Answered step by step

Verified Expert Solution

Question

1 Approved Answer

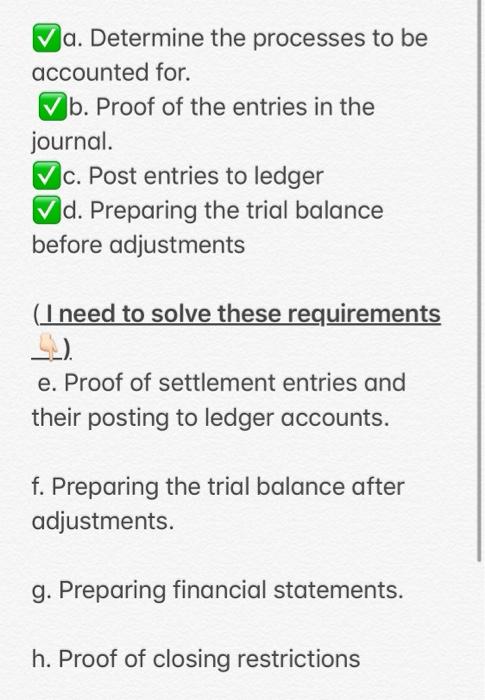

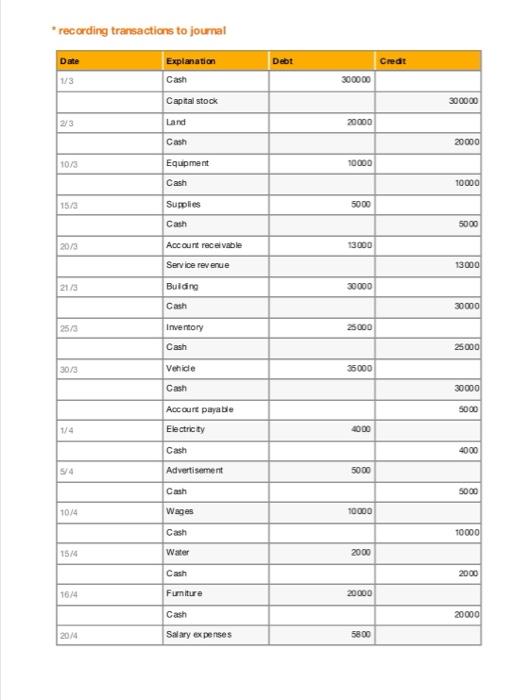

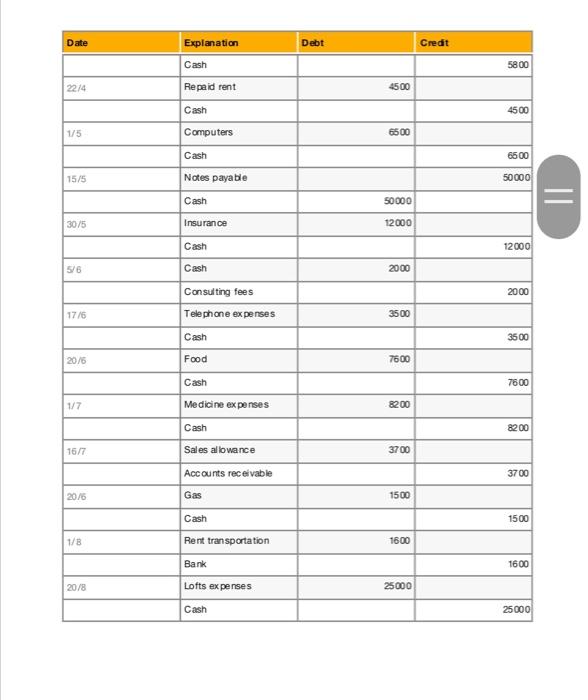

The question is to implement the accounting cycle for a hypothetical company with a capital of 300,000 in the field of poultry production. These are

