the question fully

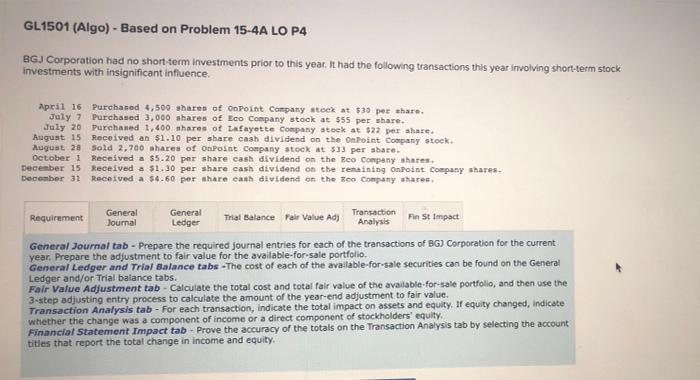

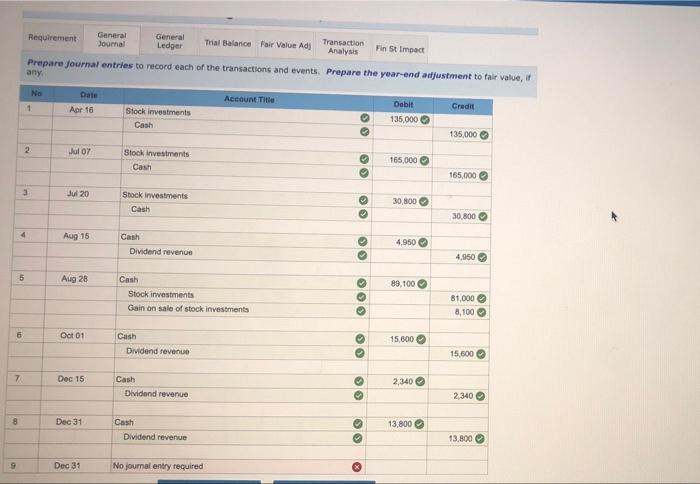

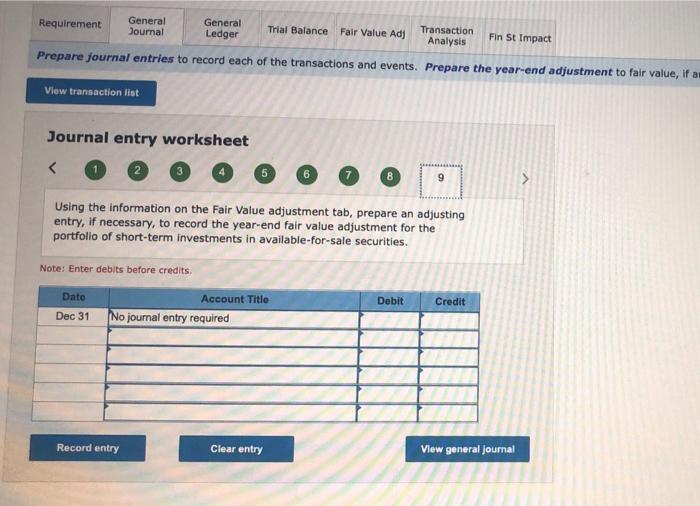

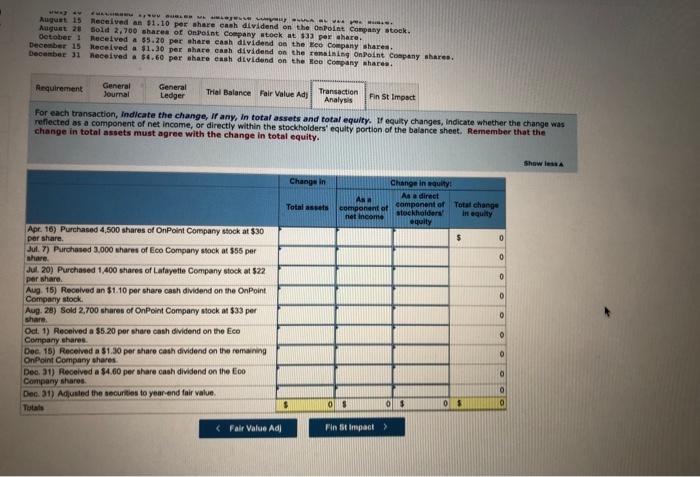

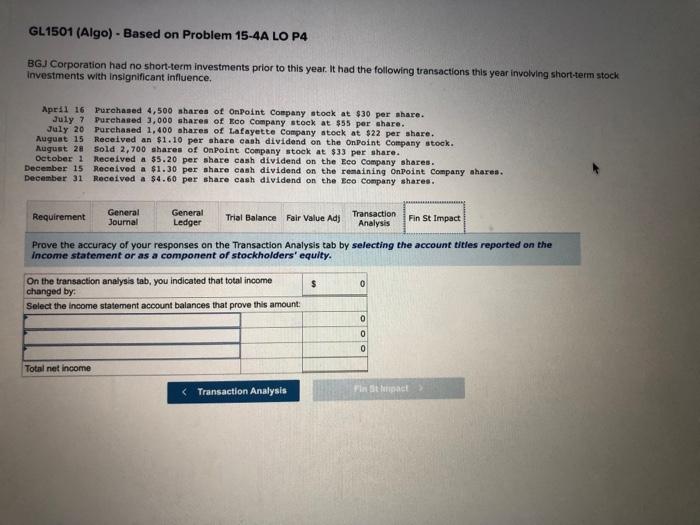

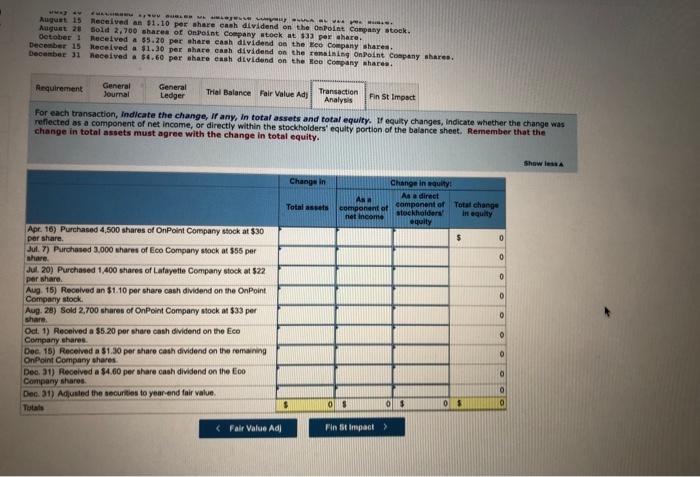

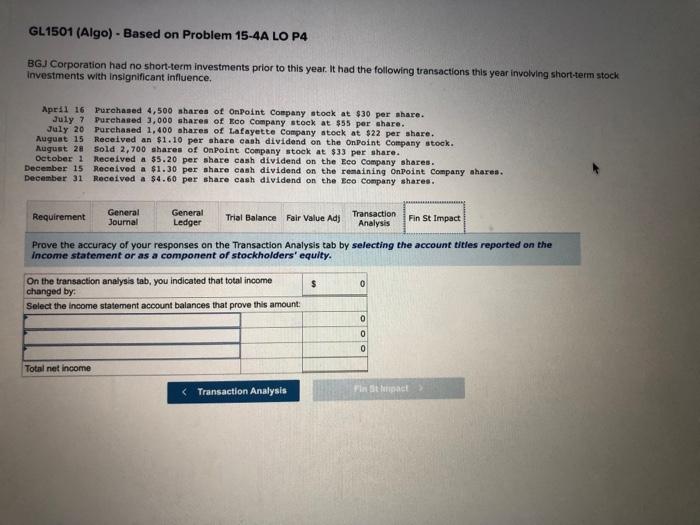

GL1501 (Algo) - Based on Problem 15-4A LO P4 BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock investments with insignificant influence April 16 Purchased 4,500 shares of On Point Company steek at $30 per share. July 7 Purchased 3,000 shares of Eco Company stock at $55 per share. July 20Purchased 1,400 shares of Lafayette Company stock at $22 per share. August 15 Received an $1.10 per share cash dividend on the On Point Company stock. August 28 Sold 2,700 shares of On Point Company stock at 533 per share. October 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining On Point Company shares. December 31 Received a 54.60 per share cash dividend on the too company shares. Requirement Transaction in St Impact General Journal General Ledger Thal Balance Fair Value Ad) Analysis General Journal tab - Prepare the required journal entries for each of the transactions of BG) Corporation for the current year. Prepare the adjustment to fair value for the available for sale portfolio General Ledger and Trial Balance tabs - The cost of each of the available for sale securities can be found on the General Ledger and/or Trial balance tabs. Fair Value Adjustment tab - Calculate the total cost and total fair value of the available for sale portfolio, and then use the 3-step adjusting entry process to calculate the amount of the year-end adjustment to fair value. Transaction Analysis tab - For each transaction, indicate the total impact on assets and equity. If equity changed, indicate whether the change was a component of income or a direct component of stockholders' equity Financial Statement Impact tab - Prove the accuracy of the totals on the Transaction Analysis tab by selecting the account titles that report the total change in income and equity. Requirement General Journal General Ledger Thal Balance Fair Value Adi Transaction Analysis Fin St Impact Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, any No Date Apr 16 Account Title 1 Credit Stock investments Cash Debit 135,000 135,000 2 Jul 07 Stock investments Cash 165,000 165,000 3 Jul 20 Stock investments Cash 30,800 30.800 4 Aug 15 Cash Dividend revenue 4,950 4,950 5 Aug 28 89.100 Cash Stock investments Gain on sale of stock investments 81,000 8,100 6 Oct 01 15,600 Cash Dividend revenue 15,600 7 Dec 15 * 2,340 Cash Dividend revenue 2.340 8 Dec 31 Cash Dividend revenue 13,800 13,800 9 Dec 31 No journal entry required 9 Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, if a View transaction list Journal entry worksheet Using the information on the Fair