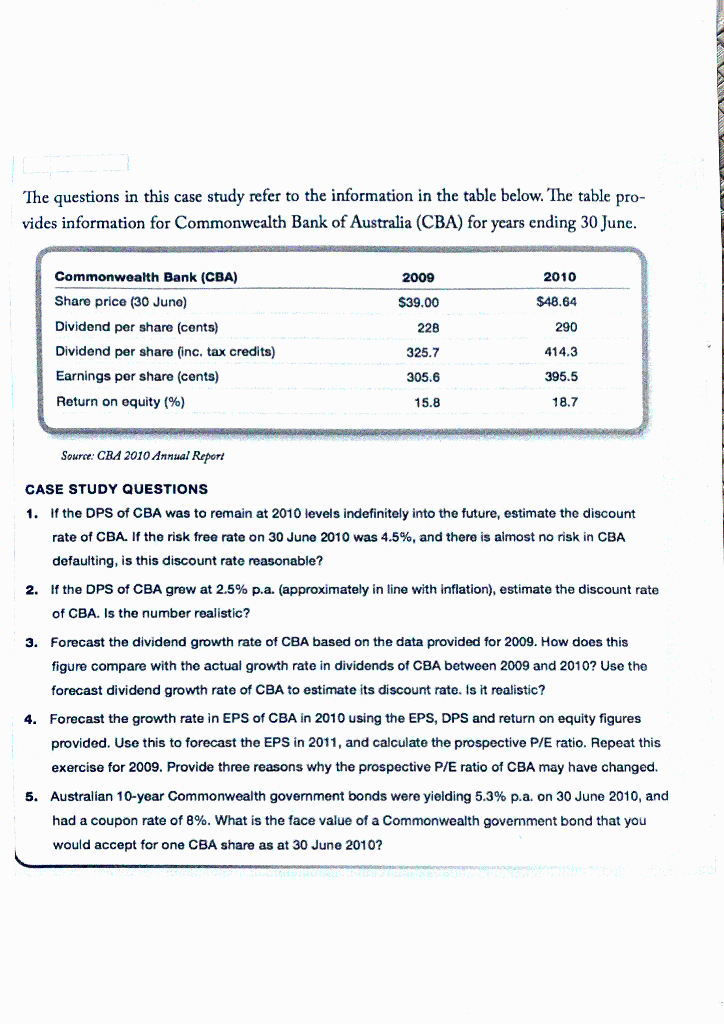

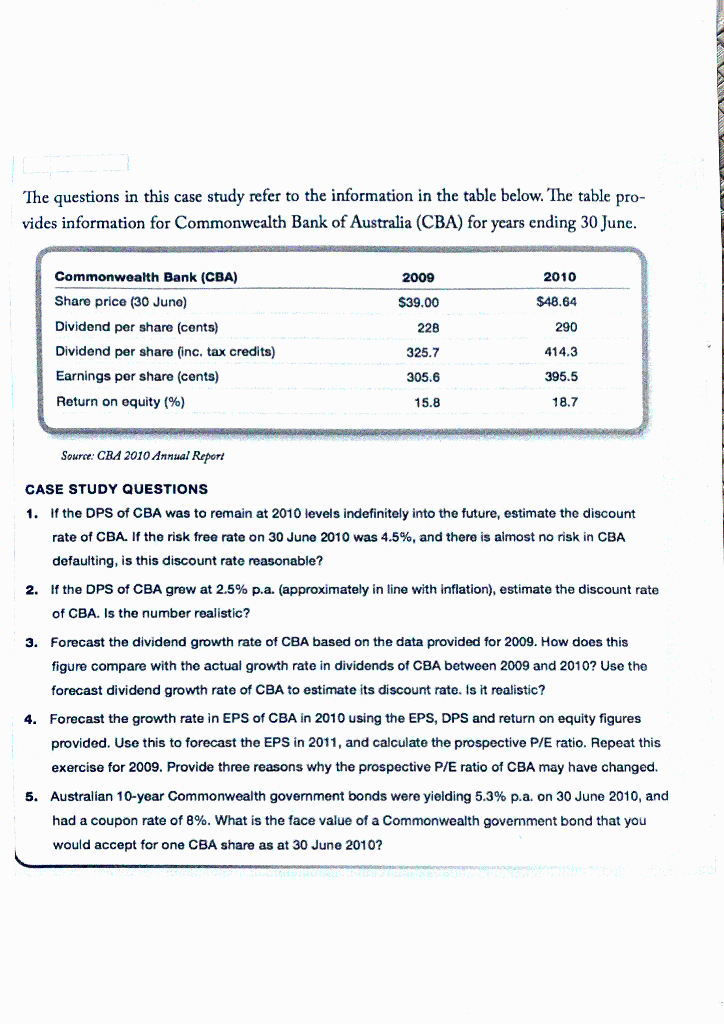

The questions in this case study refer to the information in the table below. The table pro- vides information for Commonwealth Bank of Australia (CBA) for years ending 30 June. 2009 2010 $39.00 $48.64 290 Commonwealth Bank (CBA) Share price (30 Juno) Dividend per share (cents) Dividend per share (inc, tax credits) Earnings per share (cents) Return on equity (%) 228 325.7 305.6 414.3 395.5 15.8 18.7 Source: CBA 2010 Annual Report CASE STUDY QUESTIONS 1. If the DPS of CBA was to remain at 2010 levels indefinitely into the future, estimate the discount rate of CBA. If the risk free rate on 30 June 2010 was 4.5%, and there is almost no risk in CBA defaulting, is this discount rate reasonable? 2. If the DPS of CBA grew at 2.5% p.a. (approximately in line with inflation), estimate the discount rate of CBA. Is the number realistic? 3. Forecast the dividend growth rate of CBA based on the data provided for 2009. How does this figure compare with the actual growth rate in dividends of CBA between 2009 and 2010? Use the forecast dividend growth rate of CBA to estimate its discount rate. Is it realistic? 4. Forecast the growth rate in EPS of CBA in 2010 using the EPS, DPS and return on equity figures provided. Use this to forecast the EPS in 2011, and calculate the prospective P/E ratio. Repeat this exercise for 2009. Provide three reasons why the prospective P/E ratio of CBA may have changed. 