Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is the problem provided and the blanks need to be filled in. Are you able to see the problems???? Learning Goals: Understand the

The question is the problem provided and the blanks need to be filled in. Are you able to see the problems????

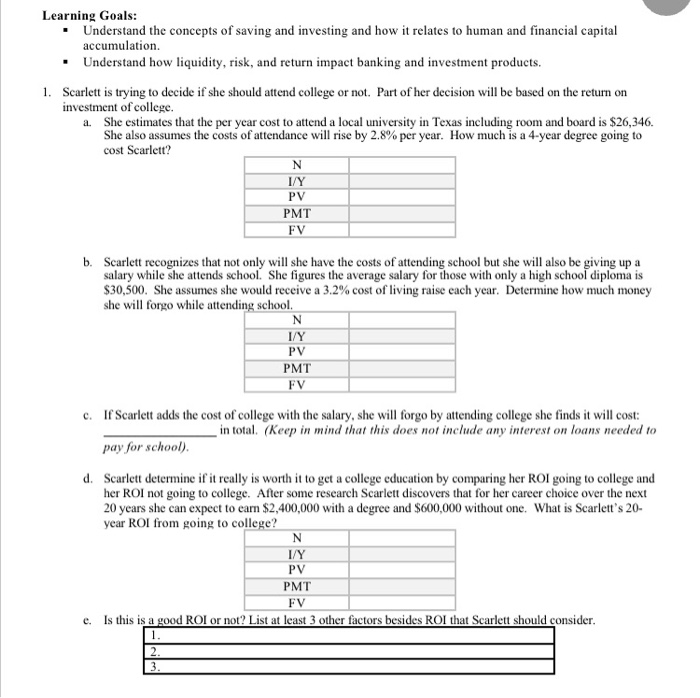

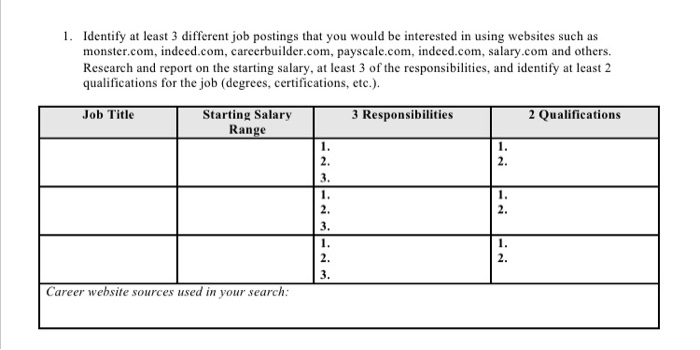

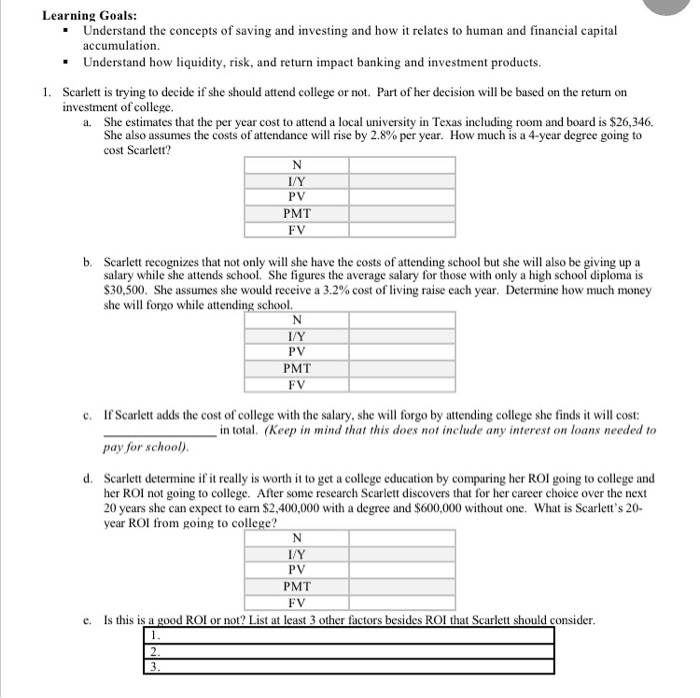

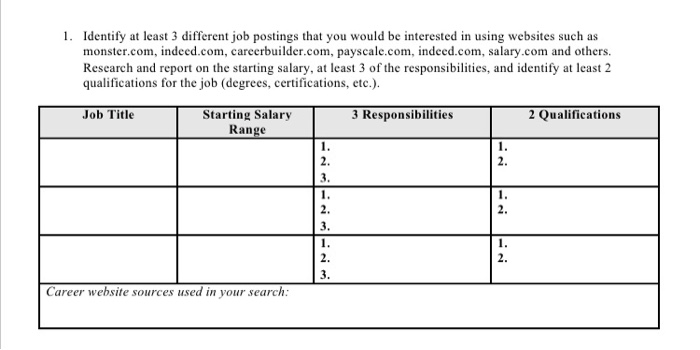

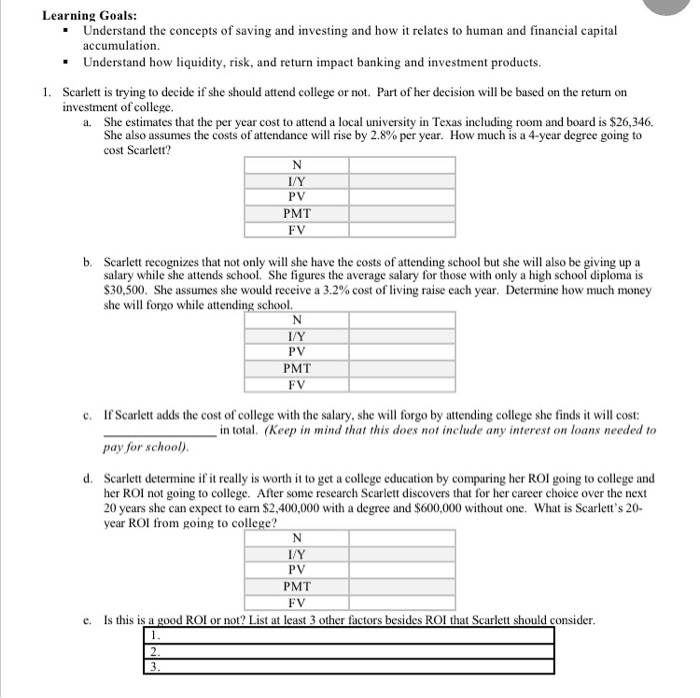

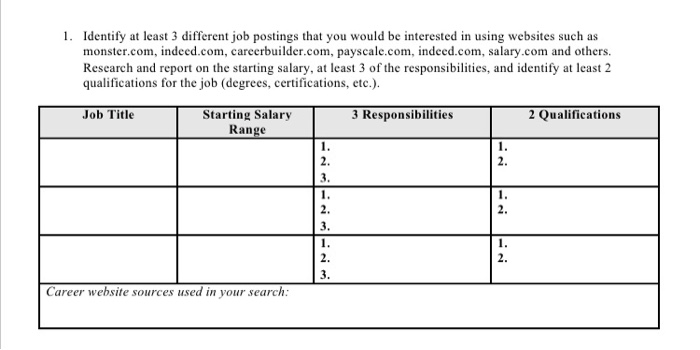

Learning Goals: Understand the concepts of saving and investing and how it relates to human and financial capital accumulation. . Understand how liquidity, risk, and return impact banking and investment products. 1. Scarlett is trying to decide if she should attend college or not. Part of her decision will be based on the return on investment of college. a. She estimates that the per year cost to attend a local university in Texas including room and board is $26,346. She also assumes the costs of attendance will rise by 2.8% per year. How much is a 4-year degree going to cost Scarlett? N I/Y PV PMT FV b. Scarlett recognizes that not only will she have the costs of attending school but she will also be giving up a salary while she attends school. She figures the average salary for those with only a high school diploma is $30,500. She assumes she would receive a 3.2% cost of living raise each year. Determine how much money she will forgo while attending school. N I/Y PV PMT FV c. If Scarlett adds the cost of college with the salary, she will forgo by attending college she finds it will cost: in total (Keep in mind that this does not include any interest on loans needed to pay for school). Scarlett determine if it really is worth it to get a college education by comparing her ROI going to college and her ROI not going to college. After some research Scarlett discovers that for her career choice over the next 20 years she can expect to earn $2,400,000 with a degree and $600,000 without one. What is Scarlett's 20- year ROI from going to college? N I/Y PV PMT FV e. Is this is a good ROI or not? List at least 3 other factors besides ROI that Scarlett should consider. 1. Identify at least 3 different job postings that you would be interested in using websites such as monster.com, indeed.com, careerbuilder.com, payscale.com, indeed.com, salary.com and others. Research and report on the starting salary, at least 3 of the responsibilities, and identify at least 2 qualifications for the job (degrees, certifications, etc.). Job Title 3 Responsibilities 2 Qualifications Starting Salary Range Career website sources used in your search: Learning Goals: Understand the concepts of saving and investing and how it relates to human and financial capital accumulation. . Understand how liquidity, risk, and return impact banking and investment products. 