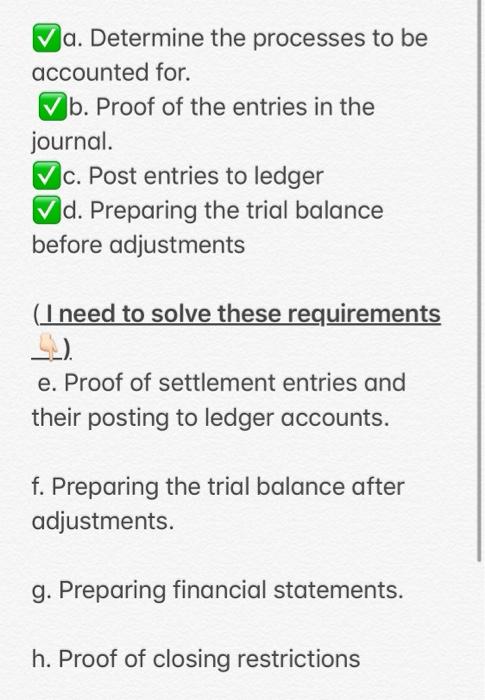

The question is to implement the accounting cycle for a hypothetical company with a capital of 300,000 in the field of poultry production. These are requests that must be fulfilled. In fact, requirements, and i want the last four which means (e-f-g-h). l attached to you my answers for the firs four requirements.please send clear picture for the answer.

my answers for the firs four requirements.

I gave you all the information that I have, and I have no more information . please help me . I really need your assistance.

