Question

The Rafi M. company, which has been in business for three years, makes all of its sales on credit and does not offer cash discounts.

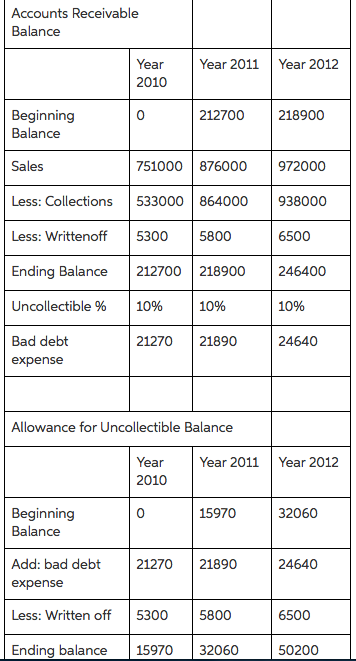

The Rafi M. company, which has been in business for three years, makes all of its sales on credit and does not offer cash discounts. Credit sales, customer collections, and writeoffs of uncollectible accounts for its first three years follow: Year 2010, Sales $751,000, collections $533,000, Accounts written off $5,300. Year 2011, Sales, 876,000, collections 864,000, accounts written off 5,800. Year 2012, sales 972,000, collections 938,000, accounts written off 6,500.

A. Rafi M. estimates uncollectibles to be 10% of accounts receivable. Identify the ending balance amount on the accounts receivable and the allowance for uncollectibile accounts reported on the balance sheet for each of the three years and the total amount of bad debt expense that appears on the income.

C. A consultant suggested using the income statement approach fo rdetermination of bad debt expense. Wht percentage would yield the same balance for the allowance for uncollectible accounts at the end of 2012, as is under the currently used method?

Accounts Receivable Balance Year Year 2011 Year 2012 2010 212700 218900 Beginning Balance Sales 751000 876000 972000 Less: Collections 533000 864000 938000 Less: Writtenoff 5300 5800 6500 Ending Balance 212700 218900 246400 Uncollectible 10% 10% 10% Bad debt 24640 21270 21890 expense Allowance for Uncollectible Balance Year Year 2011 Year 2012 2010 32060 15970 Beginning Balance Add: bad debt 21270 21890 24640 expense Less: Written off 5300 5800 6500 50200 Ending balance 15970 32060Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started