1. Scarlett is trying to decide if she should attend college or not. Part of her decision will be based on the return on investment of college. a. She estimates that the per year cost to attend a local university in Texas including room and board is $26,346. She also assumes the costs of attendance will rise by 2.8% per year. How much is a 4-year degree going to cost Scarlett? N I/Y PV PMT FV b. Scarlett recognizes that not only will she have the costs of attending school but she will also be giving up a salary while she attends school. She figures the average salary for those with only a high school diploma is $30,500. She assumes she would receive a 3.2% cost of living raise each year. Determine how much money she will forgo while attending school. N I/Y PV PMT FV c. If Scarlett adds the cost of college with the salary, she will forgo by attending college she finds it will cost: in total (Keep in mind that this does not include any interest on loans needed to pay for school). Scarlett determine if it really is worth it to get a college education by comparing her ROI going to college and her ROI not going to college. After some research Scarlett discovers that for her career choice over the next 20 years she can expect to earn $2,400,000 with a degree and $600,000 without one. What is Scarlett's 20- year ROI from going to college? N I/Y PV PMT FV e. Is this is a good ROI or not? List at least 3 other factors besides ROI that Scarlett should consider. 1. Identify at least 3 different job postings that you would be interested in using websites such as monster.com, indeed.com, careerbuilder.com, payscale.com, indeed.com, salary.com and others. Research and report on the starting salary, at least 3 of the responsibilities, and identify at least 2 qualifications for the job (degrees, certifications, etc.). Job Title 3 Responsibilities 2 Qualifications Starting Salary Range Career website sources used in your search: Learning Goals: Understand the concepts of saving and investing and how it relates to human and financial capital accumulation. . Understand how liquidity, risk, and return impact banking and investment products. 1. Scarlett is trying to decide if she should attend college or not. Part of her decision will be based on the return on investment of college. a. She estimates that the per year cost to attend a local university in Texas including room and board is $26,346. She also assumes the costs of attendance will rise by 2.8% per year. How much is a 4-year degree going to cost Scarlett? N I/Y PV PMT FV b. Scarlett recognizes that not only will she have the costs of attending school but she will also be giving up a salary while she attends school. She figures the average salary for those with only a high school diploma is $30,500. She assumes she would receive a 3.2% cost of living raise each year. Determine how much money she will forgo while attending school. N I/Y PV PMT FV c. If Scarlett adds the cost of college with the salary, she will forgo by attending college she finds it will cost: in total (Keep in mind that this does not include any interest on loans needed to pay for school). Scarlett determine if it really is worth it to get a college education by comparing her ROI going to college and her ROI not going to college. After some research Scarlett discovers that for her career choice over the next 20 years she can expect to earn $2,400,000 with a degree and $600,000 without one. What is Scarlett's 20- year ROI from going to college? N I/Y PV PMT FV e. Is this is a good ROI or not? List at least 3 other factors besides ROI that Scarlett should consider. 