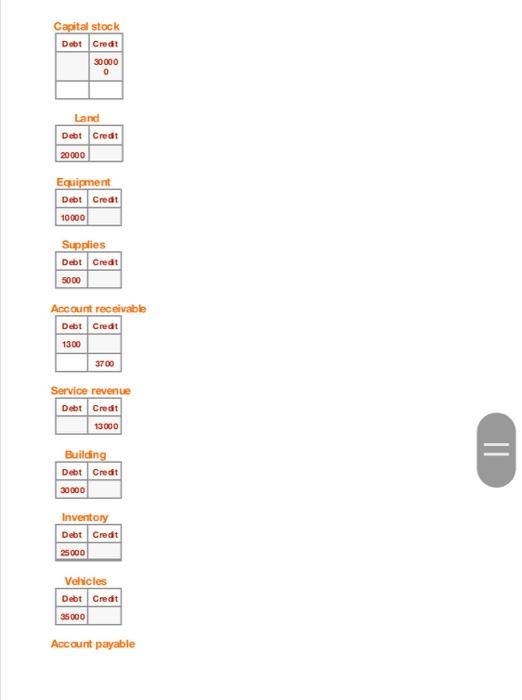

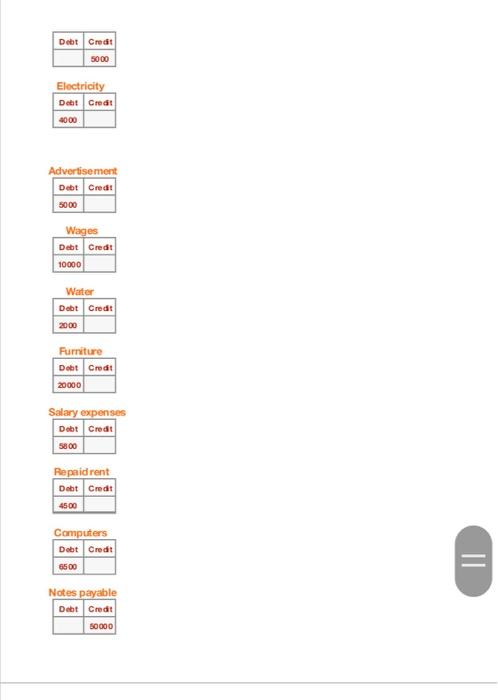

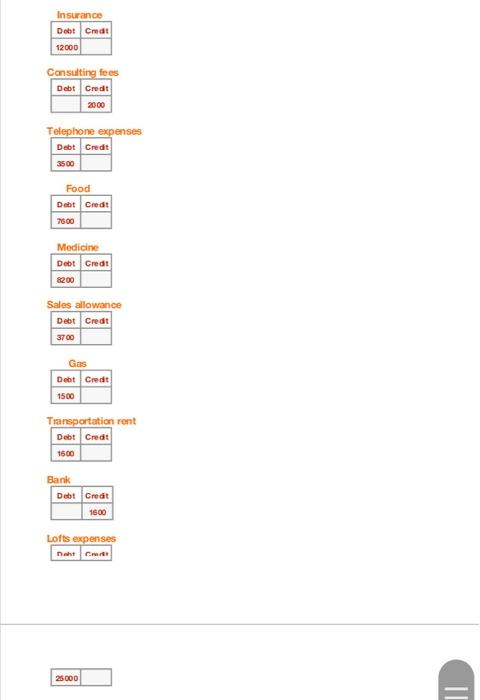

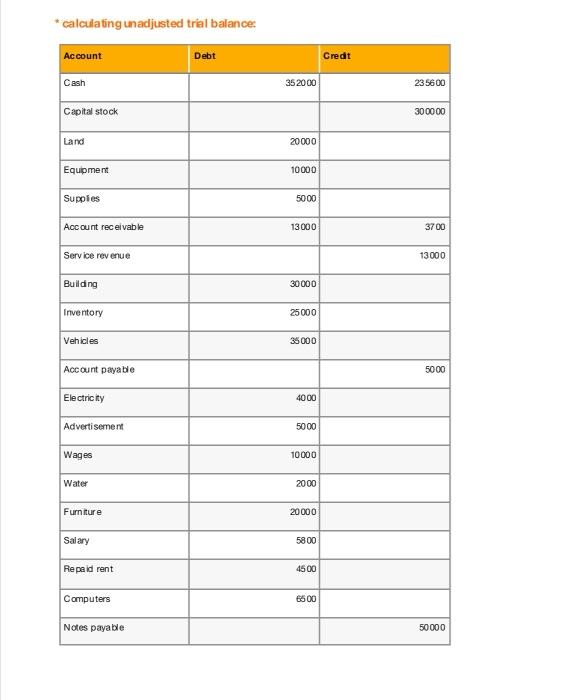

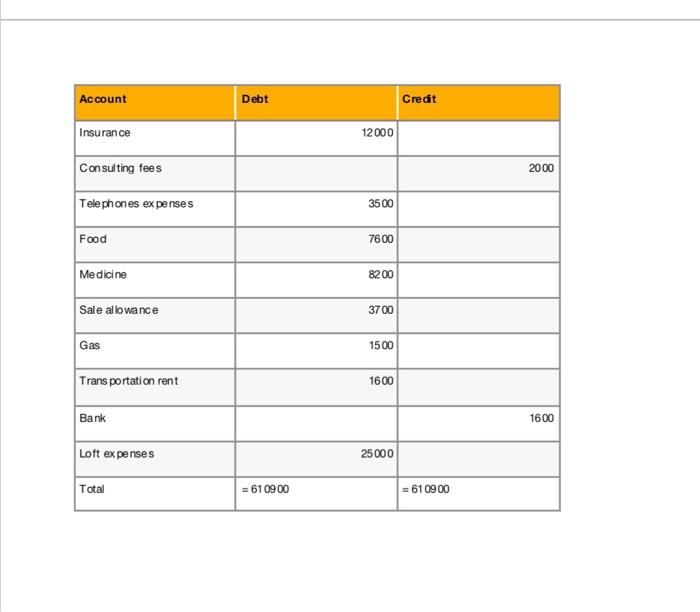

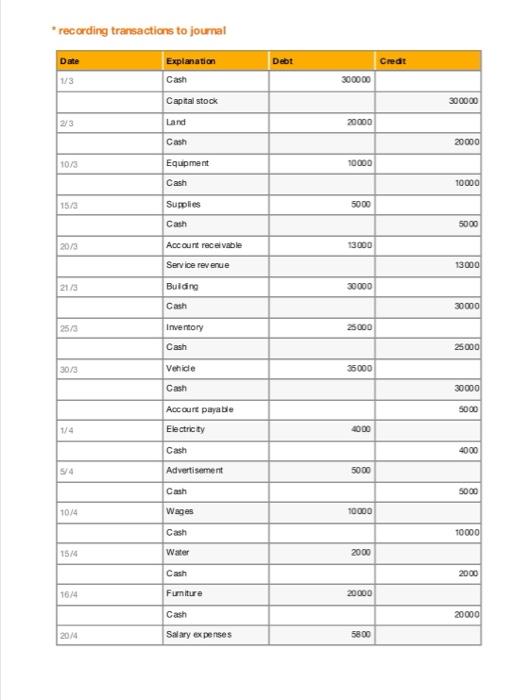

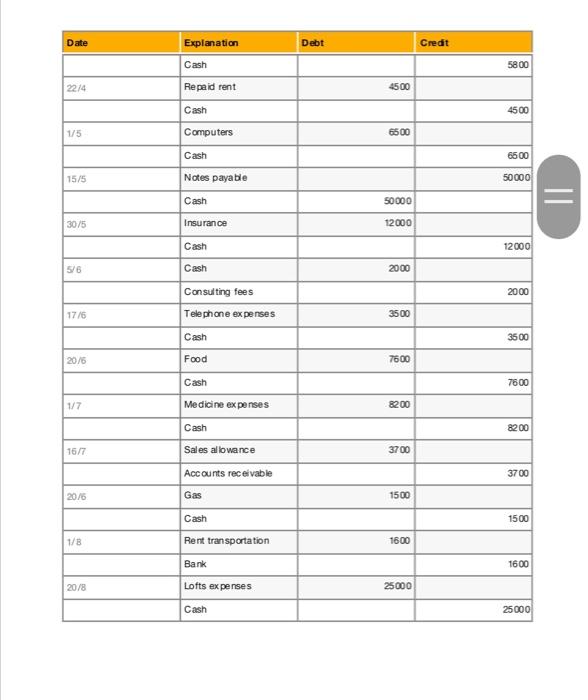

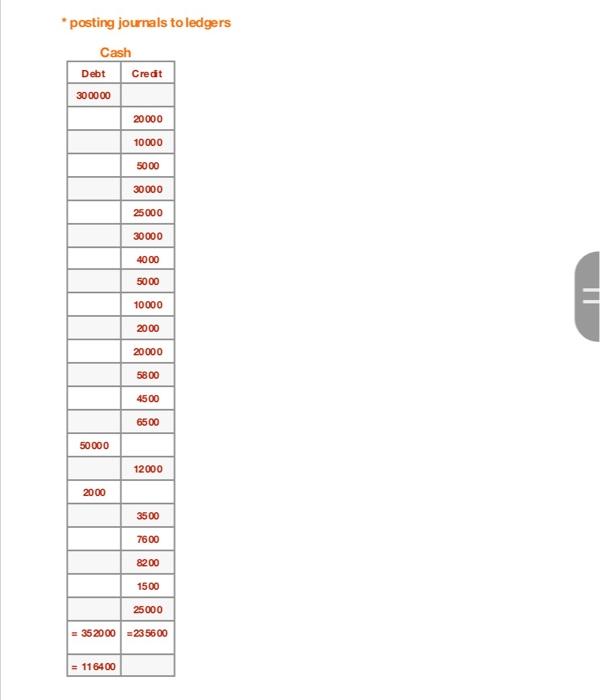

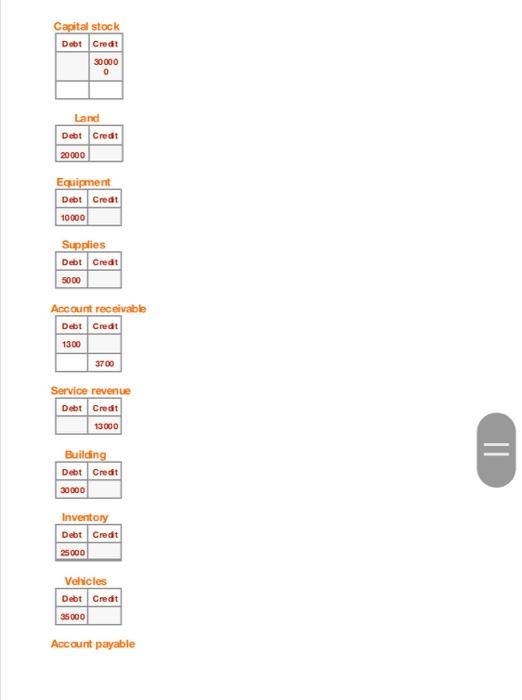

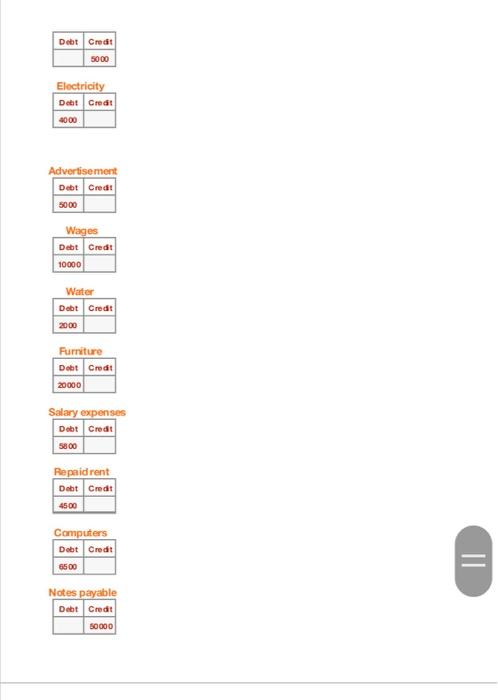

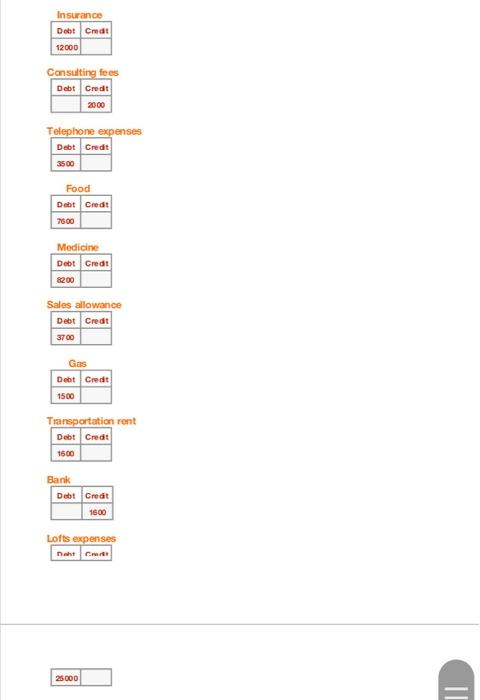

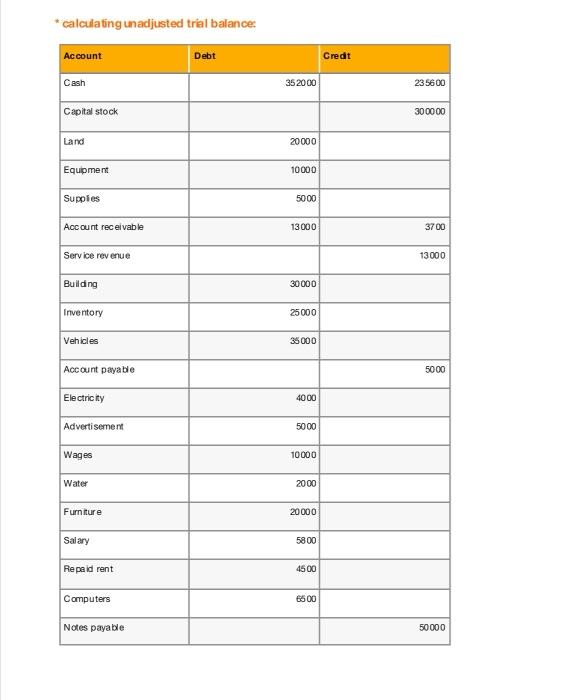

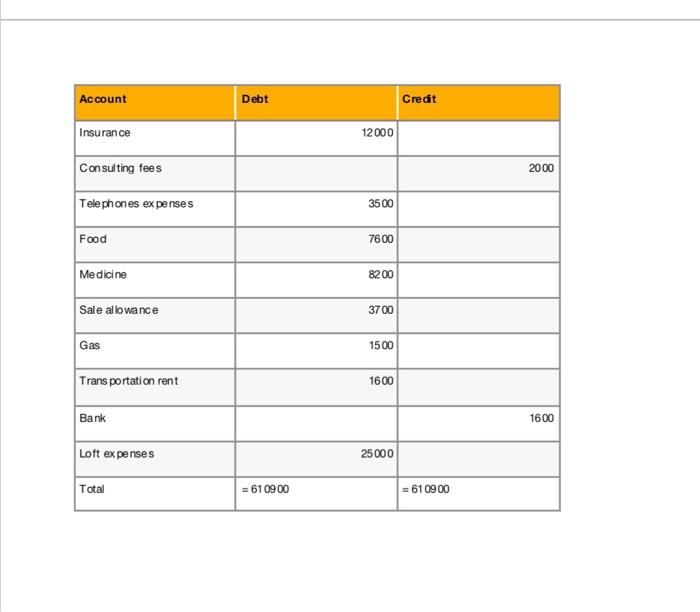

7a. Determine the processes to be accounted for. b. Proof of the entries in the journal. c. Post entries to ledger d. Preparing the trial balance before adjustments (I need to solve these requirements e. Proof of settlement entries and their posting to ledger accounts. f. Preparing the trial balance after adjustments. g. Preparing financial statements. h. Proof of closing restrictions * recording transactions to journal Debt Credit Explanation Cash 1/3 300000 Capital stock 300000 2/3 Land 20000 Cash 20000 10/3 Equipment 10000 Cash 10000 1573 Supplies 5000 Cash 5000 20/3 Account receivable 13000 Service revenue 13000 21/8 30000 Buiding Cash 30000 25/ Inventory 25000 Cash 25000 30/3 Vehide 36000 Cash 30000 Account payable 5000 Electricity 4000 Cash 4000 54 Advertisement 5000 