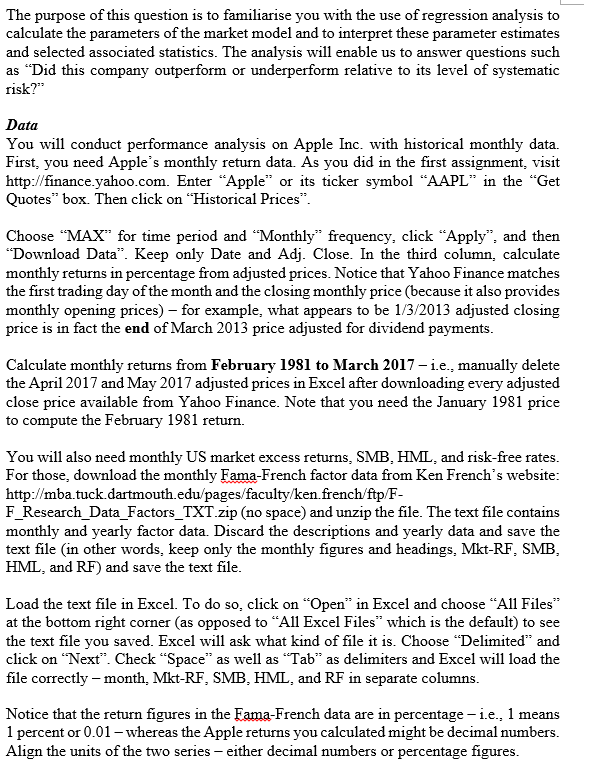

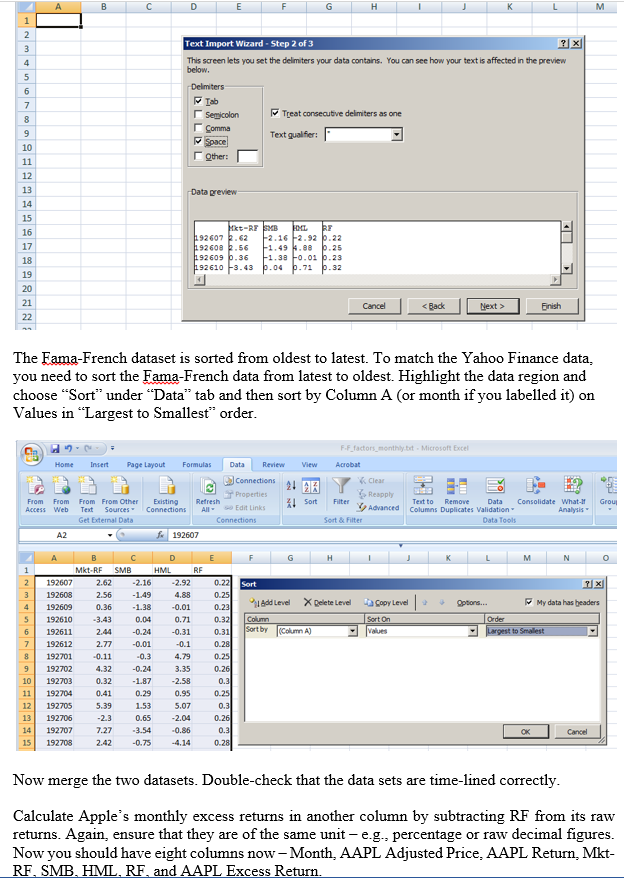

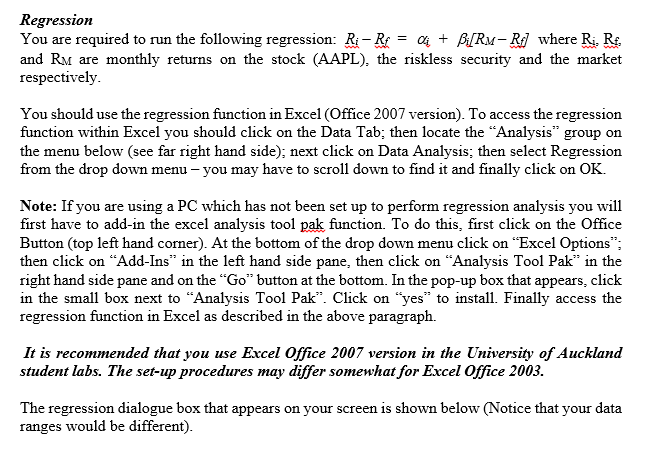

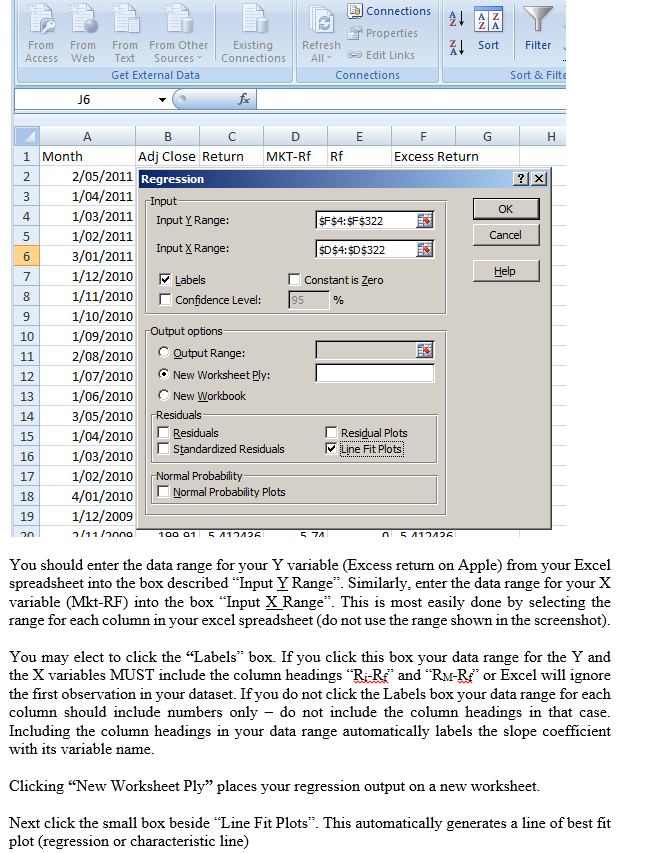

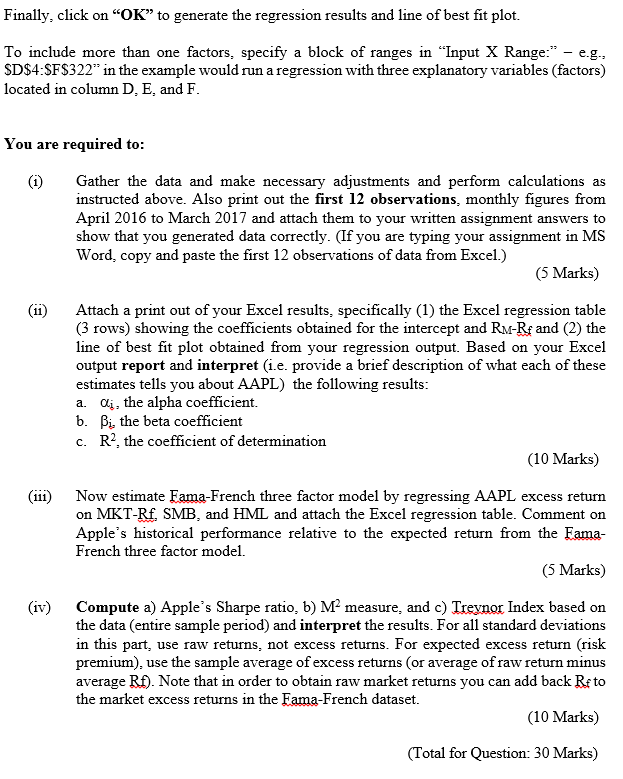

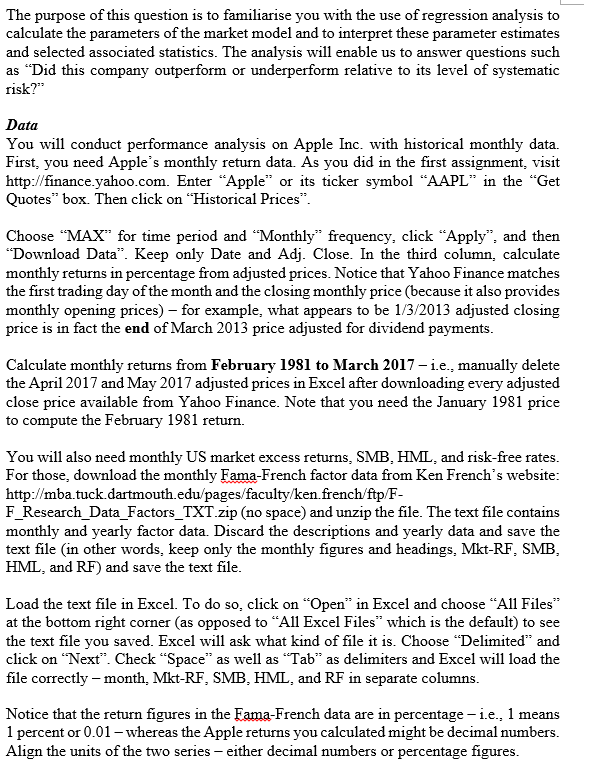

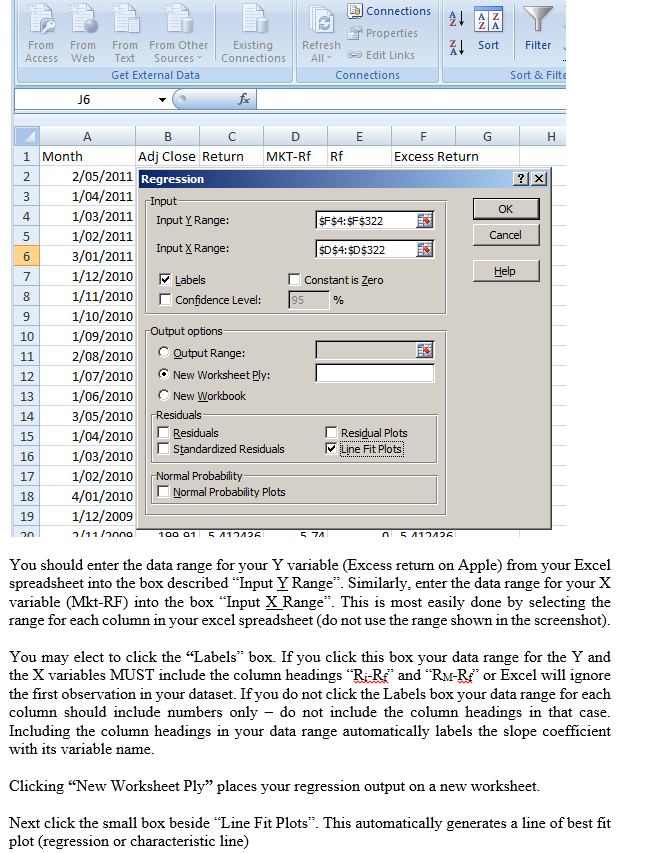

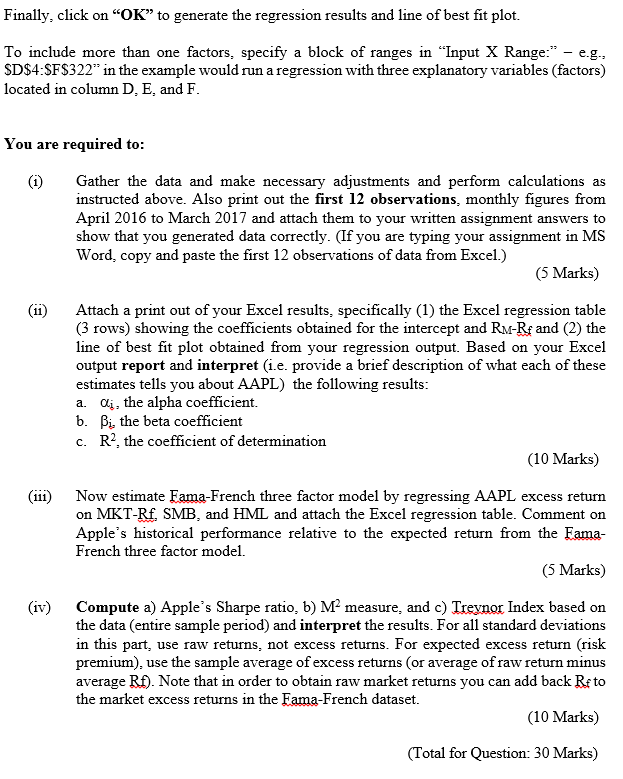

The purpose of this question is to familiarise you with the use of regression analysis to calculate the parameters of the market model and to interpret these parameter estimates and selected associated statistics. The analysis will enable us to answer questions such as "Did this company outperform or underperform relative to its level of systematic risk?" Data You will conduct performance analysis on Apple Inc. with historical monthly data. First, you need Apple's monthly return data. As you did in the first assignment, visit http://finance.yahoo.com. Enter "Apple" or its ticker symbol AAPL" in the "Get Quotes" box. Then click on "Historical Prices Choose MAX" for time period and "Monthly" frequency, click pply and then Download Data''. Keep only Date and Adj. Close. In the third column, calculate monthly returns in percentage from adjusted prices. Notice that Yahoo Finance matches the first trading day of the month and the closing mont price ecause it also provides thly monthly opening prices) for example, what appears to be 1/3/2013 