Question

The question is completed, all information has been provided. No any material is missing. Please provide me with detailed solutions, thanks. Do not waste my

The question is completed, all information has been provided. No any material is missing. Please provide me with detailed solutions, thanks. Do not waste my time by simply saying incomplete question.

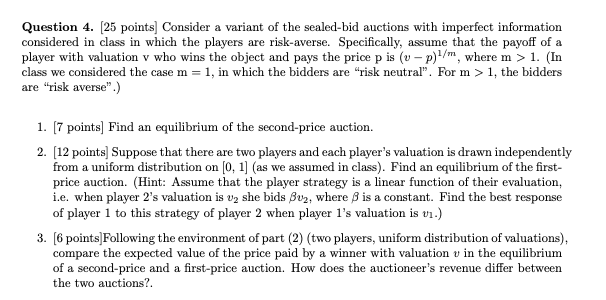

Question 4. [25 points] Consider a variant of the sealed-bid auctions with imperfect information considered in class in which the players are risk-averse. Specifically, assume that the payoff of a player with valuation v who wins the object and pays the price p is (v ? p)1/m, where m > 1. (In class we considered the case m = 1, in which the bidders are "risk neutral". For m > 1, the bidders are "risk averse".)

- [7 points] Find an equilibrium of the second-price auction.

- [12points]Suppose that there are two players and each player's valuation is drawn independently from a uniform distribution on [0, 1] (as we assumed in class). Find an equilibrium of the first- price auction. (Hint: Assume that the player strategy is a linear function of their evaluation, i.e. when player 2's valuation is v2 she bids ?v2, where ? is a constant. Find the best response of player 1 to this strategy of player 2 when player 1's valuation is v1.)

- [6points]Following the environment of part (2) (two players , uniform distribution of valuations), compare the expected value of the price paid by a winner with valuation v in the equilibrium of a second-price and a first-price auction. How does the auctioneer's revenue differ between the two auctions?.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started