5. Australian 10-year Commonwealth government bonds were yielding 5.3% p.a. on 30 June 2010, and had a coupon rate of 8%. What is the face value of a Commonwealth government bond that you would accept for one CBA share as at 30 June 2010? The questions in this case study refer to the information in the table below. The table pro- vides information for Commonwealth Bank of Australia (CBA) for years ending 30 June. 2009 2010 $39.00 $48.64 290 Commonwealth Bank (CBA) Share price (30 Juno) Dividend per share (cents) Dividend per share (inc, tax credits) Earnings per share (cents) Return on equity (%) 228 325.7 305.6 414.3 395.5 15.8 18.7 Source: CBA 2010 Annual Report CASE STUDY QUESTIONS 1. If the DPS of CBA was to remain at 2010 levels indefinitely into the future, estimate the discount rate of CBA. If the risk free rate on 30 June 2010 was 4.5%, and there is almost no risk in CBA defaulting, is this discount rate reasonable? 2. If the DPS of CBA grew at 2.5% p.a. (approximately in line with inflation), estimate the discount rate of CBA. Is the number realistic? 3. Forecast the dividend growth rate of CBA based on the data provided for 2009. How does this figure compare with the actual growth rate in dividends of CBA between 2009 and 2010? Use the forecast dividend growth rate of CBA to estimate its discount rate. Is it realistic? 4. Forecast the growth rate in EPS of CBA in 2010 using the EPS, DPS and return on equity figures provided. Use this to forecast the EPS in 2011, and calculate the prospective P/E ratio. Repeat this exercise for 2009. Provide three reasons why the prospective P/E ratio of CBA may have changed. 5. Australian 10-year Commonwealth government bonds were yielding 5.3% p.a. on 30 June 2010, and had a coupon rate of 8%. What is the face value of a Commonwealth government bond that you would accept for one CBA share as at 30 June 2010