Answered step by step

Verified Expert Solution

Question

1 Approved Answer

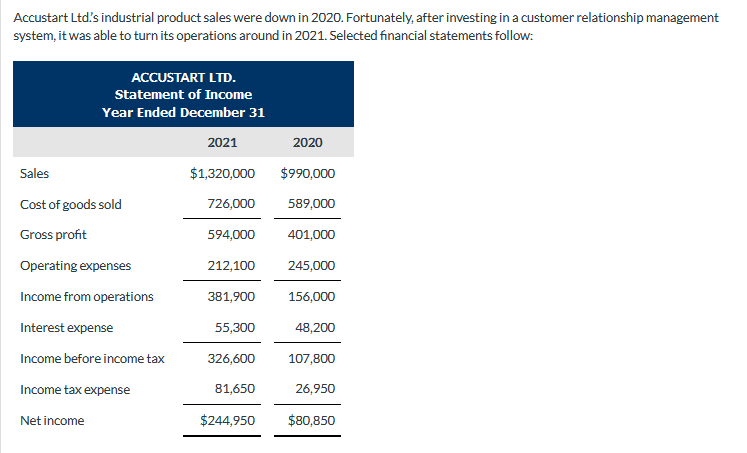

The question is to calculate all relevant solvency ratios for 2021. (Round answers to 1 decimal place) Accustart Ltd.'s industrial product sales were down in

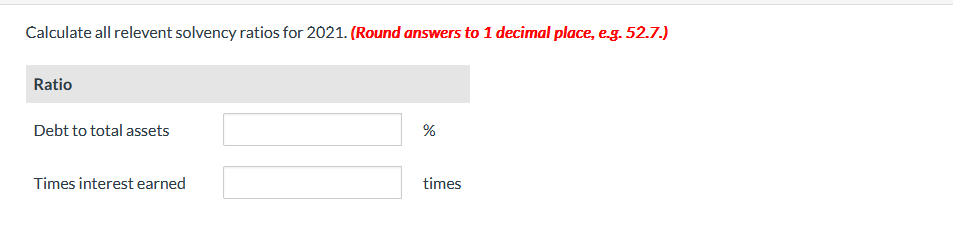

The question is to calculate all relevant solvency ratios for 2021. (Round answers to 1 decimal place)