Cash 5000 10/4 Wages 10000 10000 1514 Water 2000 Cash 2000 1614 Furniture 20000 Cash 20000 2014 Salary expenses 5800 Date Explanation Debt Credit Cash 5800 2214 Repaid rent 4500 Cash 4500 1/5 Computers 6500 Cash 6500 15/5 Notes payable 50000 Cash 50000 = 30/5 Insurance 12000 Cash 12000 5/6 Cash 2000 2000 Consulting fees Telephone expenses 17/6 3500 Cash 3500 20/6 Food 7600 Cash 7600 1/7 Medicine expenses 8200 Cash 8200 16/7 Sales allowance 3700 Accounts receivable 3700 20/6 Gas 1500 Cash 1500 1/8 1600 Rent transportation Bank Lofts expenses 1600 20/8 25000 Cash 25000 * posting journals to ledgers Cash Debt Credit 300000 20000 10000 5000 30000 25000 30000 4000 5000 10000 2000 20000 5800 4500 6500 50000 12000 2000 3500 7600 8200 1500 25000 = 352000 =235600 = 116400 Capital stock Debt Croat 30000 0 Land Debt Credit 20000 Equipment Debt Creat 10000 Supplies Debt Credit 5000 Account receivable Debt Credit 1300 3700 Service revenue Debt Credit 13000 II Building Debt Credit 30000 Inventory Debt Credit 25000 Vehicles Debt Credit 35000 Account payable Debt Credit 5000 Electricity Debit Credit 4000 Advertisement Debt Credit 5000 Wages Debt Credit 10000 Water Debt Credit 2000 Furniture Debt Croat 20000 Salary expenses Debt Credit 5800 Repaid rent Debt Credit 4500 Computers Debt Credit 6500 = Notes payable Debt Credit 