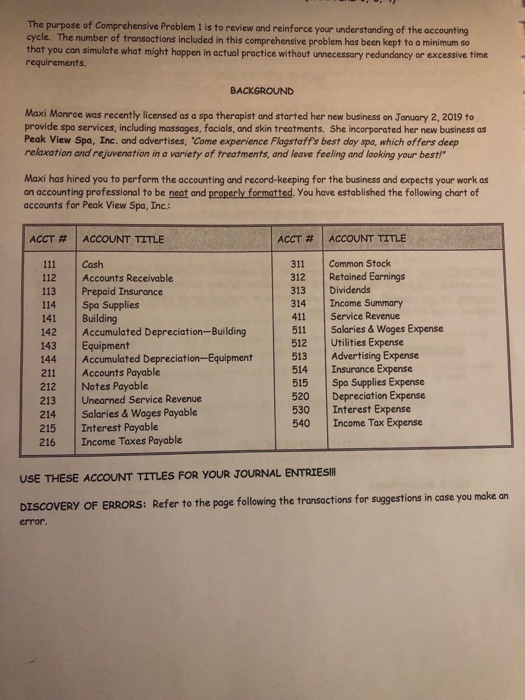

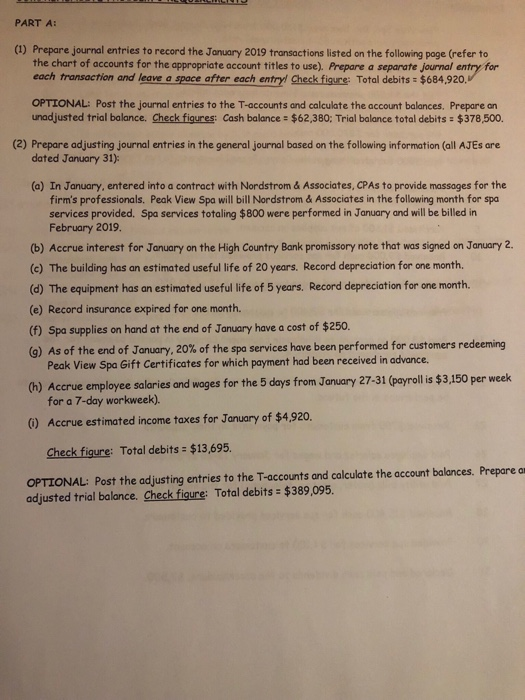

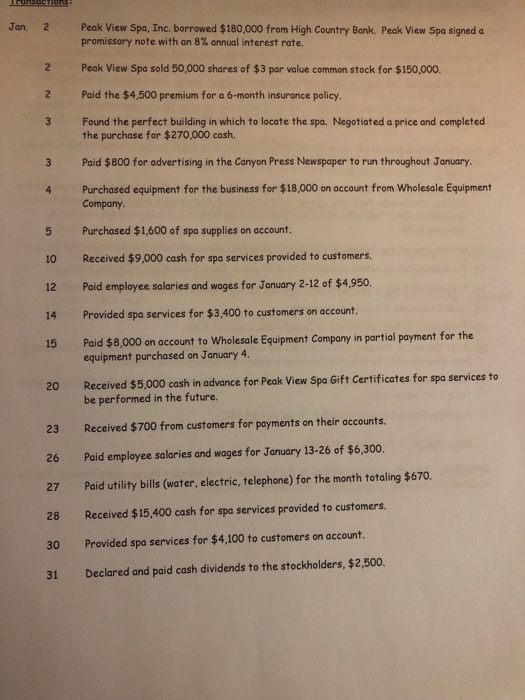

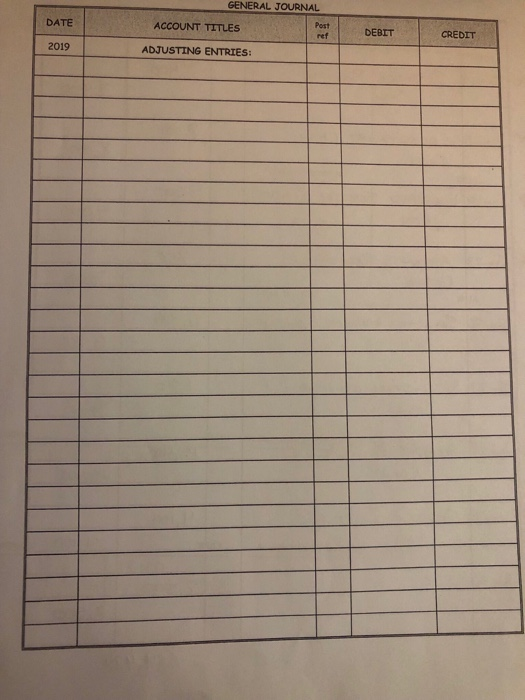

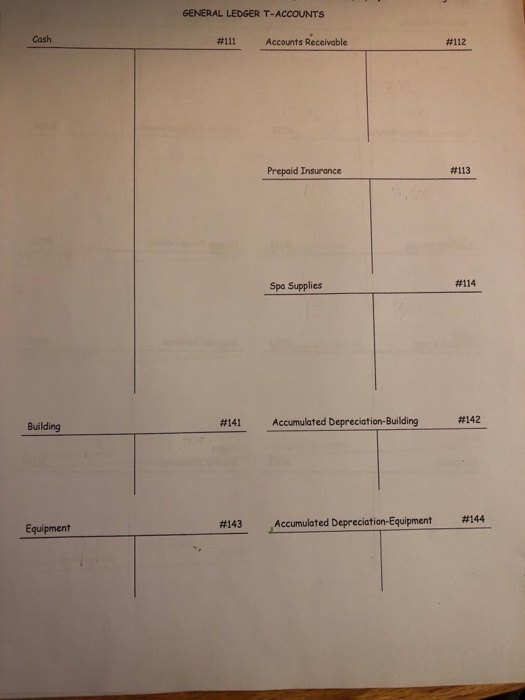

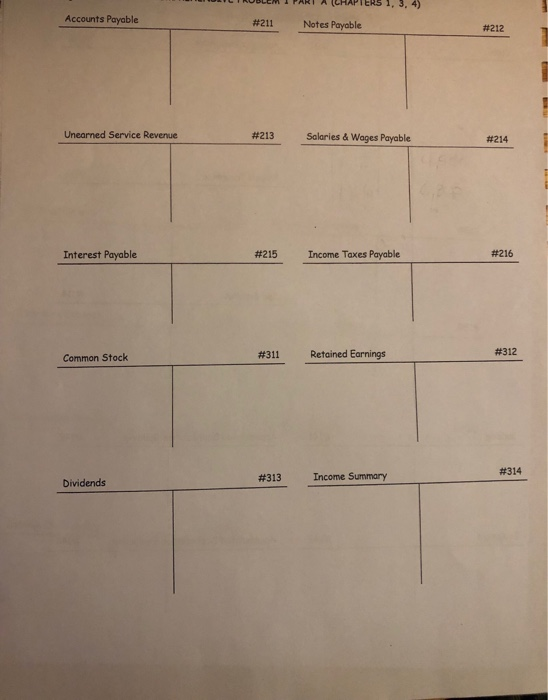

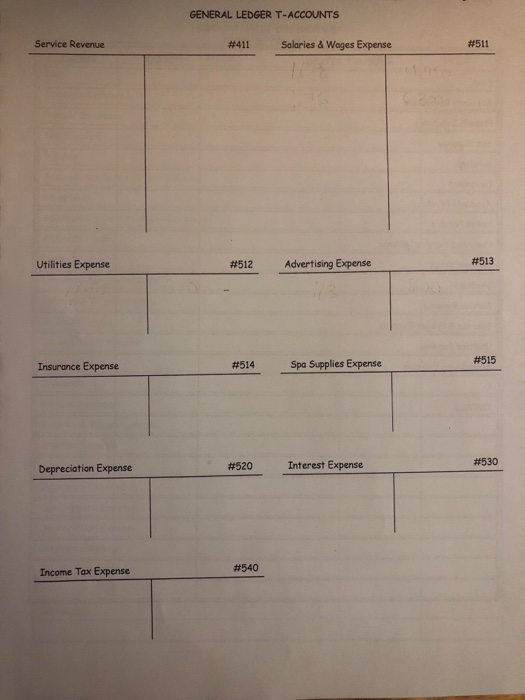

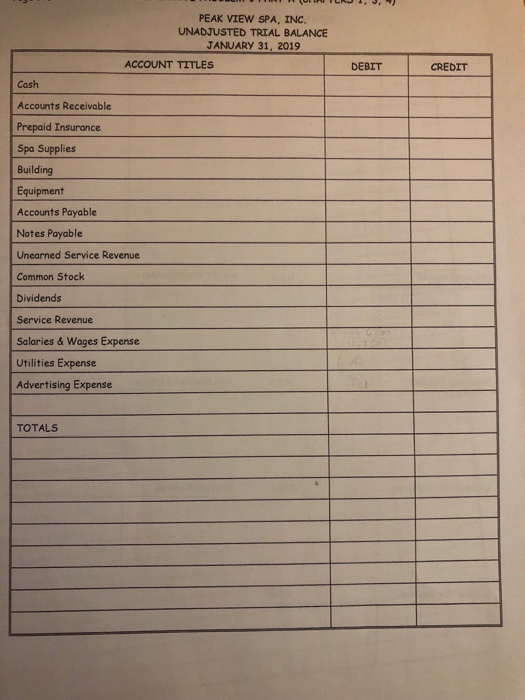

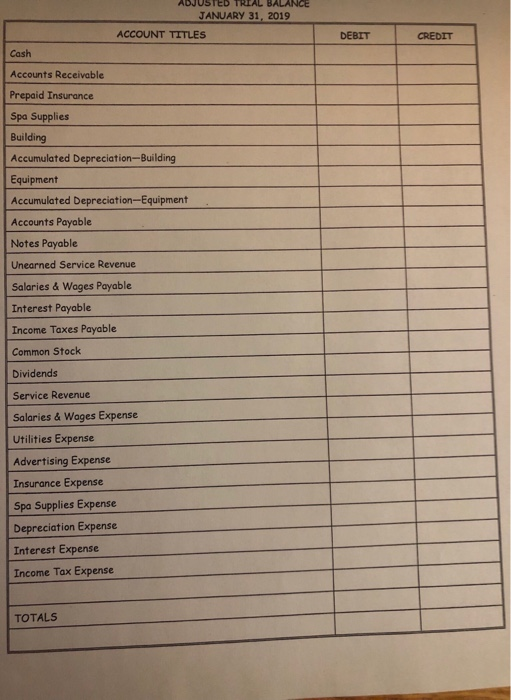

The purpose of Comprehensive Problem 1 is to review and reinforce your understanding of the accounting cycle. The number of transactions included in this comprehensive problem has been kept to a minimum so that you can simulate what might happen in actual practice without unnecessary redundancy or excessive time requirements Maxi Monroe was recently licensed as a spa therapist and started her new business on January 2,2019 t provide spa services, including massages, facials, and skin treatments. She incorporated her new business as Peak View Spa, Inc. and advertises, Come experience Flagstaff's best day spa, which offers deep relaxation and rejuvenation in a variety of treatments, and leave feeling and looking your best! Maxi has hired you to perform the accounting and record-keeping for the business and expects your work as an accounting professional to be neat and properly formatted. You have established the following chart of accounts for Peak View Spa, Inc.: ACCT # | ACCOUNT TITLE ACCT # | ACCOUNT