Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the question is complete Corporate Finance PART A - BUSINESS VALUATIONS When we look at valuing a company, we take many factors into consideration. If

the question is complete

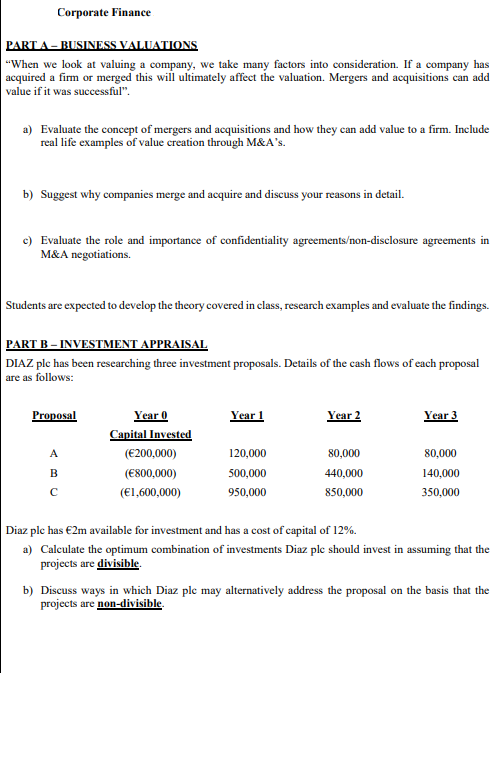

Corporate Finance PART A - BUSINESS VALUATIONS "When we look at valuing a company, we take many factors into consideration. If a company has acquired a firm or merged this will ultimately affect the valuation. Mergers and acquisitions can add value if it was successful". a) Evaluate the concept of mergers and acquisitions and how they can add value to a firm. Include real life examples of value creation through M&A's. b) Suggest why companies merge and acquire and discuss your reasons in detail. c) Evaluate the role and importance of confidentiality agreementson-disclosure agreements in M&A negotiations Students are expected to develop the theory covered in class, research examples and evaluate the findings. PART B - INVESTMENT APPRAISAL DIAZ ple has been researching three investment proposals. Details of the cash flows of each proposal are as follows: Proposal Year 1 Year 2 Year 3 A Year 0 Capital Invested (200,000) (800,000) (1,600,000) 120,000 B 500,000 950,000 80,000 440,000 850,000 80,000 140,000 350,000 Diaz ple has 2m available for investment and has a cost of capital of 12%. a) Calculate the optimum combination of investments Diaz ple should invest in assuming that the projects are divisible b) Discuss ways in which Diaz ple may alternatively address the proposal on the basis that the projects are non-divisible Corporate Finance PART A - BUSINESS VALUATIONS "When we look at valuing a company, we take many factors into consideration. If a company has acquired a firm or merged this will ultimately affect the valuation. Mergers and acquisitions can add value if it was successful". a) Evaluate the concept of mergers and acquisitions and how they can add value to a firm. Include real life examples of value creation through M&A's. b) Suggest why companies merge and acquire and discuss your reasons in detail. c) Evaluate the role and importance of confidentiality agreementson-disclosure agreements in M&A negotiations Students are expected to develop the theory covered in class, research examples and evaluate the findings. PART B - INVESTMENT APPRAISAL DIAZ ple has been researching three investment proposals. Details of the cash flows of each proposal are as follows: Proposal Year 1 Year 2 Year 3 A Year 0 Capital Invested (200,000) (800,000) (1,600,000) 120,000 B 500,000 950,000 80,000 440,000 850,000 80,000 140,000 350,000 Diaz ple has 2m available for investment and has a cost of capital of 12%. a) Calculate the optimum combination of investments Diaz ple should invest in assuming that the projects are divisible b) Discuss ways in which Diaz ple may alternatively address the proposal on the basis that the projects are non-divisible Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started