Question

The question is not as difficult as it looks, just read it before deciding. I understand if you just can answer 1 question, in that

The question is not as difficult as it looks, just read it before deciding. I understand if you just can answer 1 question, in that case, I want you to complete the yellow excel information, please.

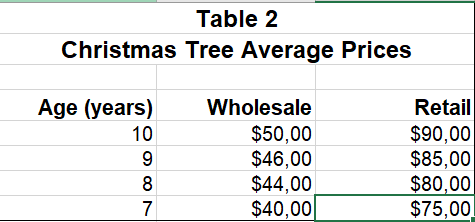

Each year they cut one third of their available trees for selling wholesale while they sell the remaining two thirds as cut your own trees.

14960 is the number of total trees.

The current owners now want to sell their business and move closer to their children and grandchildren. Their listing price for the operation is $190, 000.

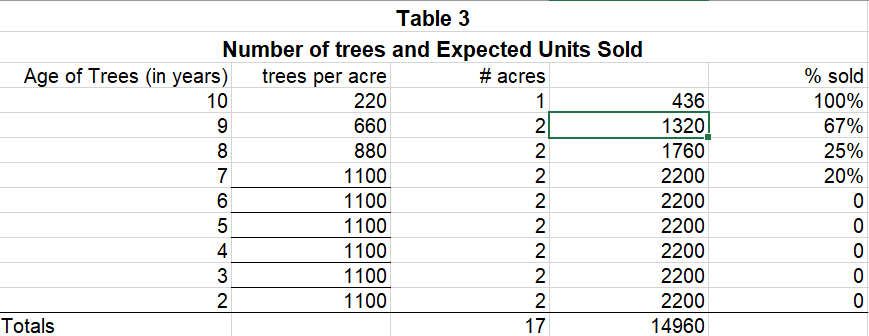

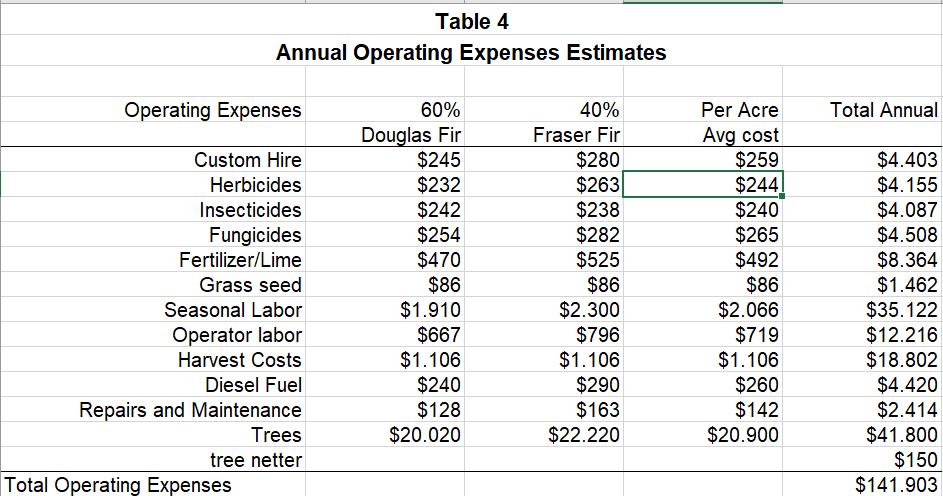

Table 4 provides the estimates of operating expenses. These operating expenses are also expected to increase each year by 2%

