Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is simple. I'm not looking for anyone to copy and paste this from other questions asked here. I simply want to know how

The question is simple. I'm not looking for anyone to copy and paste this from other questions asked here. I simply want to know how this person got the company fair value of $950,000? Is the answer even correct? If not then what would it be? How do I determine how much the NCI value is?

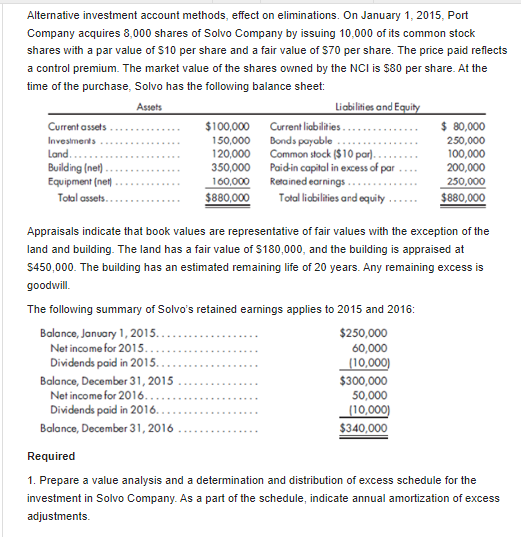

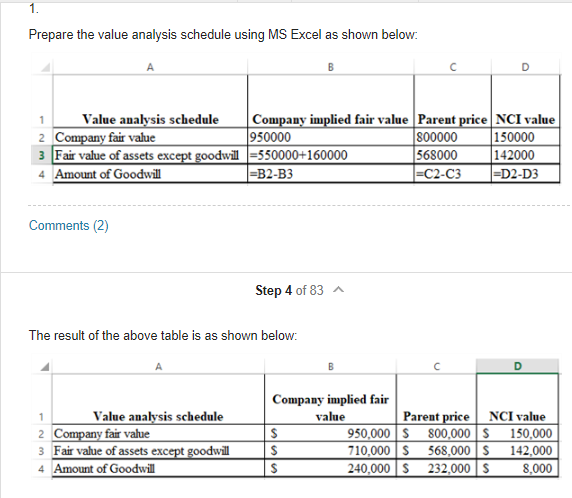

Alternative investment account methods, effect on eliminations. On January 1, 2015, Port Company acquires 8,000 shares of Solvo Company by issuing 10,000 of its common stock shares with a par value of $10 per share and a fair value of $70 per share. The price paid reflects a control premium. The market value of the shares owned by the NCI is $80 per share. At the time of the purchase, Solvo has the following balance sheet: Assets Current assets Investments Land. Building (net) Equipment (net) Total assets... $100,000 150,000 120,000 350,000 160,000 $880,000 Balance, December 31, 2015 Net income for 2016.. Dividends paid in 2016.. Balance, December 31, 2016 Liabilities and Equity Current liabilities.. Bonds payable Common stock ($10 par). Paid-in capital in excess of par Retained earnings..... Total liabilities and equity Appraisals indicate that book values are representative of fair values with the exception of the land and building. The land has a fair value of $180,000, and the building is appraised at $450,000. The building has an estimated remaining life of 20 years. Any remaining excess is goodwill. The following summary of Solvo's retained earnings applies to 2015 and 2016: Balance, January 1, 2015.. Net income for 2015.. Dividends paid in 2015.. $250,000 60,000 (10,000) $ 80,000 250,000 100,000 200,000 250,000 $880,000 $300,000 50,000 (10,000) $340,000 Required 1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Solvo Company. As a part of the schedule, indicate annual amortization of excess adjustments. 1. Prepare the value analysis schedule using MS Excel as shown below: B 1 Value analysis schedule 2 Company fair value 3 Fair value of assets except goodwill -550000+160000 4 Amount of Goodwill Comments (2) Company implied fair value Parent price NCI value 950000 800000 150000 568000 142000 =C2-C3 =D2-D3 Value analysis schedule 1 2 Company fair value 3 Fair value of assets except goodwill 4 Amount of Goodwill =B2-B3 The result of the above table is as shown below: Step 4 of 83 Company implied fair value S $ S Parent price NCI value 150,000 142,000 8,000 950,000 $ 800,000 $ 710,000 $ 568,000 $ 240,000 $ 232,000 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started