Answered step by step

Verified Expert Solution

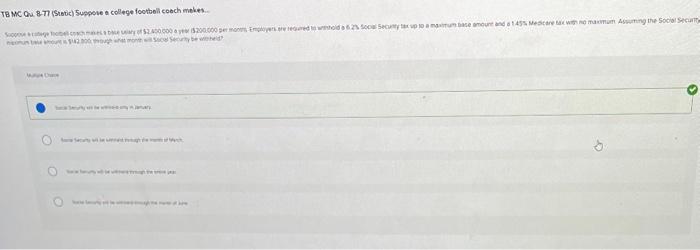

Question

1 Approved Answer

The question reads: Supposed to college football coach makes a base salary of $2,400,000 a year or $200,000 per month. Employers are required to withhold

The question reads:

a MC Qu 8-TI (Stovic) 5uppere a college footbelli coech moles Supposed to college football coach makes a base salary of $2,400,000 a year or $200,000 per month. Employers are required to withhold a 6.2% Social Security tax up to a maximum base amount and a 1.45% Medicare tax with no Maximum. Assuming the Social Security maximum base amount is $142,800 through what month will Social Security be withheld?

A. Social Security will be only withheld in January.

B. Social Security will be withheld through the month of March.

C. Social Security will be withheld through the entire year.

D. Social Security will be withheld through the month of June.

Correct Answer is A. Not sure how. Can you also explain what a maximum base amount is? How to go about answering this?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started