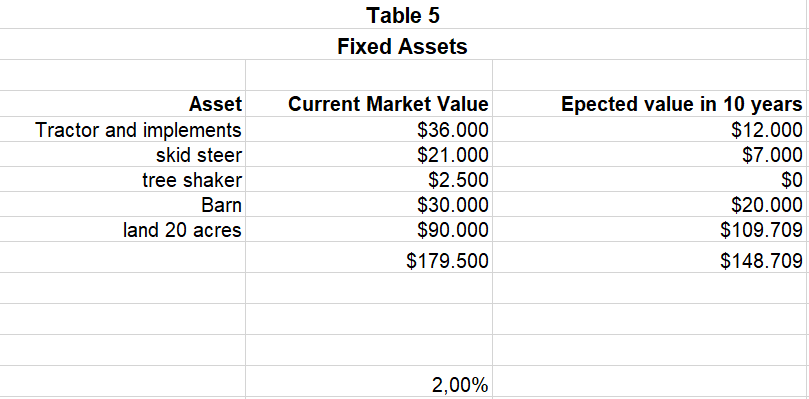

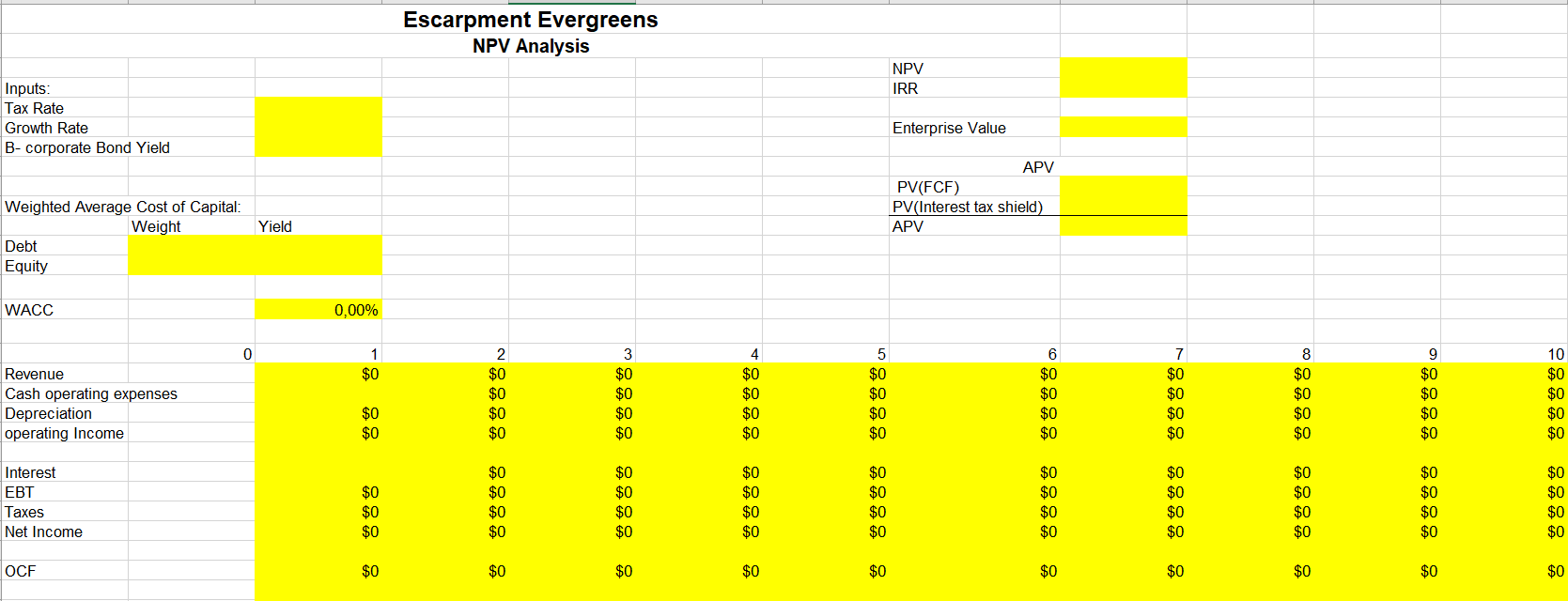

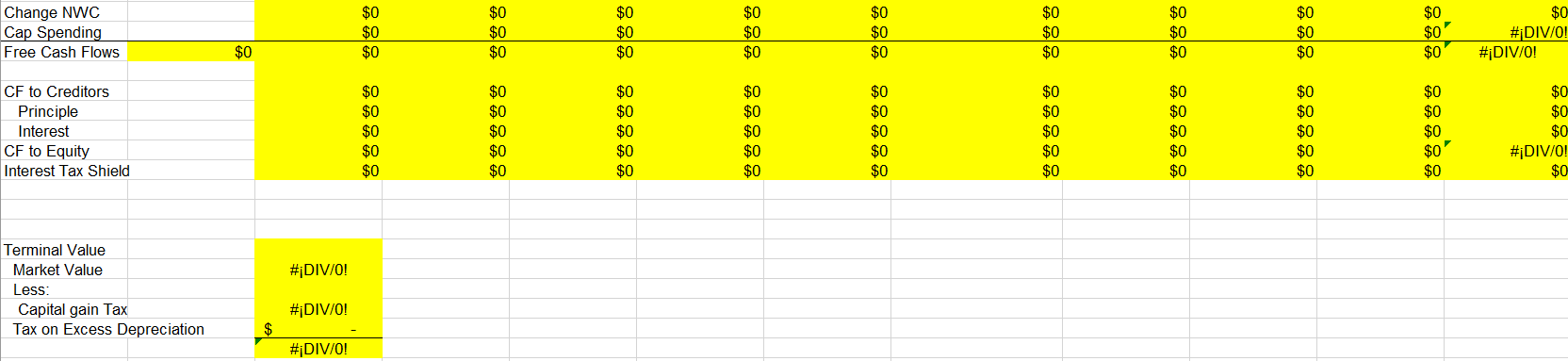

y. The rate on this loan is a fixed rate set at 200 basis points (2%) above the current prime rate. Though this loan program could provide 100% financing, the Oakes expect to finance 25% of the investment from their inheritance. Since their alternative is investing in the equity markets, The Oakes expect a 9% return on their investment. While they expect to keep the operation until they reach retirement age, 10-years is used as the time horizon for analysis of this investment. During this time, land prices are expected to increase at 4%. Closing costs associated with this transaction are expected to be $12,000. Finally, they expect a combined federal and state tax rate of 28%.

Questions; complete the excel of picture 6 and 7 please in case you can just answer one question. 1. Calculate the investment, net working capital, and cash flows for this investment. Assume that the assets can be expensed in year 1 as in the current tax law. 2. The Oakes calculated their discount rate as 5.09%. At the asking price of $190,000, would you recommend purchase of Escarpment Evergreen? 3. Bonus Question: How much would you offer for Escarpment Evergreens?