TITLE 111 Cash 112 Accounts Receivable 113 Prepaid Insurance 114 Spa Supplies 141 Building 142 Accumulated Depreciation-Building 143 Equipment 144 Accumulated Depreciation-Equipment 211 Accounts Payable 212 Notes Payable 213 Unearned Service Revenue 214 Salaries &Wages Payable 215 Interest Payable 216 Income Taxes Payable 311 Common Stock 312 Retained Earnings 313 Dividends 314 Income Summary 411 Service Revenue 511 Salaries & Wages Expense 512 Utilities Expense 513 Advertising Expense 514 Insurance Expense 515 Spa Supplies Expense 520 Depreciation Expense 530 Interest Expense 540 Income Tax Expense USE THESE ACCOUNT TITLES FOR YOUR JOURNAL ENTRIESI DISCOVERY OF ERRORS: Refer to the page following the transactions for suggestions in case you make error. an PART A: (1) Prepare journal entries to record the January 2019 transactions listed on the following page (refer to the chart of accounts for the appropriate account titles to use). Prepare a separate journal entry for each transaction and leave a space after each entryl Check figure: Total debits $684,920, OPTIONAL: Post the journal entries to the T-accounts and calculate the account balances. Prepare on unadjusted trial balance. Check figures: Cash balance $62,380: Trial balance total debits: $378,500. (2) Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated January 31): (a) In January, entered into a contract with