Question

The question from textbook: Financial Management Principles and Applications, 6edition pp. 514. Clearly information by hand type. 14-21 (Integrated problem) Correlli Ltd, a taxation category

The question from textbook: Financial Management Principles and Applications, 6edition

pp. 514.

Clearly information by hand type.

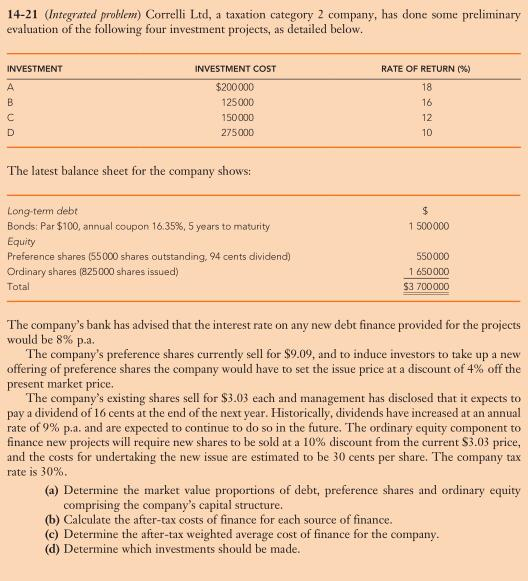

14-21 (Integrated problem) Correlli Ltd, a taxation category 2 company, has done some preliminary evaluation of the following four investment projects, as detailed below.

| Investment | Investment Cost | Rate of return (%) |

| A | $200,000 | 18 |

| B | $125,000 | 16 |

| C | $150,000 | 12 |

| D | $275,000 | 10 |

The latest balance sheet for the company shows:

| Long-term debt | $ |

| Bonds: Par $100, annual coupon 16.35%, 5 years to maturity | 1,500,000 |

| Equity | |

| Preference shares (55,000 shares outstanding, 94 cents dividend) | 550,000 |

| Ordinary shares (825,000 shares issued) | 1,650,000 |

| Total | $3,700,000 |

The companys bank has advised that the interest rate on any new debt finance provided for the projects would be 8% p.a.

The companys preference shares currently sell for $9.09, and to induce investors to take up a new offering of preference shares the company would have to set the issue price at a discount of 4% off the present market price.

The companys existing shares sell for $3.03 each and management has disclosed that it expects to pay a dividend of 16 cents at the end of the next year. Historically, dividends have increased at an annual rate of 9% p.a. and are expected to continue to do so in the future. The ordinary equity component to finance new projects will require new shares to be sold at a 10% discount from the current $3.03 price, and the costs for undertaking the new issue are estimated to be 30 cents per share. The company tax rate is 30%.

(a) Determine the market value proportions of debt, preference shares and ordinary equity comprising the companys capital structure.

(b) Calculate the after-tax costs of finance for each source of finance.

(c) Determine the after-tax weighted average cost of finance for the company.

(d) Determine which investments should be made.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started