Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is ' Assume tax is paid one year after the year of income' . Is this first year of cashflows or to account

The question is 'Assume tax is paid one year after the year of income'. Is this first year of cashflows or to account for this, create a year 11?

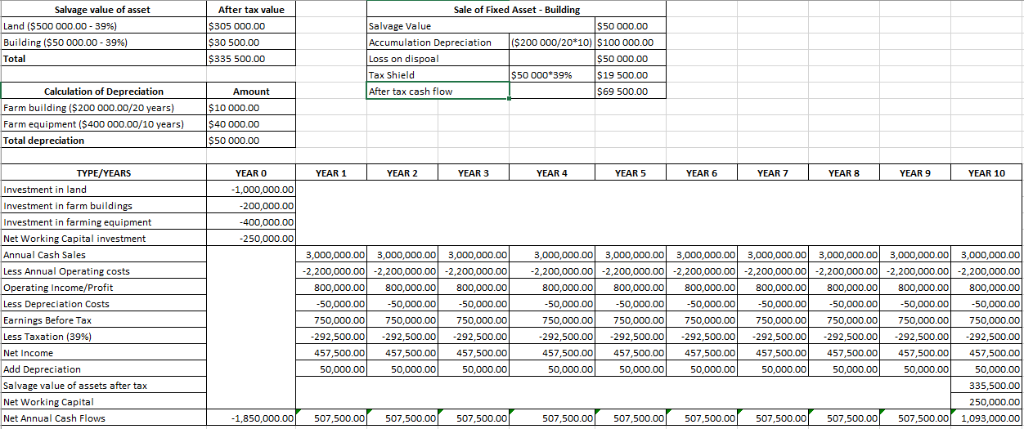

An as per example below, I have an after tax terminal cash flow from the sale of the building $69 500 ($19500 tax shield and $50000 loss on disposal), where does this get inserted into the spreadsheet example below?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started