adjusted closing price is in fact the end of March 2013 price adjusted for dividend payments Calculate monthly returns from February 1981 to March 2017 ie manually delete the April 2017 and May 2017 adjusted prices in Excel after downloading every adjusted close price available from Yahoo Finance. Note that you need the January 1981 price to compute the February 1981 return You will also need monthly US market excess returns, SMB, HML, and risk-free rates For those, download the monthly Fama-French factor data from Ken French's website http://mba tuck dartmouth edu pages faculty/ken.french/ftp/F F Research Data Factors TXT.zip (no space) and unzip the file. The text file contains monthly and yearly factor data. Discard the descriptions and yearly data and save the text file (in other words, keep only the monthly figures and headings, Mkt-RF, SMB HML, and RF) and save the text file Load the text file in Excel. To do so, click on "Open" in Excel and choose "All Files at the bottom ri ght corner (as o opposed to "All Excel Files which is the default to see the text file you saved. Excel will ask what kind of file it is. Choose "Delimited" and click on "Next". Check "Space" as well as "Tab" as delimiters and Excel will load the file correctly month, Mkt-RF, SMB, HML, and RF in separate columns Notice that the return figures in the Eama-French data are in percentage -i.e., 1 means 1 percent or 0.01 whereas the Apple returns you calculated might be decimal numbers Align the units of the two series either decimal numbers or percentage figures The purpose of this question is to familiarise you with the use of regression analysis to calculate the parameters of the market model and to interpret these parameter estimates and selected associated statistics. The analysis will enable us to answer questions such as "Did this company outperform or underperform relative to its level of systematic risk?" Data You will conduct performance analysis on Apple Inc. with historical monthly data. First, you need Apple's monthly return data. As you did in the first assignment, visit http://finance.yahoo.com. Enter "Apple" or its ticker symbol AAPL" in the "Get Quotes" box. Then click on "Historical Prices Choose MAX" for time period and "Monthly" frequency, click pply and then Download Data''. Keep only Date and Adj. Close. In the third column, calculate monthly returns in percentage from adjusted prices. Notice that Yahoo Finance matches the first trading day of the month and the closing mont price ecause it also provides thly monthly opening prices) for example, what appears to be 1/3/2013 adjusted closing price is in fact the end of March 2013 price adjusted for dividend payments Calculate monthly returns from February 1981 to March 2017 ie manually delete the April 2017 and May 2017 adjusted prices in Excel after downloading every adjusted close price available from Yahoo Finance. Note that you need the January 1981 price to compute the February 1981 return You will also need monthly US market excess returns, SMB, HML, and risk-free rates For those, download the monthly Fama-French factor data from Ken French's website http://mba tuck dartmouth edu pages faculty/ken.french/ftp/F F Research Data Factors TXT.zip (no space) and unzip the file. The text file contains monthly and yearly factor data. Discard the descriptions and yearly data and save the text file (in other words, keep only the monthly figures and headings, Mkt-RF, SMB HML, and RF) and save the text file Load the text file in Excel. To do so, click on "Open" in Excel and choose "All Files at the bottom ri ght corner (as o opposed to "All Excel Files which is the default to see the text file you saved. Excel will ask what kind of file it is. Choose "Delimited" and click on "Next". Check "Space" as well as "Tab" as delimiters and Excel will load the file correctly month, Mkt-RF, SMB, HML, and RF in separate columns Notice that the return figures in the Eama-French data are in percentage -i.e., 1 means 1 percent or 0.01 whereas the Apple returns you calculated might be decimal numbers Align the units of the two series either decimal numbers or percentage figures