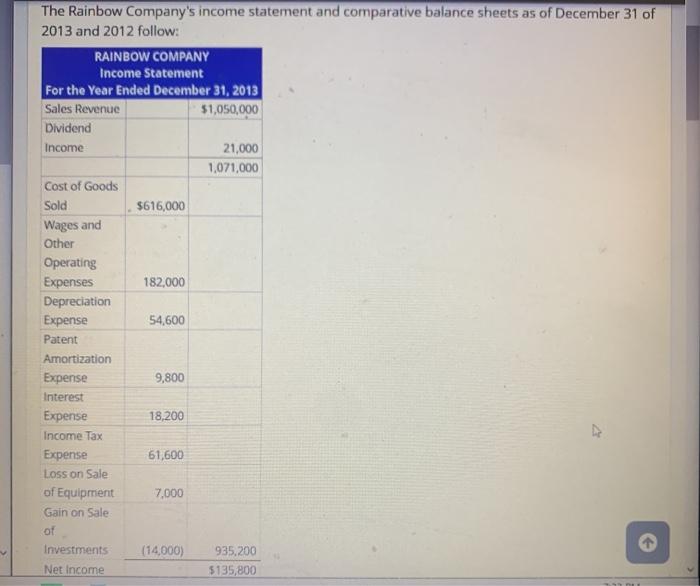

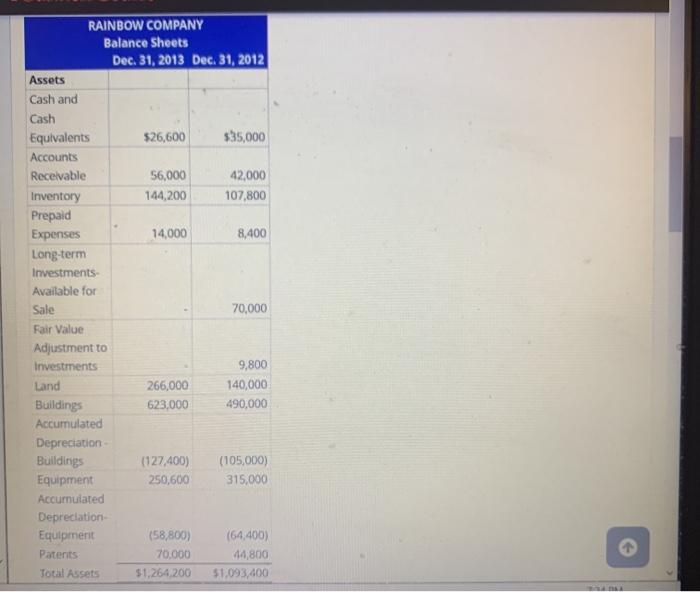

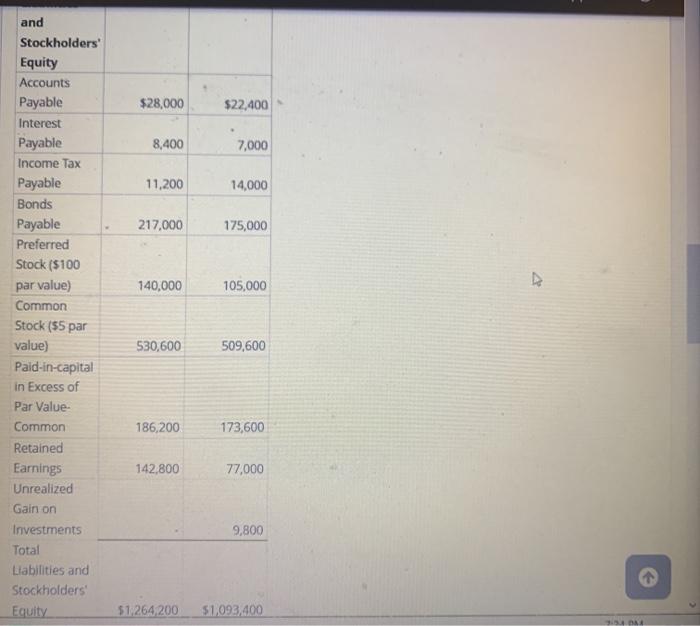

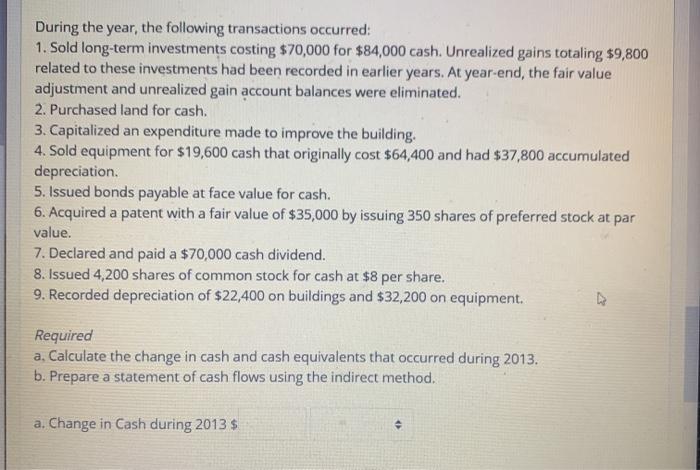

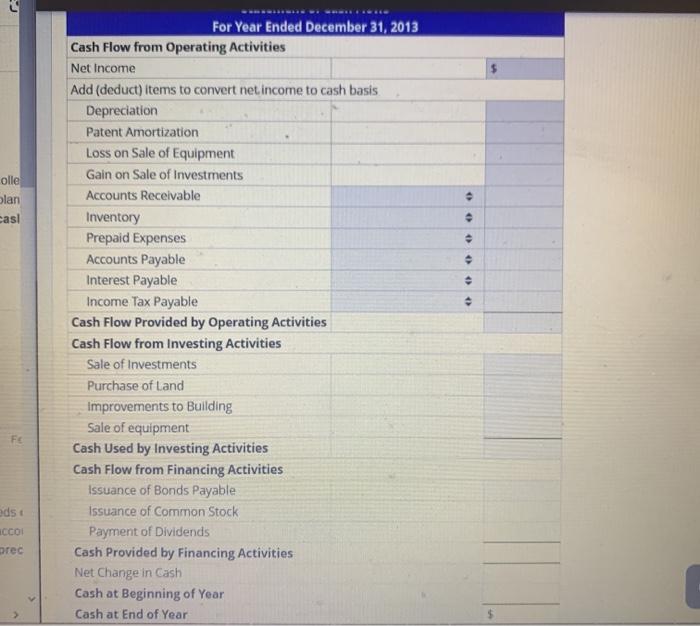

The Rainbow Company's income statement and comparative balance sheets as of December 31 of 2013 and 2012 follow: RAINBOW COMPANY Income Statement For the Year Ended December 31, 2013 Sales Revenue $1,050,000 Dividend Income 21,000 1,071,000 Cost of Goods Sold $616,000 Wages and Other Operating Expenses 182,000 Depreciation Expense 54,600 Patent Amortization Expense 9,800 Interest Expense 18,200 Income Tax Expense 61,600 Loss on Sale of Equipment 7.000 Gain on Sale of Investments (14,000) 935,200 Net Income 5135,800 RAINBOW COMPANY Balance Sheets Dec. 31, 2013 Dec. 31, 2012 Assets Cash and Cash Equivalents $26,600 $35,000 Accounts Receivable 56,000 42,000 Inventory 144,200 107,800 Prepaid Expenses 14,000 8,400 Long-term Investments Available for Sale 70,000 Fair Value Adjustment to Investments 9,800 Land 266,000 140,000 Buildings 623,000 490,000 Accumulated Depreciation Buildings (127,400) (105,000) Equipment 250,600 315,000 Accumulated Depreciation Equipment (58,800) (64,400) Patents 70.000 14,800 Total Assets $1,264,200 $1.093,400 $28,000 $22.400 8,400 7,000 11,200 14,000 217,000 175,000 140,000 105,000 and Stockholders' Equity Accounts Payable Interest Payable Income Tax Payable Bonds Payable Preferred Stock ($100 par value) Common Stock ($5 par value) Paid-in-capital in Excess of Par Value Common Retained Earnings Unrealized Gain on Investments Total Liabilities and Stockholders Equity 530,600 509,600 186,200 173,600 142,800 77,000 9,800 $1,264 200 51,093.400 During the year, the following transactions occurred: 1. Sold long-term investments costing $70,000 for $84,000 cash. Unrealized gains totaling $9,800 related to these investments had been recorded in earlier years. At year-end, the fair value adjustment and unrealized gain account balances were eliminated. 