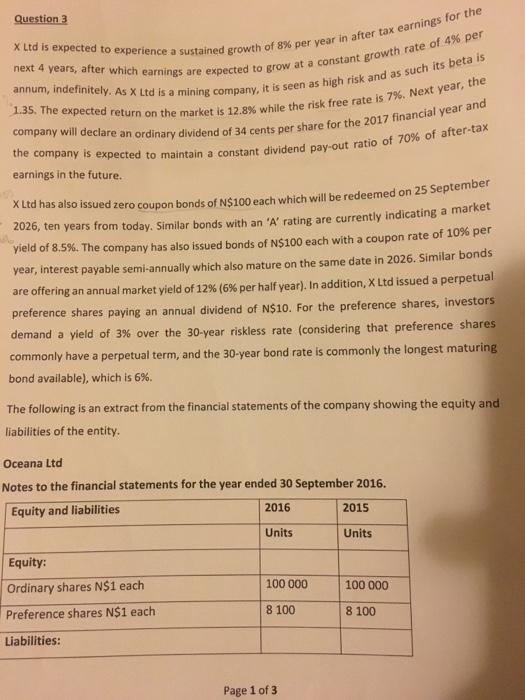

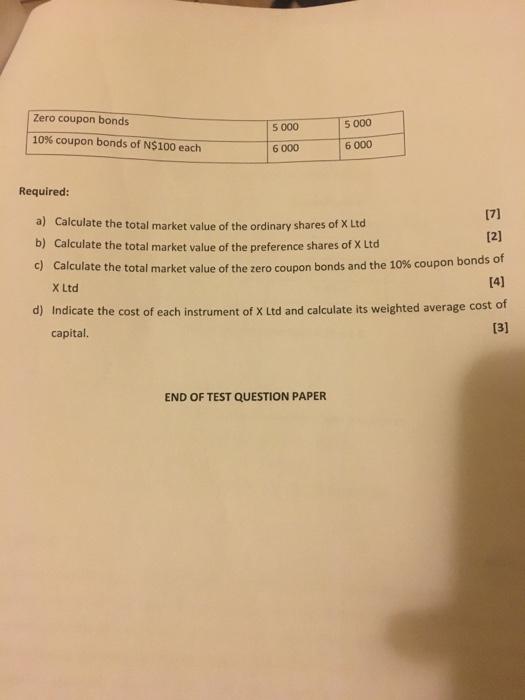

the Question 3 X Ltd is expected to experience a sustained growth of 8% per year in after tax earnings for the next 4 years, after which earnings are expected to grow at a constant growth rate of 4% per annum, indefinitely. As X Ltd is a mining company, it is seen as high risk and as such its beta is 1.35. The expected return on the market is 12.8% while the risk free rate is 7%. Next year, company will declare an ordinary dividend of 34 cents per share for the 2017 financial year and the company is expected to maintain a constant dividend pay-out ratio of 70% of after-tax earnings in the future. X Ltd has also issued zero coupon bonds of N$100 each which will be redeemed on 25 September 2026, ten years from today. Similar bonds with an 'A' rating are currently indicating a market yield of 8.5%. The company has also issued bonds of N$100 each with a coupon rate of 10% per year, interest payable semi-annually which also mature on the same date in 2026. Similar bonds are offering an annual market yield of 12% (6% per half year). In addition, X Ltd issued a perpetual preference shares paying an annual dividend of N$10. For the preference shares, investors demand a yield of 3% over the 30-year riskless rate (considering that preference shares commonly have a perpetual term, and the 30-year bond rate is commonly the longest maturing bond available), which is 6%. The following is an extract from the financial statements of the company showing the equity and liabilities of the entity. Oceana Ltd Notes to the financial statements for the year ended 30 September 2016. Equity and liabilities 2016 2015 Units Units Equity: Ordinary shares N$1 each Preference shares N$1 each 100 000 100 000 8 100 8 100 Liabilities: Page 1 of 3 Zero coupon bonds 10% coupon bonds of N$100 each 5 000 5 000 6 000 6 000 Required: a) Calculate the total market value of the ordinary shares of X Ltd [7] b) Calculate the total market value of the preference shares of X Ltd [2] c) Calculate the total market value of the zero coupon bonds and the 10% coupon bonds of X Ltd [4] d) Indicate the cost of each instrument of X Ltd and calculate its weighted average cost of capital. [3] END OF TEST QUESTION PAPER