Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question are the (a) and (b) problems, hope for help ASAP You look up the prices of European calls today on a particular stock

The question are the (a) and (b) problems, hope for help ASAP

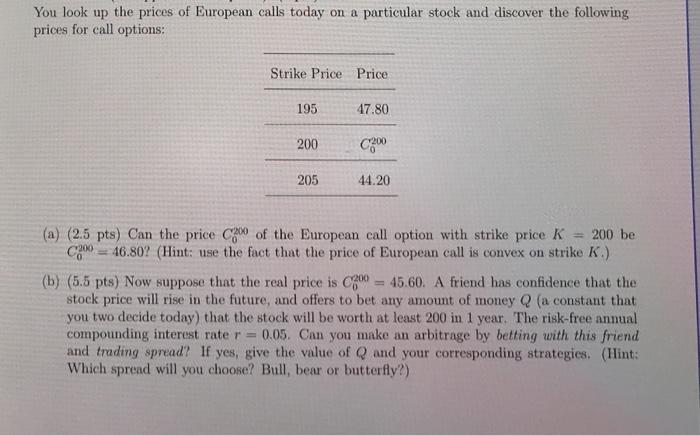

You look up the prices of European calls today on a particular stock and discover the following prices for call options: Strike Price Price 195 47.80 200 cz 205 44.20 (a) (2.5 pts) Can the price of the European call option with strike price K = 200 be C2 = 46.807 (Hint: use the fact that the price of European call is convex on strike K.) (b) (5.5 pts) Now suppose that the real price is goo = 45.60. A friend has confidence that the stock price will rise in the future, and offers to bet any amount of money Q (a constant that you two decide today) that the stock will be worth at least 200 in 1 year. The risk-free annual compounding interest rate r = 0.05. Can you make an arbitrage by betting with this friend and trading spread? If yes, give the value of Q and your corresponding strategies. (Hint: Which spread will you choose? Bull, bear or butterfly?) You look up the prices of European calls today on a particular stock and discover the following prices for call options: Strike Price Price 195 47.80 200 cz 205 44.20 (a) (2.5 pts) Can the price of the European call option with strike price K = 200 be C2 = 46.807 (Hint: use the fact that the price of European call is convex on strike K.) (b) (5.5 pts) Now suppose that the real price is goo = 45.60. A friend has confidence that the stock price will rise in the future, and offers to bet any amount of money Q (a constant that you two decide today) that the stock will be worth at least 200 in 1 year. The risk-free annual compounding interest rate r = 0.05. Can you make an arbitrage by betting with this friend and trading spread? If yes, give the value of Q and your corresponding strategies. (Hint: Which spread will you choose? Bull, bear or butterfly?) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started