The question is 7-32.

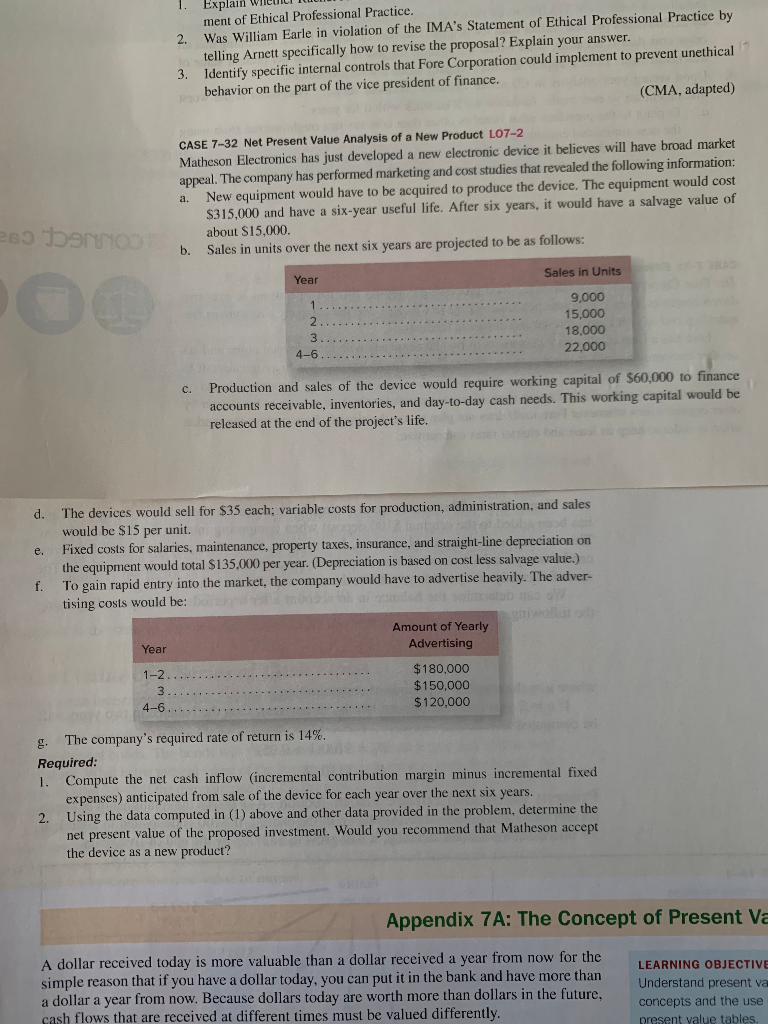

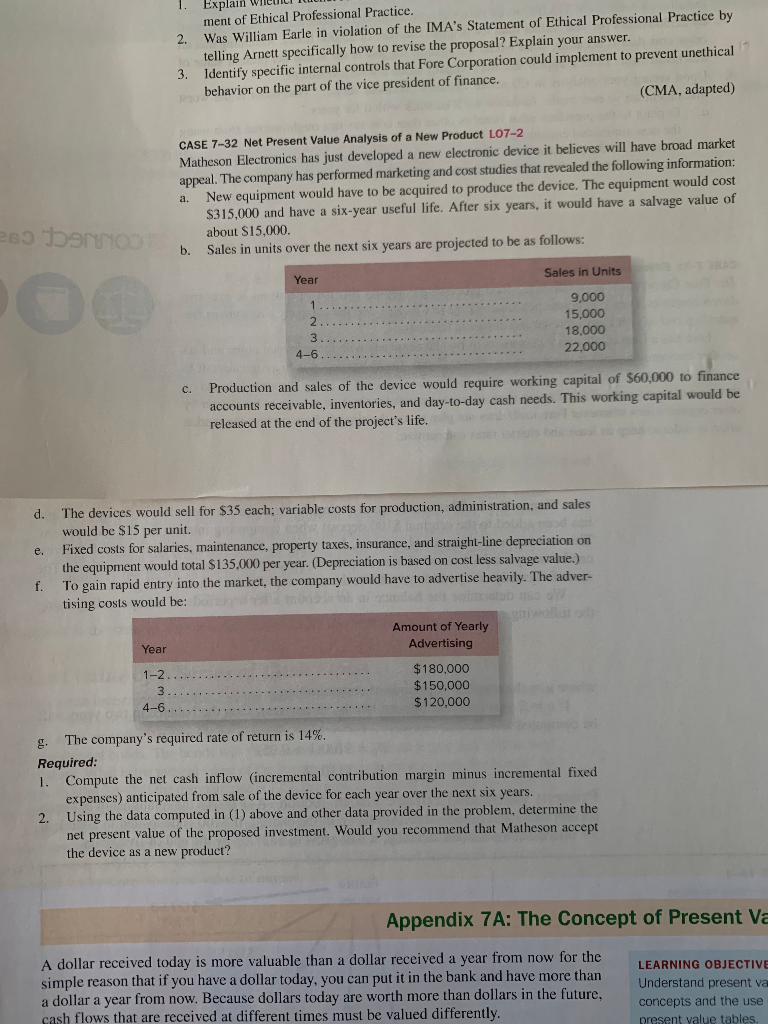

Explain ment of Ethical Professional Practice Was William Earle in violation of the IMA's Statement of Ethical Professional Practice by telling Arnett specifically how to revise the proposal? Explain your answer. Identify specific internal controls that Fore Corporation could implement to prevent unethical behavior on the part of the vice president of finance. 2. 3. (CMA, adapted) CASE 7-32 Net Present Value Analysis of a New Product LO7-2 Matheson Electronics has just developed a new electronic device it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following information: New equipment would have to be acquired to produce the device. The equipment would cost $315,000 and have a six-year useful life. After six years, it would have a salvage value of about $15,000. Sales in units over the next six years are projected to be as follows: a. b. Sales in Units Year 9,000 15,000 18,000 22,000 3 4-6 Production and sales of the device would require working capital of $60,000 to finance accounts receivable, inventories, and day-to-day cash needs. This working capital would be relcased at the end of the project's life. . The devices would sell for $35 each; variable costs for production, administration, and sales would be $15 per unit. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $135,000 per year. (Depreciation is based on cost less salvage value.) To gain rapid entry into the market, the company would have to advertise heavily. The adver- tising costs would be: d. e. f. drab moW Amount of Yearly Advertising Year $180,000 1-2 $150,000 $120,000 3 4-6. The company's required rate of return is 14%. g. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment. Would you recommend that Matheson accept the device as a new product? Appendix 7A: The Concept of Present Va A dollar received today is more valuable than a dollar received a year from now for the simple reason that if you have a dollar today, you can put it in the bank and have more than a dollar a year from now. Because dollars today are worth more than dollars in the future, cash flows that are received at different times must be valued differently. LEARNING OBJECTIVE Understand present va concepts and the use present yalue tables