Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The questions are related to each other thats why i posted all of them altogether c) How would the bond price calculated above change if

The questions are related to each other thats why i posted all of them altogether

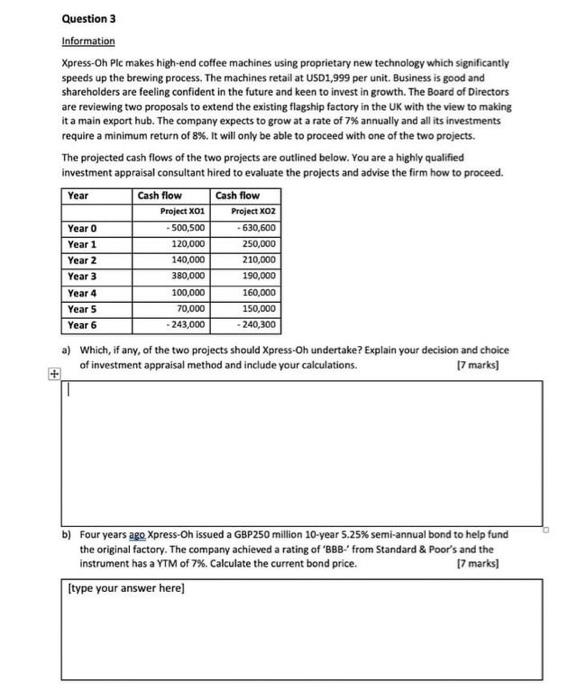

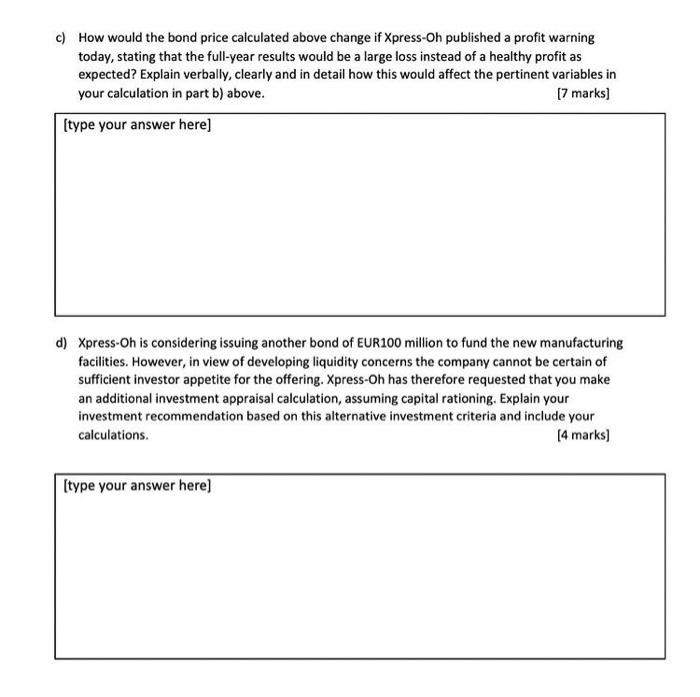

c) How would the bond price calculated above change if Xpress-Oh published a profit warning today, stating that the full-year results would be a large loss instead of a healthy profit as expected? Explain verbally, clearly and in detail how this would affect the pertinent variables in your calculation in part b) above. [7 marks) (type your answer here] d) Xpress-Oh is considering issuing another bond of EUR 100 million to fund the new manufacturing facilities. However, in view of developing liquidity concerns the company cannot be certain of sufficient investor appetite for the offering. Xpress-Oh has therefore requested that you make an additional investment appraisal calculation, assuming capital rationing. Explain your investment recommendation based on this alternative investment criteria and include your calculations. [4 marks) [type your answer here) c) How would the bond price calculated above change if Xpress-Oh published a profit warning today, stating that the full-year results would be a large loss instead of a healthy profit as expected? Explain verbally, clearly and in detail how this would affect the pertinent variables in your calculation in part b) above. [7 marks) (type your answer here] d) Xpress-Oh is considering issuing another bond of EUR 100 million to fund the new manufacturing facilities. However, in view of developing liquidity concerns the company cannot be certain of sufficient investor appetite for the offering. Xpress-Oh has therefore requested that you make an additional investment appraisal calculation, assuming capital rationing. Explain your investment recommendation based on this alternative investment criteria and include your calculations. [4 marks) [type your answer here) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started