2. Purchased land for cash. 3. Capitalized an expenditure made to improve the building. 4. Sold equipment for $19,600 cash that originally cost $64,400 and had $37,800 accumulated depreciation. 5. Issued bonds payable at face value for cash. 6. Acquired a patent with a fair value of $35,000 by issuing 350 shares of preferred stock at par value. 7. Declared and paid a $70,000 cash dividend. 8. Issued 4,200 shares of common stock for cash at $8 per share. 9. Recorded depreciation of $22,400 on buildings and $32,200 on equipment Required a. Calculate the change in cash and cash equivalents that occurred during 2013. b. Prepare a statement of cash flows using the indirect method. a. Change in Cash during 2013 $ . olle olan cas! e 4 e For Year Ended December 31, 2013 Cash Flow from Operating Activities Net Income Add (deduct) items to convert net income to cash basis Depreciation Patent Amortization Loss on Sale of Equipment Gain on Sale of Investments Accounts Receivable Inventory Prepaid Expenses Accounts Payable Interest Payable Income Tax Payable Cash Flow Provided by Operating Activities Cash Flow from Investing Activities Sale of Investments Purchase of Land Improvements to Building Sale of equipment Cash Used by Investing Activities Cash Flow from Financing Activities Issuance of Bonds Payable Issuance of Common Stock Payment of Dividends Cash Provided by Financing Activities Net Change in Cash Cash at Beginning of Year Cash at End of Year FC odst ACCO prec