50000 Insurance Debt Credit 12000 Consulting fees Debt Credit 2000 Telephone expenses Debt Credit Food Debt Credit 7600 Medicine Debt Credit 8200 Sales allowance Debt Credit 3700 Gas Debt Credit 1500 Transportation rent Debt Credit 1500 Bank Debt Credit 1500 Lofts expenses naht. 25000 * calculating unadjusted trial balance: Account Debt Credit Cash 352000 235600 Capital stock 300000 Land 20000 Equipment 10000 Supplies 5000 Account receivable 13000 37 00 Service revenue 13000 Building 30 000 Inventory 25000 Vehicles 35 000 5000 Account payable Electric ty 4000 Advertisement 5000 Wages 10000 Water 2000 Furniture 20000 Salary 58 00 Repaid rent 4500 Computers 65 00 Notes payable 50 000 Account Debt Credit Insurance 12000 Consulting fees 2000 Telephones expenses 3500 Food 7600 Medicine 8200 Sale allowance 3700 Gas 1500 Transportation rent 1600 Bank 1600 Loft expenses 25000 Total = 61 0900 = 610900 7a. Determine the processes to be accounted for. b. Proof of the entries in the journal. c. Post entries to ledger d. Preparing the trial balance before adjustments (I need to solve these requirements e. Proof of settlement entries and their posting to ledger accounts. f. Preparing the trial balance after adjustments. g. Preparing financial statements. h. Proof of closing restrictions * recording transactions to journal