Value adjustment tab, prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of short-term investments in available-for-sale securities. Note: Enter debits before credits Date Debit Credit Account Title No journal entry required Dec 31 Record entry Clear entry View general journal WALE WA August 15 Received an $1.10 per share cash dividend on the nint Company stock. August 28 Sold 2.700 shares of On Point Company stock at 33 per share. detober Received a 55.20 per where cash dividend on the tee Company shares December 15 Received a $1.30 per share cash dividend on the remaining on Point Company shares. December 31 Received a $4.60 per share cash dividend on the Rea company shares. Requirement General General Journal Tral Balance Fair Value Ad; Transaction Fin St Impact Ledger Analysis For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. Show Change in Total assets Change in equity As a direct As component of component of Total change stockholders in equity net income equily $ 0 0 0 0 Apr. 16) Purchased 4,500 shares of On Point Company stock at $3 per share. Jul. 7) Purchased 3,000 shares of Eco Company stock at $55 per share Jul. 20) Purchased 1.400 shares of Lafayette Company stock at 522 per share Aug 15) Received an $1.10 per share cash dividend on the On Point Company stock. Aug. 28) Sold 2,700 shares of OnPoint Company stock at 533 per shamn Odl. 1) Received a $5.20 por share cash dividend on the Eco Company shares Dec 15) Received a $1,30 per sharo cash dividend on the remaining OnPoint Company shares Deo. 21) Received a $4.60 per share cash dividend on the Eco Company shares Dec. 31) Adulted the securities to year and fair value Total 0 0 O 0 $ OS O $ 05 Fair Value Ad Fint impact > GL1501 (Algo) - Based on Problem 15-4A LO P4 BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock Investments with insignificant influence, Apr 11 16 Purchased 4,500 shares of OnPoint Company stock at $30 per share. July 7 Purchased 3,000 shares of Keo Company stock at $55 per share. July 20 Purchased 1,400 shares of Lafayette Company stock at $22 per share. August 15 Received an $1.10 per share cash dividend on the On Point Company stock. August 28 Sold 2,700 shares of On Point Company stock at $33 per share. Detober 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. December 31 Received a $4.60 per share cash dividend on the Eco Company shares. Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the Income statement or as a component of stockholders' equity. $ 0 On the transaction analysis tab. you indicated that total income changed by: Select the income statement account balances that prove this amount: 0 0 0 Total net income Using the information on the Fair Value adjustment tab, prepare an adjusting entry, if necessary, to record the year-end fair value adjustment for the portfolio of short-term investments in