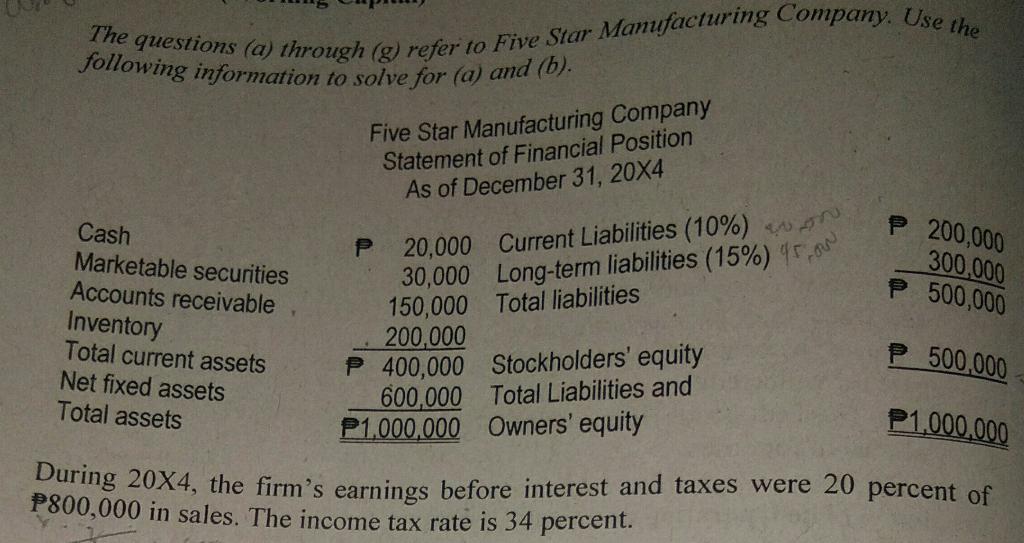

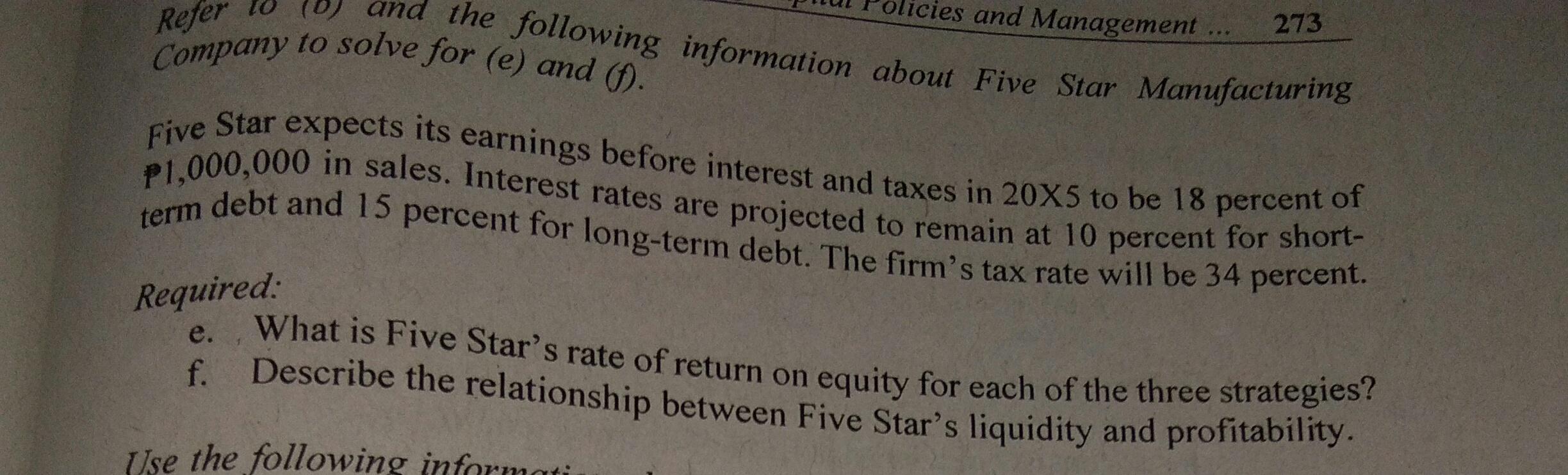

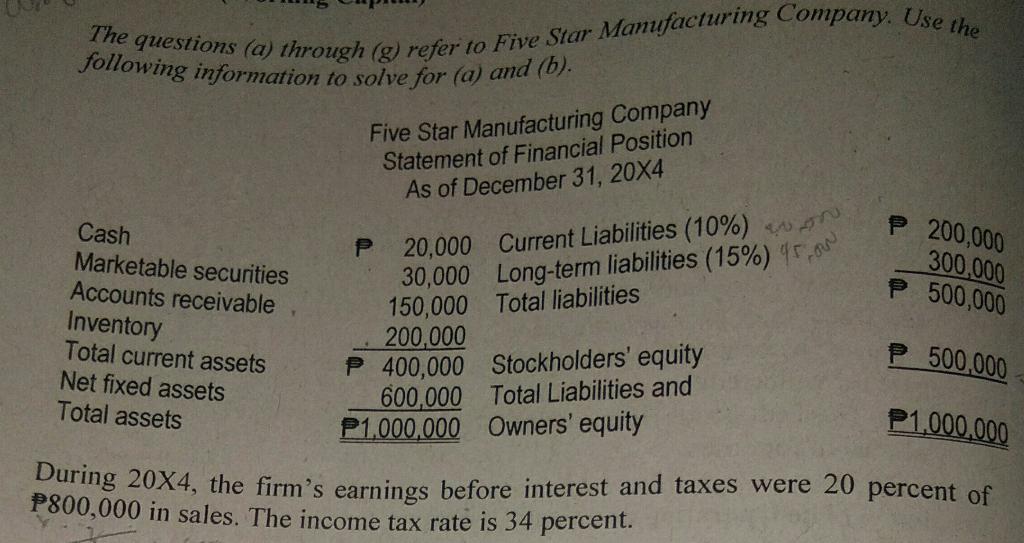

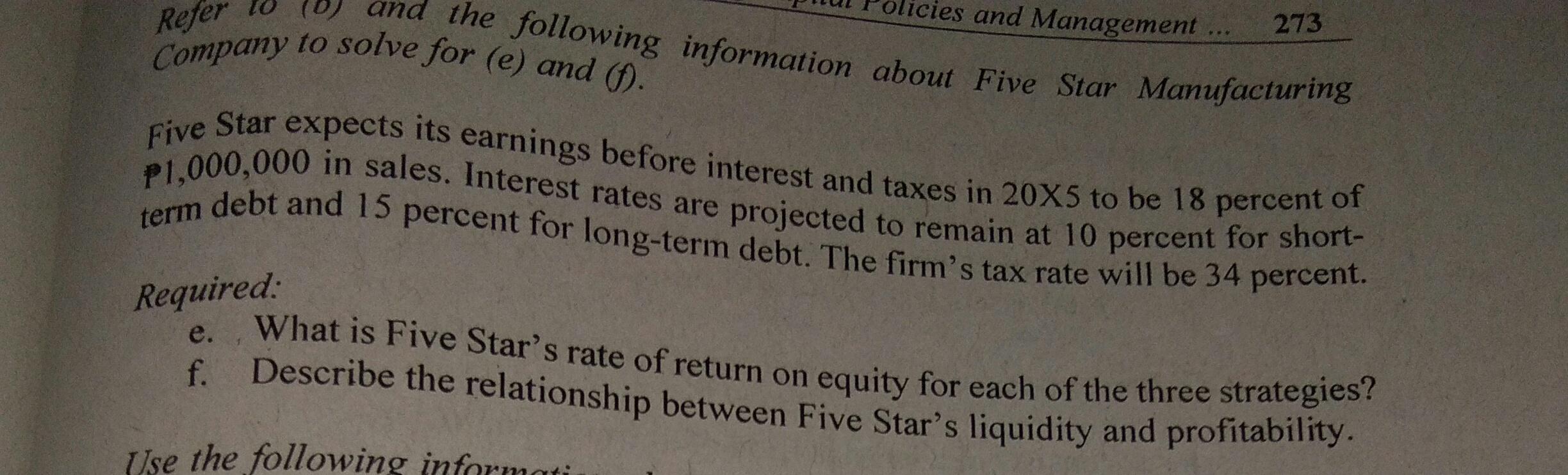

The questions (a) through (g) refer to Five Star Manufacturing Company. Use the following information to solve for (a) and (b). Five Star Manufacturing Company Statement of Financial Position As of December 31, 20X4 P200,000 300,000 P500,000 Cash Marketable securities Accounts receivable Inventory Total current assets Net fixed assets Total assets P 20,000 Current Liabilities (10%) 30,000 Long-term liabilities (15%), on 150,000 Total liabilities 200,000 P 400,000 Stockholders' equity 600,000 Total Liabilities and P1,000,000 Owners' equity P500,000 P1.000.000 During 20X4, the firm's earnings before interest and taxes were 20 percent of P800,000 in sales. The income tax rate is 34 percent. Refer licies and Management 273 and the following information about Five Star Manufacturing Company to solve for (e) and (1) expects its earnings before interest and taxes in 20x5 to be 18 percent of P1,000,000 in sales. Interest rates are projected to remain at 10 percent for short- debt and 15 percent for long-term debt. The firm's tax rate will be 34 percent. Five Star term Required: e. What is Five Star's rate of return on equity for each of the three strategies? f. Describe the relationship between Five Star's liquidity and profitability. Use the following informati The questions (a) through (g) refer to Five Star Manufacturing Company. Use the following information to solve for (a) and (b). Five Star Manufacturing Company Statement of Financial Position As of December 31, 20X4 P200,000 300,000 P500,000 Cash Marketable securities Accounts receivable Inventory Total current assets Net fixed assets Total assets P 20,000 Current Liabilities (10%) 30,000 Long-term liabilities (15%), on 150,000 Total liabilities 200,000 P 400,000 Stockholders' equity 600,000 Total Liabilities and P1,000,000 Owners' equity P500,000 P1.000.000 During 20X4, the firm's earnings before interest and taxes were 20 percent of P800,000 in sales. The income tax rate is 34 percent. Refer licies and Management 273 and the following information about Five Star Manufacturing Company to solve for (e) and (1) expects its earnings before interest and taxes in 20x5 to be 18 percent of P1,000,000 in sales. Interest rates are projected to remain at 10 percent for short- debt and 15 percent for long-term debt. The firm's tax rate will be 34 percent. Five Star term Required: e. What is Five Star's rate of return on equity for each of the three strategies? f. Describe the relationship between Five Star's liquidity and profitability. Use the following informati