The question has 15 parts.

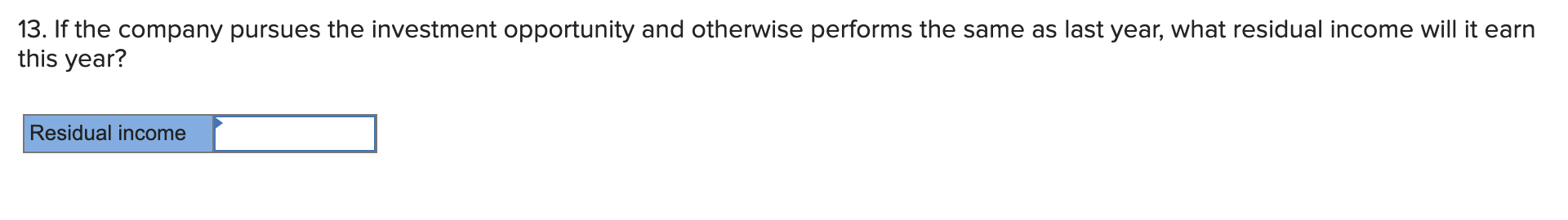

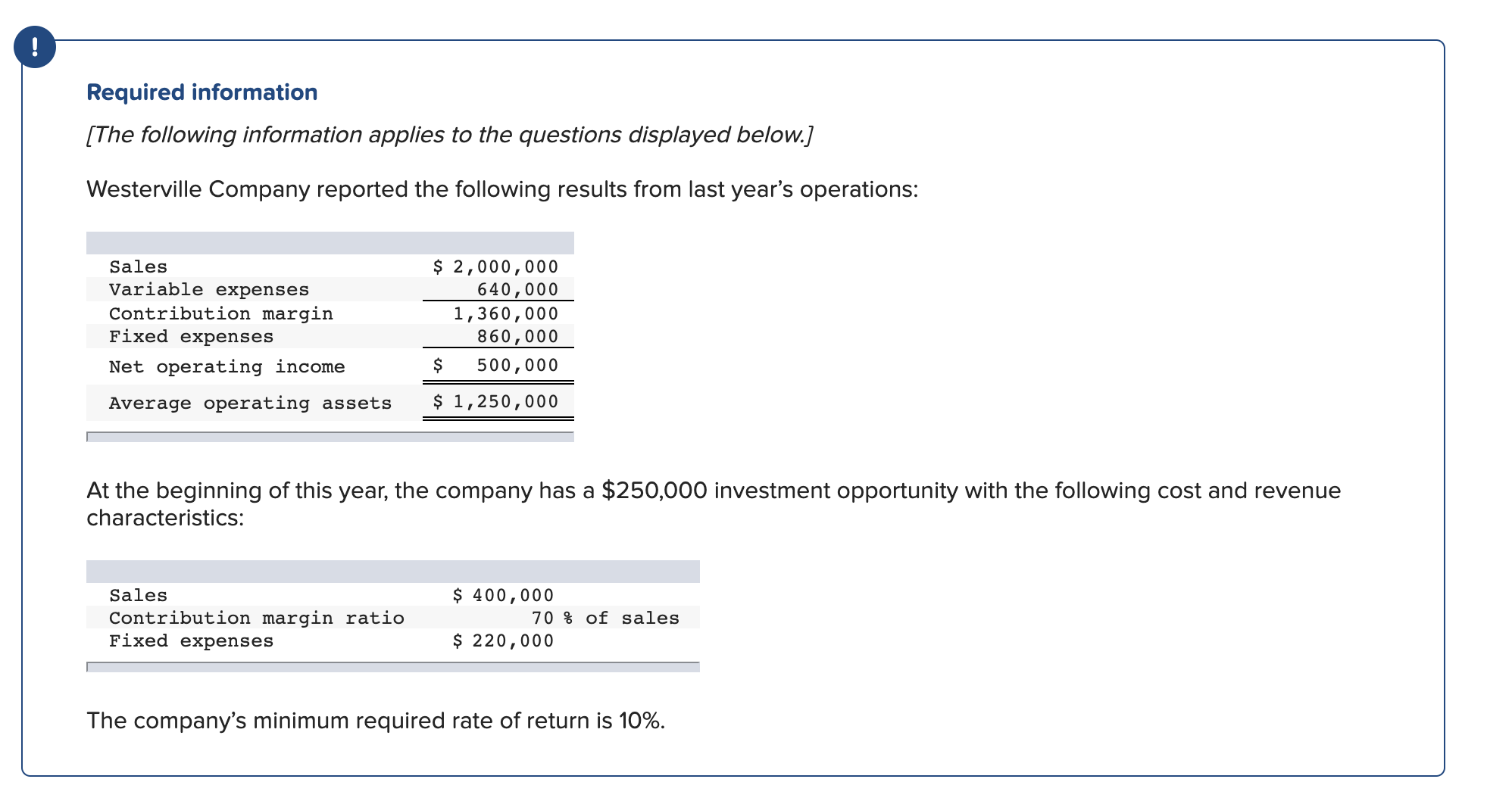

Required information [The following information applies to the questions displayed below. ] Westerville Company reported the following results from last year's operations: Sales $ 2,000,000 Variable expenses 640,000 Contribution margin 1 , 360 , 000 Fixed expenses 860 , 000 Net operating income $ 500 , 00 0 Average operating assets $ 1,2501000 [ At the beginning of this year, the company has a $250,000 investment opportunity with the following cost and revenue characteristics: Sales $ 400,000 Contribution margin ratio 70 % of sales Fixed expenses $ 220,000 The company's minimum required rate of return is 10%. \f2. What is last year's turnover? (Round your answer to 1 decimal place.) -:| 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) _:| \f7. If the company pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? (Round your percentage answer to 1 decimal place (Le .1234 should be entered as 12.3)) -% 8. If the company pursues the investment opportunity and otherwise performs the same as last year. what turnover will it earn this year? (Round your answer to 2 decimal places.) :| 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%. % 10~a. If Westerville's chief executive officer will earn a bonus only if her ROI from this year exceeds her ROI from last year, would she pursue the investment opportunity? 0 Yes 0 No 10-b. Would the owners of the company want her to pursue the investment opportunity? 0 Yes 0 No 13. If the company pursues the investment opportunity and otherwise performs the same as last year, what residual income will it earn this year? :| 14. If Westerville's chief executive officer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunity? O Yes O No15-a. Assume that the contribution margin ratio of the investment opportunity was 60% instead of 70%. If Westerville's Chief Executive Ofcer will earn a bonus only if her residual income from this year exceeds her residual income from last year, would she pursue the investment opportunity? 0 Yes 0 No 15-b. Would the owners of the company want her to pursue the investment opportunity? 0 Yes 0 No