available-for-sale securities. Note: Enter debits before credits Date Debit Credit Account Title No journal entry required Dec 31 Record entry Clear entry View general journal WALE WA August 15 Received an $1.10 per share cash dividend on the nint Company stock. August 28 Sold 2.700 shares of On Point Company stock at 33 per share. detober Received a 55.20 per where cash dividend on the tee Company shares December 15 Received a $1.30 per share cash dividend on the remaining on Point Company shares. December 31 Received a $4.60 per share cash dividend on the Rea company shares. Requirement General General Journal Tral Balance Fair Value Ad; Transaction Fin St Impact Ledger Analysis For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. Show Change in Total assets Change in equity As a direct As component of component of Total change stockholders in equity net income equily $ 0 0 0 0 Apr. 16) Purchased 4,500 shares of On Point Company stock at $3 per share. Jul. 7) Purchased 3,000 shares of Eco Company stock at $55 per share Jul. 20) Purchased 1.400 shares of Lafayette Company stock at 522 per share Aug 15) Received an $1.10 per share cash dividend on the On Point Company stock. Aug. 28) Sold 2,700 shares of OnPoint Company stock at 533 per shamn Odl. 1) Received a $5.20 por share cash dividend on the Eco Company shares Dec 15) Received a $1,30 per sharo cash dividend on the remaining OnPoint Company shares Deo. 21) Received a $4.60 per share cash dividend on the Eco Company shares Dec. 31) Adulted the securities to year and fair value Total 0 0 O 0 $ OS O $ 05 Fair Value Ad Fint impact > GL1501 (Algo) - Based on Problem 15-4A LO P4 BGJ Corporation had no short-term investments prior to this year. It had the following transactions this year involving short-term stock Investments with insignificant influence, Apr 11 16 Purchased 4,500 shares of OnPoint Company stock at $30 per share. July 7 Purchased 3,000 shares of Keo Company stock at $55 per share. July 20 Purchased 1,400 shares of Lafayette Company stock at $22 per share. August 15 Received an $1.10 per share cash dividend on the On Point Company stock. August 28 Sold 2,700 shares of On Point Company stock at $33 per share. Detober 1 Received a $5.20 per share cash dividend on the Eco Company shares. December 15 Received a $1.30 per share cash dividend on the remaining OnPoint Company shares. December 31 Received a $4.60 per share cash dividend on the Eco Company shares. Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact Prove the accuracy of your responses on the Transaction Analysis tab by selecting the account titles reported on the Income statement or as a component of stockholders' equity. $ 0 On the transaction analysis tab. you indicated that total income changed by: Select the income statement account balances that prove this amount: 0 0 0 Total net income