1. Identify at least 3 different job postings that you would be interested in using websites such as monster.com, indeed.com, careerbuilder.com, payscale.com, indeed.com, salary.com and others. Research and report on the starting salary, at least 3 of the responsibilities, and identify at least 2 qualifications for the job (degrees, certifications, etc.). Job Title 3 Responsibilities 2 Qualifications Starting Salary Range Career website sources used in your search: Learning Goals: Understand the concepts of saving and investing and how it relates to human and financial capital accumulation. . Understand how liquidity, risk, and return impact banking and investment products. 1. Scarlett is trying to decide if she should attend college or not. Part of her decision will be based on the return on investment of college. a. She estimates that the per year cost to attend a local university in Texas including room and board is $26,346. She also assumes the costs of attendance will rise by 2.8% per year. How much is a 4-year degree going to cost Scarlett? N I/Y PV PMT FV b. Scarlett recognizes that not only will she have the costs of attending school but she will also be giving up a salary while she attends school. She figures the average salary for those with only a high school diploma is $30,500. She assumes she would receive a 3.2% cost of living raise each year. Determine how much money she will forgo while attending school. N I/Y PV PMT FV c. If Scarlett adds the cost of college with the salary, she will forgo by attending college she finds it will cost: in total (Keep in mind that this does not include any interest on loans needed to pay for school). Scarlett determine if it really is worth it to get a college education by comparing her ROI going to college and her ROI not going to college. After some research Scarlett discovers that for her career choice over the next 20 years she can expect to earn $2,400,000 with a degree and $600,000 without one. What is Scarlett's 20- year ROI from going to college? N I/Y PV PMT FV e. Is this is a good ROI or not? List at least 3 other factors besides ROI that Scarlett should consider. 1. Identify at least 3 different job postings that you would be interested in using websites such as monster.com, indeed.com, careerbuilder.com, payscale.com, indeed.com, salary.com and others. Research and report on the starting salary, at least 3 of the responsibilities, and identify at least 2 qualifications for the job (degrees, certifications, etc.). Job Title 3 Responsibilities 2 Qualifications Starting Salary Range Career website sources used in your search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started