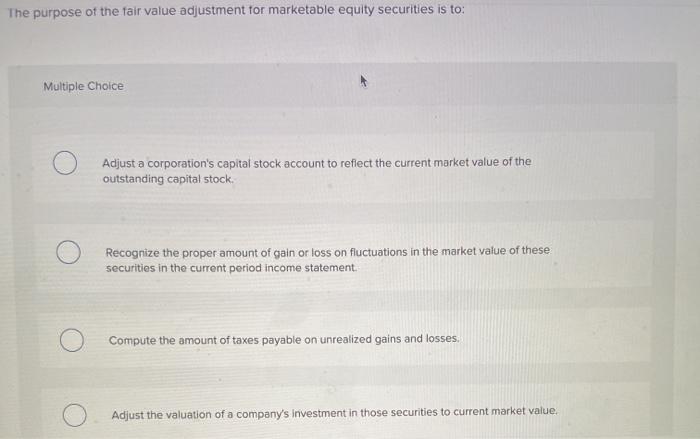

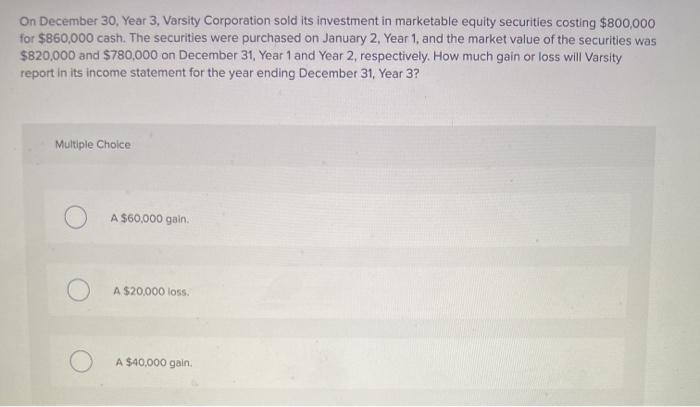

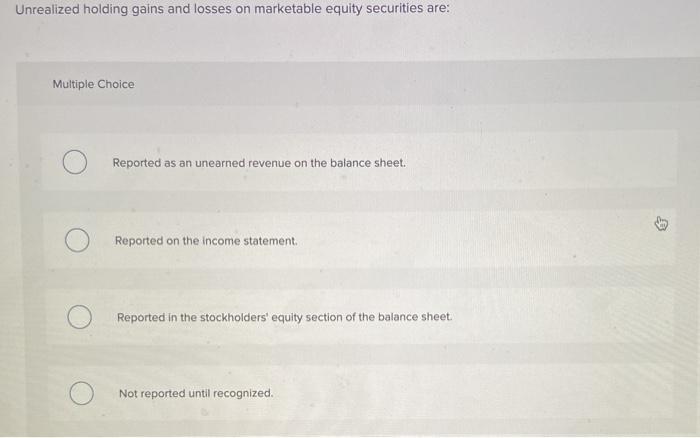

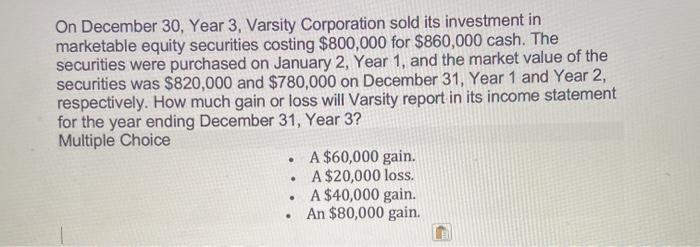

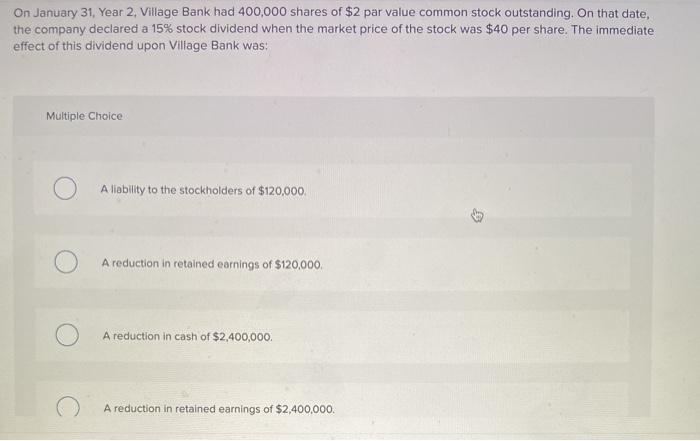

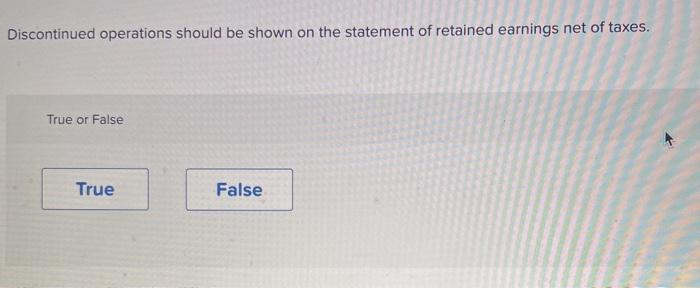

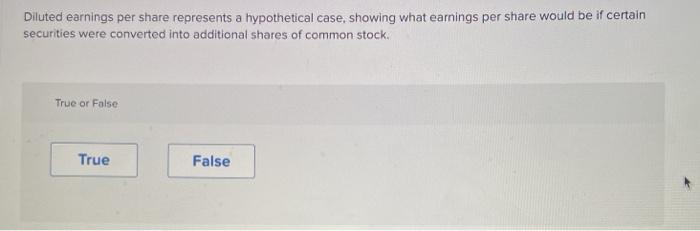

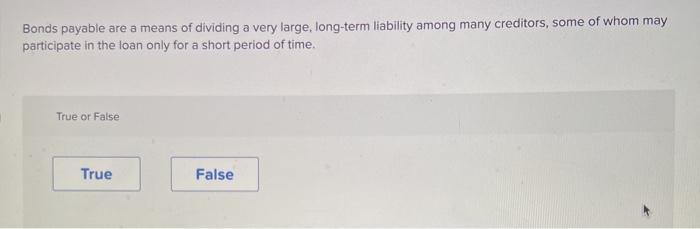

The purpose of the fair value adjustment for marketable equity securities is to: Multiple Choice Adjust a corporation's capital stock account to reflect the current market value of the outstanding capital stock. Recognize the proper amount of gain or loss on fluctuations in the market value of these securities in the current period income statement Compute the amount of taxes payable on unrealized gains and losses. Adjust the valuation of a company's Investment in those securities to current market value. On December 30, Year 3. Varsity Corporation sold its investment in marketable equity securities costing $800,000 for $860,000 cash. The securities were purchased on January 2, Year 1, and the market value of the securities was $820,000 and $780,000 on December 31, Year 1 and Year 2, respectively. How much gain or loss will Varsity report in its income statement for the year ending December 31, Year 3? Multiple Choice A $60,000 gain A $20,000 loss A $40,000 gain Unrealized holding gains and losses on marketable equity securities are: Multiple Choice Reported as an unearned revenue on the balance sheet. Reported on the income statement Reported in the stockholders' equity section of the balance sheet Not reported until recognized On December 30, Year 3, Varsity Corporation sold its investment