Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is regarding the Feb 10th transaction regarding the sale of the note receivable. Thank you! sall Sales on account for the month of

The question is regarding the Feb 10th transaction regarding the sale of the note receivable. Thank you!

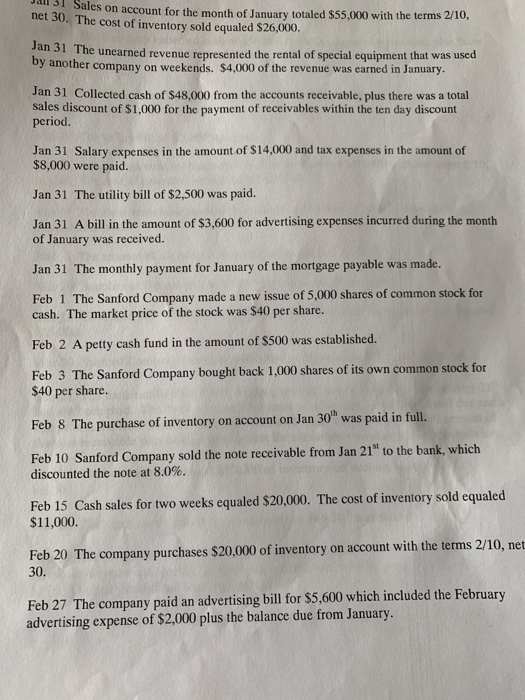

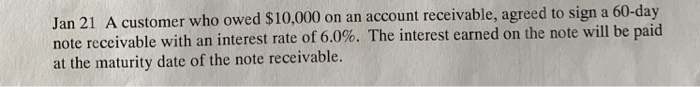

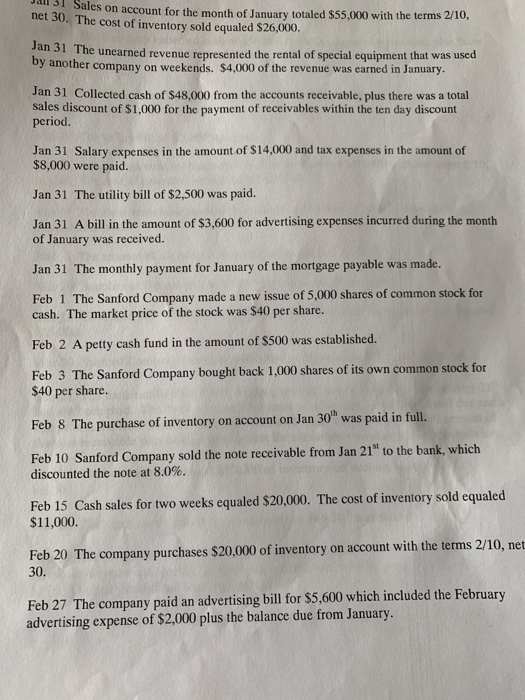

sall Sales on account for the month of January totaled $55,000 with the terms 2/10 net 30. The cost of inventory sold equaled $26,000. an 31 The unearned revenue represented the rental of special equipment that was used y another company on weekends. $4,000 of the revenue was earned in January. Jan 31 Collected cash of $48,000 from the accounts receivable, plus there was a total sales discount of $1,000 for the payment of receivables within the ten day discount period Jan 31 Salary expenses in the amount of $14,000 and tax expenses in the amount of $8,000 were paid. Jan 31 The utility bill of $2,500 was paid. Jan 31 A bill in the amount of $3,600 for advertising expenses incurred during the month of January was received. Jan 31 The monthly payment for January of the mortgage payable was made. Feb 1 The Sanford Company made a new issue of 5,000 shares of common stock for cash. The market price of the stock was $40 per share. Feb 2 A petty cash fund in the amount of $500 was established. Feb 3 The Sanford Company bought back 1,000 shares of its own common stock for $40 per share. Feb 8 The purchase of inventory on account on Jan 30' was paid in full. Feb 10 Sanford Company sold the note receivable from Jan 21 to the bank, which discounted the note at 8.0%. Feb 15 Cash sales for two weeks equaled $20,000. The cost of inventory sold equaled $11,000 Feb 20 The company purchases $20,000 of inventory on account with the terms 2/10, net 30 Feb 27 The company paid an advertising bill for $5,600 which included the February advertising expense of $2,000 plus the balance due from January. Jan 21 A customer who owed $10,000 on an account receivable, agreed to sign a 60-day note receivable with an interest rate of 6.0%. The interest earned on the at the maturity date of the note receivable. note will be paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started