Answered step by step

Verified Expert Solution

Question

1 Approved Answer

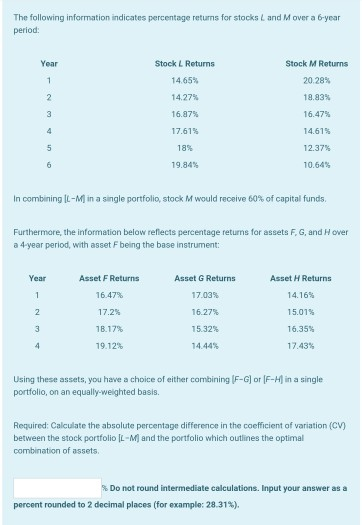

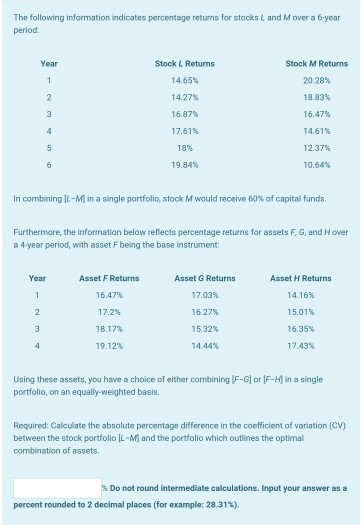

the question is inside yhe picture, please answer it right The following information indicates percentage returns for stocks L and Mover a 6-year period: Year

the question is inside yhe picture, please answer it right

The following information indicates percentage returns for stocks L and Mover a 6-year period: Year Stock M Returns 20.28% 1 Stock Returns 14.65% 14.27% 16.87% 2 18.83% 16.47% 3 4 17.61% 14.61% 5 18% 19.84% 12.37% 10.64% 6 In combining IL-M in a single portfolio, stock Mwould receive 60% of capital funds. Furthermore, the information below reflects percentage returns for assets F, G, and Hover a 4-year period, with asset F being the base instrument: Year Asset H Returns 1 Asset F Returns 16.47% 17.2% 14.16% 2. Asset G Returns 17.03% 16.27% 15.32% 14.44% 3 18.17% 15.01% 16.35% 17.43% 4 19.12% Using these assets, you have a choice of either combining F-G] or [F-H in a single portfolio, on an equally-weighted basis. Required: Calculate the absolute percentage difference in the coefficient of variation (CV) between the stock portfolio IL-M) and the portfolio which outlines the optimal combination of assets. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places (for example: 28.31%). The following information indicates percentage returns for stocks L and Mover a 6-year period: Year Stock M Returns 20.28% 1 Stock Returns 14.65% 14.27% 16.87% 2 18.83% 16.47% 3 4 17.61% 14.61% 5 18% 19.84% 12.37% 10.64% 6 In combining IL-M in a single portfolio, stock Mwould receive 60% of capital funds. Furthermore, the information below reflects percentage returns for assets F, G, and Hover a 4-year period, with asset F being the base instrument: Year Asset H Returns 1 Asset F Returns 16.47% 17.2% 14.16% 2. Asset G Returns 17.03% 16.27% 15.32% 14.44% 3 18.17% 15.01% 16.35% 17.43% 4 19.12% Using these assets, you have a choice of either combining F-G] or [F-H in a single portfolio, on an equally-weighted basis. Required: Calculate the absolute percentage difference in the coefficient of variation (CV) between the stock portfolio IL-M) and the portfolio which outlines the optimal combination of assets. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places (for example: 28.31%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started