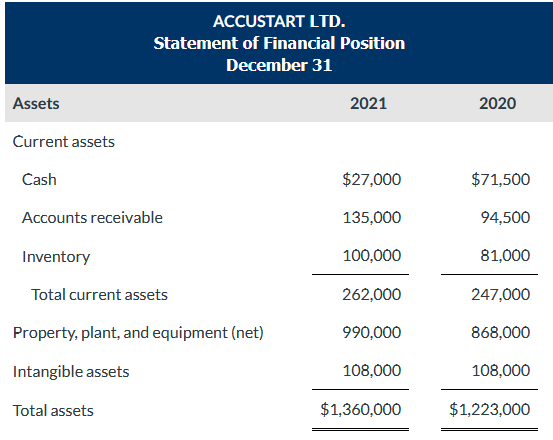

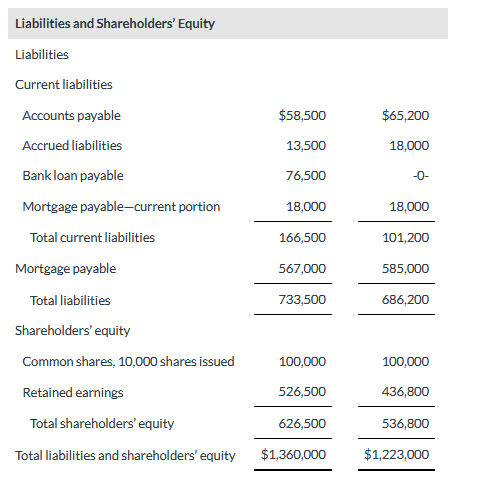

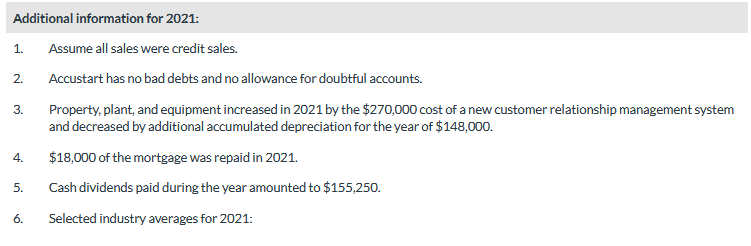

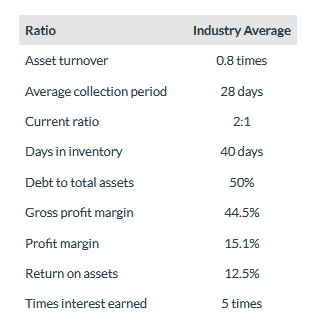

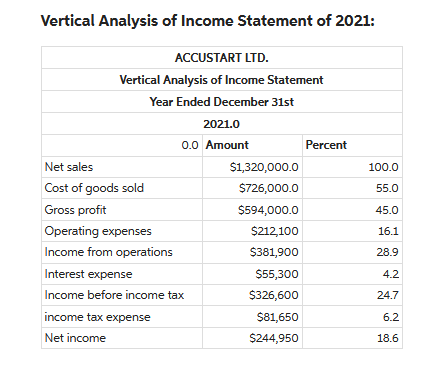

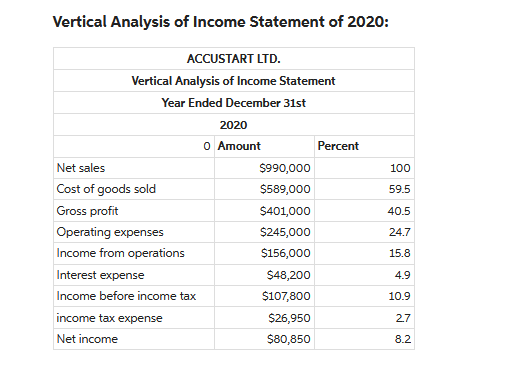

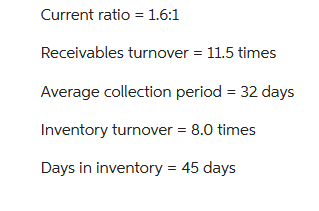

Accustart Ltd.'s industrial product sales were down in 2020 . Fortunately, after investing in a customer relationship management system, it was able to turn its operations around in 2021 . Selected financial statements follow: ACCUSTART LTD. Statement of Financial Position December 31 Assets 2021 2020 Current assets Cash $27,000$71,500 Accounts receivable 135,00094,500 Inventory Total current assets 262,000100,000247,00081,000 Property, plant, and equipment (net) 990,000868,000 Intangible assets Total assets Liabilities and Shareholders' Equity Liabilities Current liabilities Accounts payable Accrued liabilities \begin{tabular}{rrr} $58,500 & $65,200 \\ 13,500 & 18,000 \\ 76,500 & 0 \\ 18,000 & & 18,000 \\ \cline { 1 - 2 } 166,500 & & 101,200 \\ 567,000 & & 585,000 \\ \hline 733,500 & & 686,200 \\ \hline \end{tabular} Shareholders' equity Common shares, 10,000 shares issued Additional information for 2021: 1. Assume all sales were credit sales. 2. Accustart has no bad debts and no allowance for doubtful accounts. 3. Property, plant, and equipment increased in 2021 by the $270,000 cost of a new customer relationship management system and decreased by additional accumulated depreciation for the year of $148,000. 4. $18,000 of the mortgage was repaid in 2021 . 5. Cash dividends paid during the year amounted to $155,250. 6. Selected industry averages for 2021: Ratio Industry Average Asset turnover 0.8 times Average collection period 28 days Current ratio 2:1 Days in inventory 40 days Debt to total assets 50% Gross profit margin 44.5% Profit margin 15.1% Return on assets 12.5% Times interest earned 5 times Vertical Analysis of Income Statement of 2021: Vertical Analysis of Income Statement of 2020: Current ratio =1.6:1 Receivables turnover =11.5 times Average collection period =32 days Inventory turnover =8.0 times Days in inventory =45 days Calculate all relevent solvency ratios for 2021. (Round answers to 1 decimal place, e.g. 52.7.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started