Debt Credit Explanation Cash 1/3 300000 Capital stock 300000 2/3 Land 20000 Cash 20000 10/3 Equipment 10000 Cash 10000 1573 Supplies 5000 Cash 5000 20/3 Account receivable 13000 Service revenue 13000 21/8 30000 Buiding Cash 30000 25/ Inventory 25000 Cash 25000 30/3 Vehide 36000 Cash 30000 Account payable 5000 Electricity 4000 Cash 4000 54 Advertisement 5000 Cash 5000 10/4 Wages 10000 10000 1514 Water 2000 Cash 2000 1614 Furniture 20000 Cash 20000 2014 Salary expenses 5800 Date Explanation Debt Credit Cash 5800 2214 Repaid rent 4500 Cash 4500 1/5 Computers 6500 Cash 6500 15/5 Notes payable 50000 Cash 50000 = 30/5 Insurance 12000 Cash 12000 5/6 Cash 2000 2000 Consulting fees Telephone expenses 17/6 3500 Cash 3500 20/6 Food 7600 Cash 7600 1/7 Medicine expenses 8200 Cash 8200 16/7 Sales allowance 3700 Accounts receivable 3700 20/6 Gas 1500 Cash 1500 1/8 1600 Rent transportation Bank Lofts expenses 1600 20/8 25000 Cash 25000 * posting journals to ledgers Cash Debt Credit 300000 20000 10000 5000 30000 25000 30000 4000 5000 10000 2000 20000 5800 4500 6500 50000 12000 2000 3500 7600 8200 1500 25000 = 352000 =235600 = 116400 Capital stock Debt Croat 30000 0 Land Debt Credit 20000 Equipment Debt Creat 10000 Supplies Debt Credit 5000 Account receivable Debt Credit 1300 3700 Service revenue Debt Credit 13000 II Building