Nordstrom & Associates, CPAs to provide massages for the firm's professionals. Peak View Spa will bill Nordstrom & Associates in the following month for spa services provided. Spa services totaling $800 were performed in January and will be billed ir February 2019. (b) Accrue interest for January on the High Country Bank promissory note that was signed on January 2. (c) The building has an estimated useful life of 20 years. Record depreciation for one month. (d) The equipment has an estimated useful life of 5 years. Record depreciation for one month. (e) Record insurance expired for one month. (f) Spa supplies on hand at the end of January have a cost of $250 (g) As of the end of January, 20% of the spa services have been performed for customers redeeming Peak View Spa Gift Certificates for which payment had been received in advance. (h) Accrue employee salaries ond wages for the 5 days from January 27-31 (payrollis $3,150 per weelk 0) Accrue estimated income taxes for January of $4.920. for a 7-day workweek). Check figure: Total debits $13,695. OPTIONAL: Post the adjusting entries to the T-accounts and calculate the account balances. Prepare a adjusted trial balance. Check figure: Total debits $389,095 GENERAL JOURNAL Pst DEET DATE ACCOUNT TITLES DEBIT CREDIT ref 2019 ADJUSTING ENTRIES: GENERAL LEDGER T-ACCOUNTS Cash #111 Accounts Receivable #112 Prepaid Insurance #113 Spa