in marketable equity securities costing $800,000 for $860,000 cash. The securities were purchased on January 2, Year 1, and the market value of the securities was $820,000 and $780,000 on December 31, Year 1 and Year 2, respectively. How much gain or loss will Varsity report in its income statement for the year ending December 31, Year 3? Multiple Choice A $60,000 gain. A $20,000 loss. A $40,000 gain. An $80,000 gain. . . On January 31, Year 2. Village Bank had 400,000 shares of $2 par value common stock outstanding. On that date, the company declared a 15% stock dividend when the market price of the stock was $40 per share. The immediate effect of this dividend upon Village Bank was: Multiple Choice Aliability to the stockholders of $120,000 A reduction in retained earnings of $120,000 A reduction in cash of $2,400,000. A reduction in retained earnings of $2,400,000. Discontinued operations should be shown on the statement of retained earnings net of taxes. True or False True False Diluted earnings per share represents a hypothetical case, showing what earnings per share would be if certain securities were converted into additional shares of common stock, True or False True False Bonds payable are a means of dividing a very large, long-term liability among many creditors, some of whom may participate in the loan only for a short period of time. True or False True False Sinking funds make a bond issue less attractive to the investor. True or False True False Dividends paid by a corporation to its stockholders are tax deductible by the corporation, but interest paid on bonds is not tax deductible. True or False True False