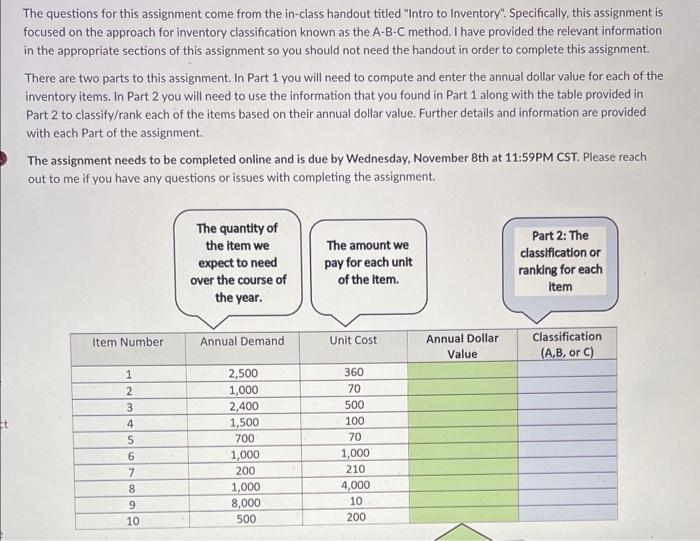

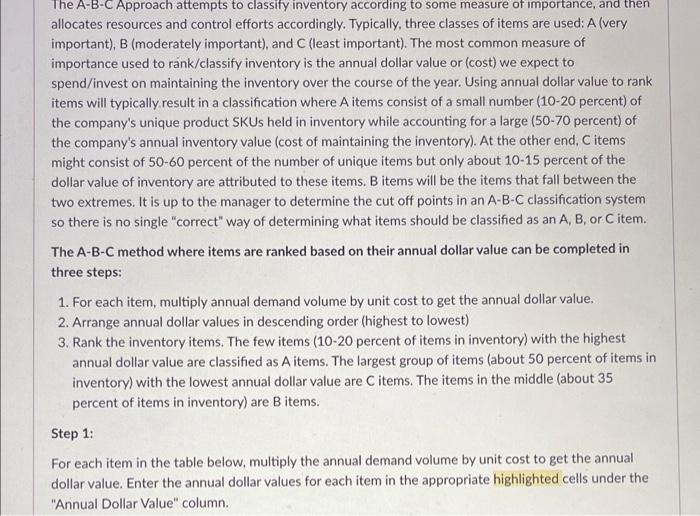

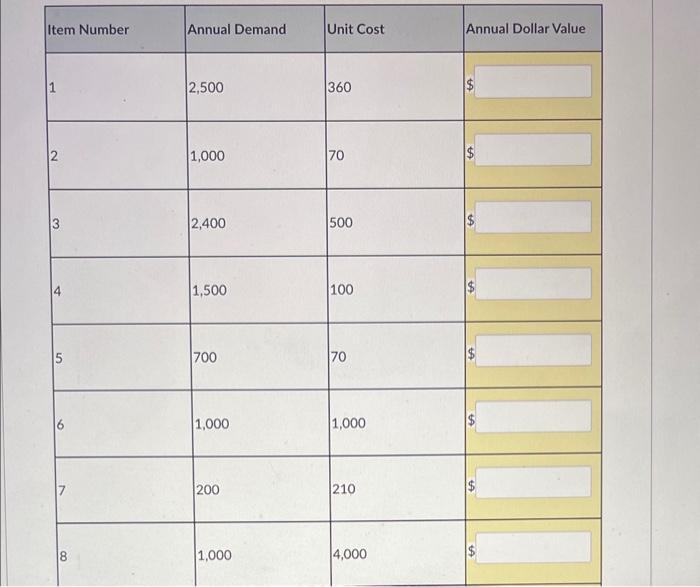

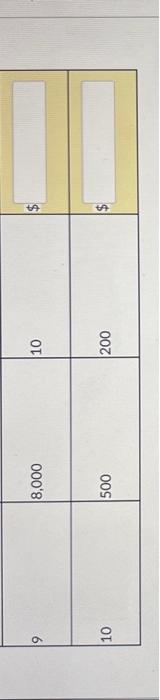

The questions for this assignment come from the in-class handout titled "Intro to Inventory". Specifically, this assignment is focused on the approach for inventory classification known as the A-B-C method. I have provided the relevant information in the appropriate sections of this assignment so you should not need the handout in order to complete this assignment. There are two parts to this assignment. In Part 1 you will need to compute and enter the annual dollar value for each of the inventory items. In Part 2 you will need to use the information that you found in Part 1 along with the table provided in Part 2 to classify/rank each of the items based on their annual dollar value. Further details and information are provided with each Part of the assignment. The assignment needs to be completed online and is due by Wednesday, November 8th at 11:59PM CST. Please reach out to me if you have any questions or issues with completing the assignment. The A-B-C Approach attempts to classify inventory according to some measure of importance, and then allocates resources and control efforts accordingly. Typically, three classes of items are used: A (very important), B (moderately important), and C (least important). The most common measure of importance used to rank/classify inventory is the annual dollar value or (cost) we expect to spend/invest on maintaining the inventory over the course of the year. Using annual dollar value to rank items will typically result in a classification where A items consist of a small number (10-20 percent) of the company's unique product SKUs held in inventory while accounting for a large (50-70 percent) of the company's annual inventory value (cost of maintaining the inventory). At the other end, C items might consist of 50-60 percent of the number of unique items but only about 10-15 percent of the dollar value of inventory are attributed to these items. B items will be the items that fall between the two extremes. It is up to the manager to determine the cut off points in an A-B-C classification system so there is no single "correct" way of determining what items should be classified as an A, B, or C item. The A-B-C method where items are ranked based on their annual dollar value can be completed in three steps: 1. For each item, multiply annual demand volume by unit cost to get the annual dollar value. 2. Arrange annual dollar values in descending order (highest to lowest) 3. Rank the inventory items. The few items (10-20 percent of items in inventory) with the highest annual dollar value are classified as A items. The largest group of items (about 50 percent of items in inventory) with the lowest annual dollar value are C items. The items in the middle (about 35 percent of items in inventory) are B items. Step 1: For each item in the table below, multiply the annual demand volume by unit cost to get the annual dollar value. Enter the annual dollar values for each item in the appropriate highlighted cells under the "Annual Dollar Value" column. \begin{tabular}{|l|l|l|l|} \hline Item Number & Annual Demand & Unit Cost & Annual Dollar Value \\ \hline 1 & 2,500 & 360 & $ \\ \hline 2 & 1,000 & 70 & $ \\ \hline 3 & 2,400 & 500 & $ \\ \hline 4 & 1,500 & 100 & $ \\ \hline 5 & 1,000 & 1,000 & $ \\ \hline 6 & 700 & 7000 & $ \\ \hline 7 & 200 & 210 & $ \\ \hline \end{tabular}