Supplies #114 Building #141 Accumulated Depreciation-Building #142 #144 #143 ,Accumulated Depreciation-Equipment Equipment eTRoBLEMPART A Accounts Payable #211 Notes Payable #212 Unearned Service Revenue #213 salaries & wages Payable #214 Interest Payable #215 Income Taxes Payable #216 Common Stock #311 Retained Earnings #312 #314 #313 Income Summary Dividends GENERAL LEDGER T-ACCOUNTS Service Revenue #411 Salaries & wages Expense #511 #513 Utilities Expense #512 Advertising Expense #515 Insurance Expense #514 Spa Supplies Expense #530 Depreciation Expense #520 Interest Expense #540 Income Tax Expense PEAK VIEW SPA, INC UNADJUSTED TRIAL BALANCE JANUARY 31, 2019 ACCOUNT TITLES DEBIT CREDIT Cash Accounts Receivable Prepaid Insurance Spa Supplies Building Equipment Accounts Payable Notes Payable Unearned Service Revenue Common Stock Dividends Service Revenue Salaries & Wages Expense Utilities Expense Advertising Expense TOTALS JANUARY 31, 2019 ACCOUNT TITLES DEBIT CREDIT Cash Accounts Receivable Prepaid Insurance Spa Supplies Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Notes Payable Unearned Service Revenue Salaries & Wages Payable Interest Payable Income Taxes Payable Common Stock Dividends Service Revenue Salaries & Wages Expense Utilities Expense Advertising Expense Insurance Expense Spa Supplies Expense Depreciation Expense Interest Expense Income Tax Expense TOTALS

