Answered step by step

Verified Expert Solution

Question

1 Approved Answer

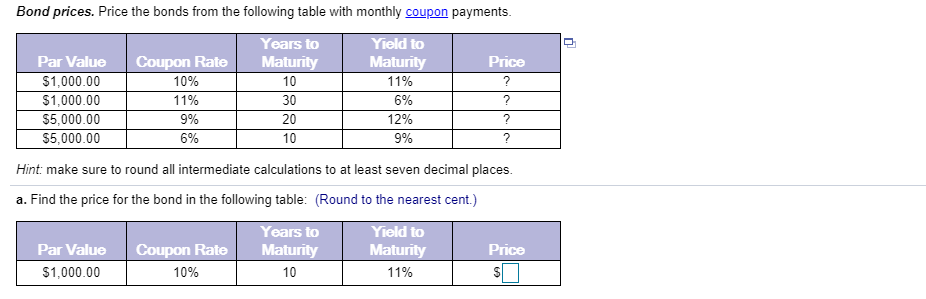

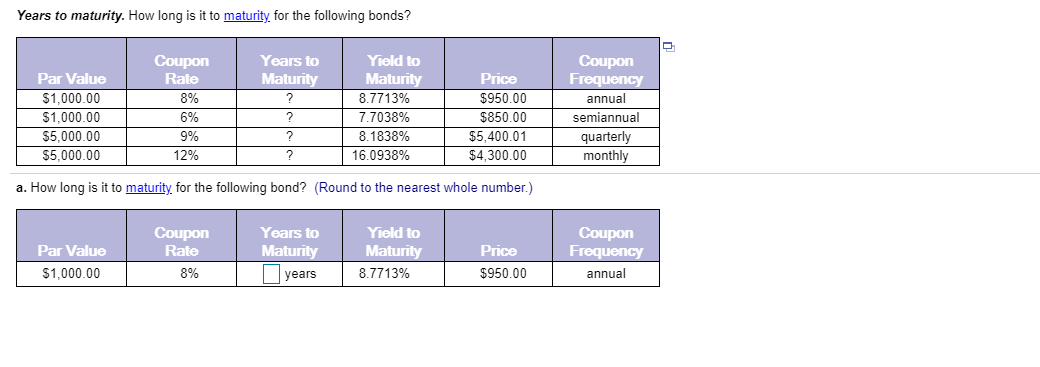

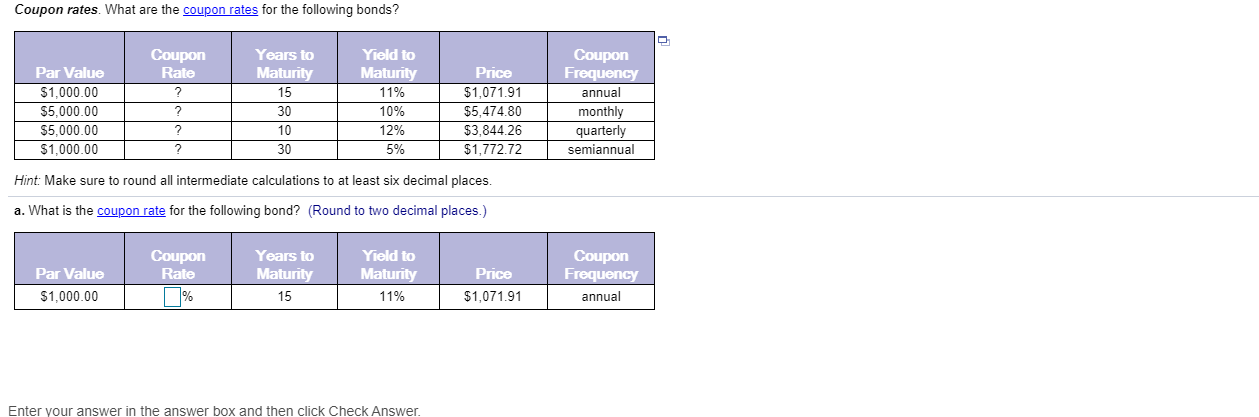

The question is related to financial management. 1) 2) 3) Bond prices. Price the bonds from the following table with monthly coupon payments. Years to

The question is related to financial management.

1)

2)

3)

Bond prices. Price the bonds from the following table with monthly coupon payments. Years to Maturity Price Par Value $1,000.00 $1,000.00 $5,000.00 $5,000.00 Coupon Rate 10% 11% Yield to Maturity 11% 6% 12% 9% 9% 30 20 10 6% Hint: make sure to round all intermediate calculations to at least seven decimal places. a. Find the price for the bond in the following table: (Round to the nearest cent.) Par Value $1,000.00 Years to Maturity 10 Coupon Rate 10% Price Yield to Maturity 11% Years to maturity. How long is it to maturity for the following bonds? Years to Maturity Par Value $1,000.00 $1,000.00 $5,000.00 $5,000.00 Coupon Rate 8% 6% 9% 12% Yield to Maturity 8.7713% 7.7038% 8.1838% 16.0938% Price $950.00 $850.00 $5,400.01 $4,300.00 Coupon Frequency annual semiannual quarterly monthly a. How long is it to maturity for the following bond? (Round to the nearest whole number.) Coupon Rate 8% Par Value $1,000.00 Years to Maturity years Yield to Maturity 8.7713% Coupon Frequency Price $950.00 annual Coupon rates. What are the coupon rates for the following bonds? Coupon Rate Years to Maturity Par Value $1,000.00 $5,000.00 $5,000.00 $1,000.00 Yield to Maturity 11% 10% 12% Coupon Frequency annual monthly quarterly semiannual Price $1,071.91 $5,474.80 $3,844.26 $1,772.72 30 10 30 5% Hint: Make sure to round all intermediate calculations to at least six decimal places. a. What is the coupon rate for the following bond? (Round to two decimal places.) Par Value $1,000.00 Coupon Rate % Years to Maturity 15 Yield to Maturity 11% Price $1,071.91 Coupon Frequency annual | Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started