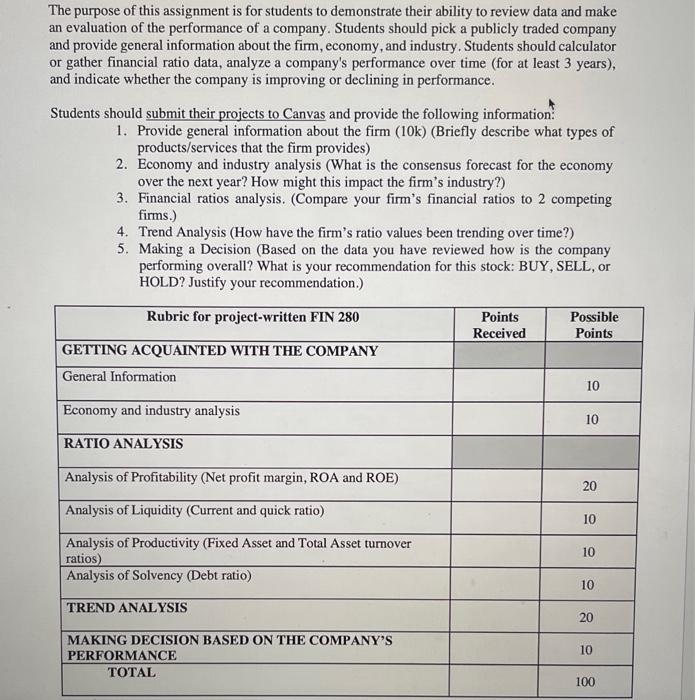

The purpose of this assignment is for students to demonstrate their ability to review data and make an evaluation of the performance of a company. Students should pick a publicly traded company and provide general information about the firm, economy, and industry. Students should calculator or gather financial ratio data, analyze a company's performance over time (for at least 3 years), and indicate whether the company is improving or declining in performance. Students should submit their projects to Canvas and provide the following information: 1. Provide general information about the firm (10k) (Briefly describe what types of products/services that the firm provides) 2. Economy and industry analysis (What is the consensus forecast for the economy over the next year? How might this impact the firm's industry?) 3. Financial ratios analysis. (Compare your firm's financial ratios to 2 competing firms.) 4. Trend Analysis (How have the firm's ratio values been trending over time?) 5. Making a Decision (Based on the data you have reviewed how is the company performing overall? What is your recommendation for this stock: BUY, SELL, or HOLD? Justify your recommendation.) The purpose of this assignment is for students to demonstrate their ability to review data and make an evaluation of the performance of a company. Students should pick a publicly traded company and provide general information about the firm, economy, and industry. Students should calculator or gather financial ratio data, analyze a company's performance over time (for at least 3 years), and indicate whether the company is improving or declining in performance. Students should submit their projects to Canvas and provide the following information: 1. Provide general information about the firm (10k) (Briefly describe what types of products/services that the firm provides) 2. Economy and industry analysis (What is the consensus forecast for the economy over the next year? How might this impact the firm's industry?) 3. Financial ratios analysis. (Compare your firm's financial ratios to 2 competing firms.) 4. Trend Analysis (How have the firm's ratio values been trending over time?) 5. Making a Decision (Based on the data you have reviewed how is the company performing overall? What is your recommendation for this stock: BUY, SELL, or HOLD? Justify your recommendation.)