The purpose of Comprehensive Problem 1 is to review and reinforce your understanding of the accounting cycle. The number of transactions included in this comprehensive problem has been kept to a minimum so that you can simulate what might happen in actual practice without unnecessary redundancy or excessive time requirements Maxi Monroe was recently licensed as a spa therapist and started her new business on January 2,2019 t provide spa services, including massages, facials, and skin treatments. She incorporated her new business as Peak View Spa, Inc. and advertises, Come experience Flagstaff's best day spa, which offers deep relaxation and rejuvenation in a variety of treatments, and leave feeling and looking your best! Maxi has hired you to perform the accounting and record-keeping for the business and expects your work as an accounting professional to be neat and properly formatted. You have established the following chart of accounts for Peak View Spa, Inc.: ACCT # | ACCOUNT TITLE ACCT # | ACCOUNT TITLE 111 Cash 112 Accounts Receivable 113 Prepaid Insurance 114 Spa Supplies 141 Building 142 Accumulated Depreciation-Building 143 Equipment 144 Accumulated Depreciation-Equipment 211 Accounts Payable 212 Notes Payable 213 Unearned Service Revenue 214 Salaries &Wages Payable 215 Interest Payable 216 Income Taxes Payable 311 Common Stock 312 Retained Earnings 313 Dividends 314 Income Summary 411 Service Revenue 511 Salaries & Wages Expense 512 Utilities Expense 513 Advertising Expense 514 Insurance Expense 515 Spa Supplies Expense 520 Depreciation Expense 530 Interest Expense 540 Income Tax Expense USE THESE ACCOUNT TITLES FOR YOUR JOURNAL ENTRIESI DISCOVERY OF ERRORS: Refer to the page following the transactions for suggestions in case you make error. an PART A: (1) Prepare journal entries to record the January 2019 transactions listed on the following page (refer to the chart of accounts for the appropriate account titles to use). Prepare a separate journal entry for each transaction and leave a space after each entryl Check figure: Total debits $684,920, OPTIONAL: Post the journal entries to the T-accounts and calculate the account balances. Prepare on unadjusted trial balance. Check figures: Cash balance $62,380: Trial balance total debits: $378,500. (2) Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated January 31): (a) In January, entered into a contract with Nordstrom & Associates, CPAs to provide massages for the firm's professionals. Peak View Spa will bill Nordstrom & Associates in the following month for spa services provided. Spa services totaling $800 were performed in January and will be billed ir February 2019. (b) Accrue interest for January on the High Country Bank promissory note that was signed on January 2. (c) The building has an estimated useful life of 20 years. Record depreciation for one month. (d) The equipment has an estimated useful life of 5 years. Record depreciation for one month. (e) Record insurance expired for one month. (f) Spa supplies on hand at the end of January have a cost of $250 (g) As of the end of January, 20% of the spa services have been performed for customers redeeming Peak View Spa Gift Certificates for which payment had been received in advance. (h) Accrue employee salaries ond wages for the 5 days from January 27-31 (payrollis $3,150 per weelk 0) Accrue estimated income taxes for January of $4.920. for a 7-day workweek). Check figure: Total debits $13,695. OPTIONAL: Post the adjusting entries to the T-accounts and calculate the account balances. Prepare a adjusted trial balance. Check figure: Total debits $389,095 GENERAL JOURNAL Pst DEET DATE ACCOUNT TITLES DEBIT CREDIT ref 2019 ADJUSTING ENTRIES: GENERAL LEDGER T-ACCOUNTS Cash #111 Accounts Receivable #112 Prepaid Insurance #113 Spa Supplies #114 Building #141 Accumulated Depreciation-Building #142 #144 #143 ,Accumulated Depreciation-Equipment Equipment eTRoBLEMPART A Accounts Payable #211 Notes Payable #212 Unearned Service Revenue #213 salaries & wages Payable #214 Interest Payable #215 Income Taxes Payable #216 Common Stock #311 Retained Earnings #312 #314 #313 Income Summary Dividends GENERAL LEDGER T-ACCOUNTS Service Revenue #411 Salaries & wages Expense #511 #513 Utilities Expense #512 Advertising Expense #515 Insurance Expense #514 Spa Supplies Expense #530 Depreciation Expense #520 Interest Expense #540 Income Tax Expense PEAK VIEW SPA, INC UNADJUSTED TRIAL BALANCE JANUARY 31, 2019 ACCOUNT TITLES DEBIT CREDIT Cash Accounts Receivable Prepaid Insurance Spa Supplies Building Equipment Accounts Payable Notes Payable Unearned Service Revenue Common Stock Dividends Service Revenue Salaries & Wages Expense Utilities Expense Advertising Expense TOTALS JANUARY 31, 2019 ACCOUNT TITLES DEBIT CREDIT Cash Accounts Receivable Prepaid Insurance Spa Supplies Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Notes Payable Unearned Service Revenue Salaries & Wages Payable Interest Payable Income Taxes Payable Common Stock Dividends Service Revenue Salaries & Wages Expense Utilities Expense Advertising Expense Insurance Expense Spa Supplies Expense Depreciation Expense Interest Expense Income Tax Expense TOTALS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started