Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is alot but I cannot post it one by one since its all linked together. I appreciate your help. Thank you so much!

The question is alot but I cannot post it one by one since its all linked together.

I appreciate your help.

Thank you so much!

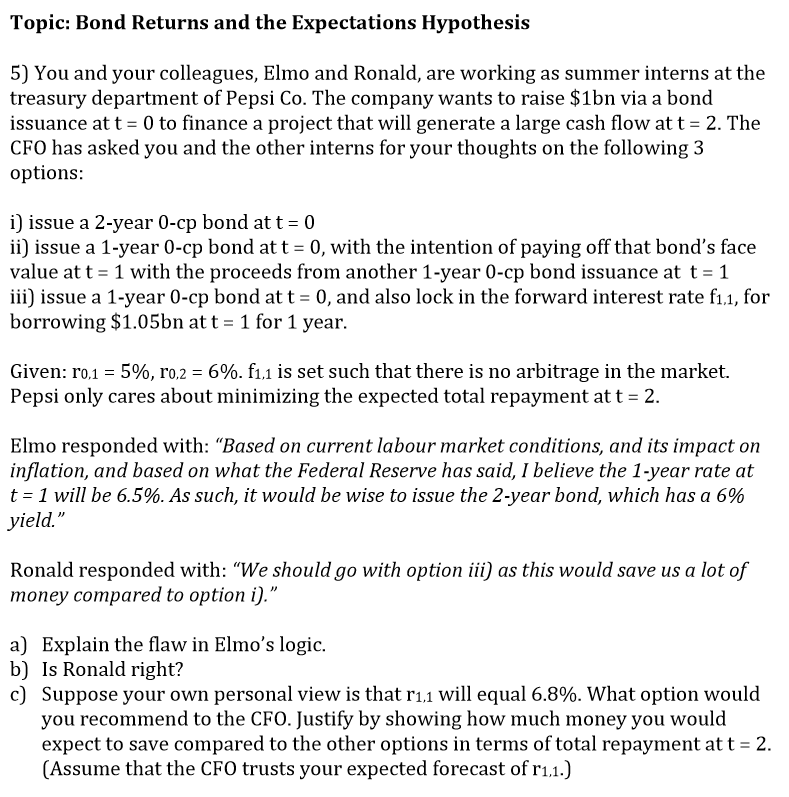

Topic: Bond Returns and the Expectations Hypothesis 5) You and your colleagues, Elmo and Ronald, are working as summer interns at the treasury department of Pepsi Co. The company wants to raise $1bn via a bond issuance at t 0 to finance a project that will generate a large cash flow at t 2. The CFO has asked you and the other interns for your thoughts on the following 3 options: i) issue a 2-year 0-cp bond at t -0 in issue a 1-year 0-cp bond at t 0, with the intention of paying off that bond's face value att 31 with the proceeds from another 1-year 0-cp bond issuance at t 1 iii) issue a 1-year 0-cp bond at t 0, and also lock in the forward interest rate f1.1, for borrowing $1.05bn at t 1 for 1 year. Given: ro.1 5%, ro, 2 6%. f1,1 is set such that there is no arbitrage in the market. Pepsi only cares about minimizing the expected total repayment at t 2 Elmo responded with: "Based on current labour market conditions, and its impact on inflation, and based on what the Federal Reserve has said, I believe the 1-year rate at t 1 will be 6.5%. As such, it would be wise to issue the 2-year bond, which has a 6% yield. Ronald responded with: "We should go with option iii) as this would save us a lot of money compared to option i)." a) Explain the flaw in Elmo's logic. b) Is Ronald right? c) Suppose your own personal view is that r will equal 6.8%. What option would 1,1 you recommend to the CFO. Justify by showing how much money you would expect to save compared to the other options in terms of total repayment att (Assume that the CFO trusts your expected forecast of ri,1.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started