Debt Credit 30000 Inventory Debt Credit 25000 Vehicles Debt Credit 35000 Account payable Debt Credit 5000 Electricity Debit Credit 4000 Advertisement Debt Credit 5000 Wages Debt Credit 10000 Water Debt Credit 2000 Furniture Debt Croat 20000 Salary expenses Debt Credit 5800 Repaid rent Debt Credit 4500 Computers Debt Credit 6500 = Notes payable Debt Credit 50000 Insurance Debt Credit 12000 Consulting fees Debt Credit 2000 Telephone expenses Debt Credit Food Debt Credit 7600 Medicine Debt Credit 8200 Sales allowance Debt Credit 3700 Gas Debt Credit 1500 Transportation rent Debt Credit 1500 Bank Debt Credit 1500 Lofts expenses naht. 25000 * calculating unadjusted trial balance: Account Debt Credit Cash 352000 235600 Capital stock 300000 Land 20000 Equipment 10000 Supplies 5000 Account receivable 13000 37 00 Service revenue 13000 Building 30 000 Inventory 25000 Vehicles 35 000 5000 Account payable Electric ty 4000 Advertisement 5000 Wages 10000 Water 2000 Furniture 20000 Salary 58 00 Repaid rent 4500 Computers 65 00 Notes payable 50 000 Account Debt Credit Insurance 12000 Consulting fees 2000 Telephones expenses 3500 Food 7600 Medicine 8200 Sale allowance 3700 Gas 1500 Transportation rent 1600 Bank 1600 Loft expenses 25000 Total = 61 0900 = 610900 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started