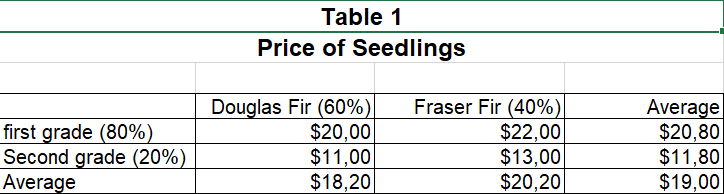

Table 1 Price of Seedlings first grade (80%) Second grade (20%) Average Douglas Fir (60%) $20,00 $11,00 $18,20 Fraser Fir (40%) $22.00 $13,00 $20,20 Average $20.80 $11,80 $19,00 Table 2 Christmas Tree Average Prices Age (years) 10 9 8 7 Wholesale $50,00 $46,00 $44,00 $40,00 Retail $90,00 $85,00 $80,00 $75,00 Table 3 Number of trees and Expected Units Sold Age of Trees (in years) trees per acre # acres 10 220 1 436 9 660 2 1320 8 880 1760 7 1100 2 2200 6 1100 2200 5 1100 2200 4 1100 2 2200 3 1100 2200 2 1100 2200 Totals 17 14960 NNNNNNNN % sold 100% 67% 25% 20% 0 0 0 0 0 4 Nw Table 4 Annual Operating Expenses Estimates Operating Expenses Total Annual Custom Hire Herbicides Insecticides Fungicides Fertilizer/Lime Grass seed Seasonal Labor Operator labor Harvest Costs Diesel Fuel Repairs and Maintenance Trees tree netter Total Operating Expenses 60% Douglas Fir $245 $232 $242 $254 $470 $86 $1.910 $667 $1.106 $240 $128 $20.020 40% Fraser Fir $280 $263 $238 $282 $525 $86 $2.300 $796 $1.106 $290 $163 $22.220 Per Acre Avg cost $259 $244 $240 $265 $492 $86 $2.066 $719 $1.106 $260 $142 $20.900 $4.403 $4.155 $4.087 $4.508 $8.364 $1.462 $35.122 $12.216 $18.802 $4.420 $2.414 $41.800 $150 $141.903 Table 5 Fixed Assets Asset Tractor and implements skid steer tree shaker Barn land 20 acres Current Market Value $36.000 $21.000 $2.500 $30.000 $90.000 $179.500 Epected value in 10 years $12.000 $7.000 $0 $20.000 $109.709 $148.709 2,00% Escarpment Evergreens NPV Analysis NPV IRR Inputs: Tax Rate Growth Rate B-corporate Bond Yield Enterprise Value APV PV(FCF) PV (Interest tax shield) APV Yield Weighted Average Cost of Capital: Weight Debt Equity WACC 0,00% 0 1 $0 Revenue Cash operating expenses Depreciation operating Income 2 $0 $0 $0 $0 3 $0 $0 $0 $0 4 $0 $0 $0 $0 5 $0 $0 $0 $0 6 $0 $0 $0 $0 7 $0 $0 $0 $0 8 $0 $0 $0 $0 9 $0 $0 $0 $0 10 $0 $0 $0 $0 $0 $0 Interest EBT Taxes Net Income $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 OCF $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Change NWC Cap Spending Free Cash Flows $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/0! #DIV/0! $0 CF to Creditors Principle Interest CF to Equity Interest Tax Shield $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/0! $0 #DIV/0! Terminal Value Market Value Less: Capital gain Tax Tax on Excess Depreciation #DIV/0! $ #DIV/0! Table 1 Price of Seedlings first grade (80%) Second grade (20%) Average Douglas Fir (60%) $20,00 $11,00 $18,20 Fraser Fir (40%) $22.00 $13,00 $20,20 Average $20.80 $11,80 $19,00 Table 2 Christmas Tree Average Prices Age (years) 10 9 8 7 Wholesale $50,00 $46,00 $44,00 $40,00 Retail $90,00 $85,00 $80,00 $75,00 Table 3 Number of trees and Expected Units Sold Age of Trees (in years) trees per acre # acres 10 220 1 436 9 660 2 1320 8 880 1760 7 1100 2 2200 6 1100 2200 5 1100 2200 4 1100 2 2200 3 1100 2200 2 1100 2200 Totals 17 14960 NNNNNNNN % sold 100% 67% 25% 20% 0 0 0 0 0 4 Nw Table 4 Annual Operating Expenses Estimates Operating Expenses Total Annual Custom Hire Herbicides Insecticides Fungicides Fertilizer/Lime Grass seed Seasonal Labor Operator labor Harvest Costs Diesel Fuel Repairs and Maintenance Trees tree netter Total Operating Expenses 60% Douglas Fir $245 $232 $242 $254 $470 $86 $1.910 $667 $1.106 $240 $128 $20.020 40% Fraser Fir $280 $263 $238 $282 $525 $86 $2.300 $796 $1.106 $290 $163 $22.220 Per Acre Avg cost $259 $244 $240 $265 $492 $86 $2.066 $719 $1.106 $260 $142 $20.900 $4.403 $4.155 $4.087 $4.508 $8.364 $1.462 $35.122 $12.216 $18.802 $4.420 $2.414 $41.800 $150 $141.903 Table 5 Fixed Assets Asset Tractor and implements skid steer tree shaker Barn land 20 acres Current Market Value $36.000 $21.000 $2.500 $30.000 $90.000 $179.500 Epected value in 10 years $12.000 $7.000 $0 $20.000 $109.709 $148.709 2,00% Escarpment Evergreens NPV Analysis NPV IRR Inputs: Tax Rate Growth Rate B-corporate Bond Yield Enterprise Value APV PV(FCF) PV (Interest tax shield) APV Yield Weighted Average Cost of Capital: Weight Debt Equity WACC 0,00% 0 1 $0 Revenue Cash operating expenses Depreciation operating Income 2 $0 $0 $0 $0 3 $0 $0 $0 $0 4 $0 $0 $0 $0 5 $0 $0 $0 $0 6 $0 $0 $0 $0 7 $0 $0 $0 $0 8 $0 $0 $0 $0 9 $0 $0 $0 $0 10 $0 $0 $0 $0 $0 $0 Interest EBT Taxes Net Income $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 OCF $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Change NWC Cap Spending Free Cash Flows $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/0! #DIV/0! $0 CF to Creditors Principle Interest CF to Equity Interest Tax Shield $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #DIV/0! $0 #DIV/0! Terminal Value Market Value Less: Capital gain Tax Tax on Excess Depreciation #DIV/0! $ #DIV/0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started