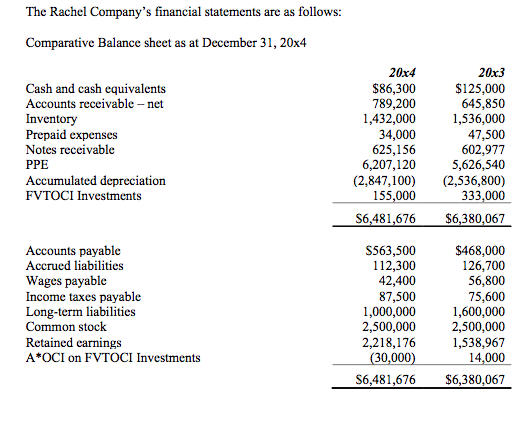

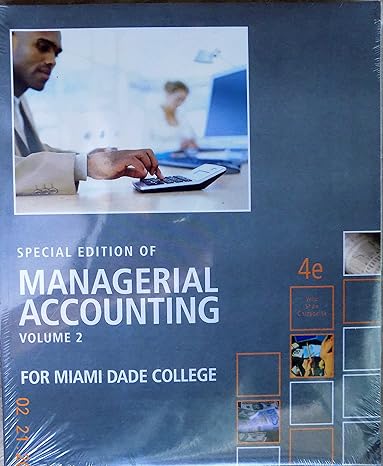

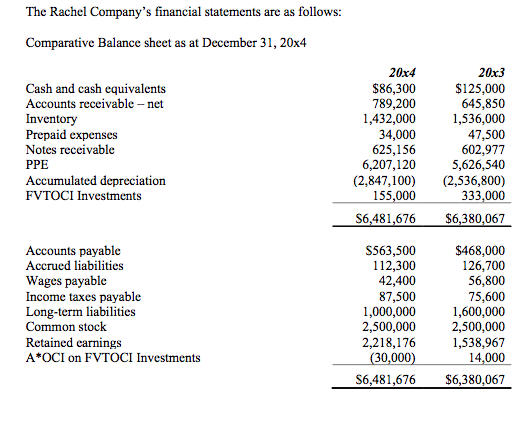

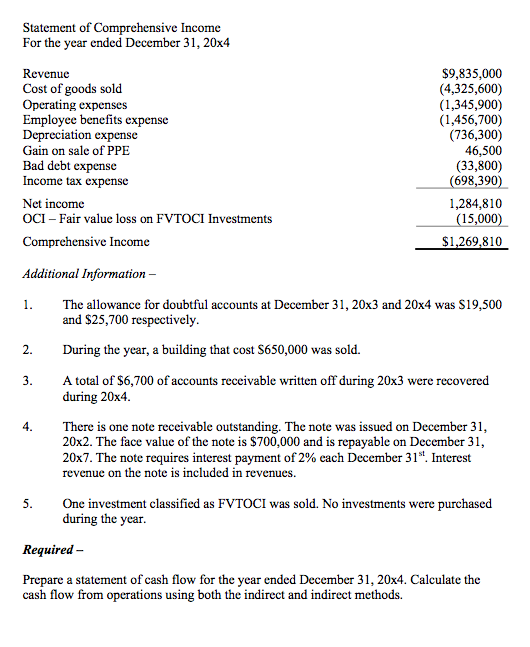

The Rachel Company's financial statements are as follows: Comparative Balance sheet as at December 31, 20x4 20x3 S125,000 645,850 ,432,000 1,536,000 47,500 602,977 6,207,1205,626,540 (2,847,100) (2,536,800) 333,000 20x4 $86,300 789,200 Cash and cash equivalents Accounts reccivable -net Inventory Prepaid expenses Notes receivable PPE Accumulated depreciation FVTOCI Investments 34,000 625,156 155,000 S6,481,676 6,380,067 Accounts payable Accrued liabilities Wages payable Income taxes payable Long-term liabilities Common stock Retained earnings A*OCI on FVTOCI Investments S468,000 126,700 56,800 75,600 1,600,000 2,500,0002,500,000 2,218,176 1,538,967 14,000 S563,500 112,300 42,400 87,500 1,000,000 30,000 S6,481,676 $6,380,067 Statement of Comprehensive Income For the year ended December 31, 20x4 Revenue Cost of goods sold Operating expenses Employee benefits expense Depreciation expense Gain on sale of PPE Bad debt expense Income tax expense Net income OCI- Fair value loss on FVTOCI Investments $9,835,000 (4,325,600) (1,345,900) (1,456,700) (736,300) 46,500 (33,800) 698,390 1,284,810 15,000 $1,269,810 Comprehensive Income Additional Information 1.The allowance for doubtful accounts at December 31, 20x3 and 20x4 was S19,500 and $25,700 respectively 2. During the year, a building that cost S650,000 was sold. 3.A total of $6,700 of accounts receivable written off during 20x3 were recovered during 20x4 4.There is one note receivable outstanding. The note was issued on December 31 20x2. The face value of the note is $700,000 and is repayable on December 31, 20x7. The note requires interest payment of 2% each December 31st. Interest revenue on the note is included in revenues One investment classified as FVTOCI was sold. No investments were purchased during the year eguired Prepare a statement of cash flow for the year ended December 31, 20x4. Calculate the cash flow from operations using both the indirect and indirect methods. The Rachel Company's financial statements are as follows: Comparative Balance sheet as at December 31, 20x4 20x3 S125,000 645,850 ,432,000 1,536,000 47,500 602,977 6,207,1205,626,540 (2,847,100) (2,536,800) 333,000 20x4 $86,300 789,200 Cash and cash equivalents Accounts reccivable -net Inventory Prepaid expenses Notes receivable PPE Accumulated depreciation FVTOCI Investments 34,000 625,156 155,000 S6,481,676 6,380,067 Accounts payable Accrued liabilities Wages payable Income taxes payable Long-term liabilities Common stock Retained earnings A*OCI on FVTOCI Investments S468,000 126,700 56,800 75,600 1,600,000 2,500,0002,500,000 2,218,176 1,538,967 14,000 S563,500 112,300 42,400 87,500 1,000,000 30,000 S6,481,676 $6,380,067 Statement of Comprehensive Income For the year ended December 31, 20x4 Revenue Cost of goods sold Operating expenses Employee benefits expense Depreciation expense Gain on sale of PPE Bad debt expense Income tax expense Net income OCI- Fair value loss on FVTOCI Investments $9,835,000 (4,325,600) (1,345,900) (1,456,700) (736,300) 46,500 (33,800) 698,390 1,284,810 15,000 $1,269,810 Comprehensive Income Additional Information 1.The allowance for doubtful accounts at December 31, 20x3 and 20x4 was S19,500 and $25,700 respectively 2. During the year, a building that cost S650,000 was sold. 3.A total of $6,700 of accounts receivable written off during 20x3 were recovered during 20x4 4.There is one note receivable outstanding. The note was issued on December 31 20x2. The face value of the note is $700,000 and is repayable on December 31, 20x7. The note requires interest payment of 2% each December 31st. Interest revenue on the note is included in revenues One investment classified as FVTOCI was sold. No investments were purchased during the year eguired Prepare a statement of cash flow for the year ended December 31, 20x4. Calculate the cash flow from operations using both the indirect and indirect methods