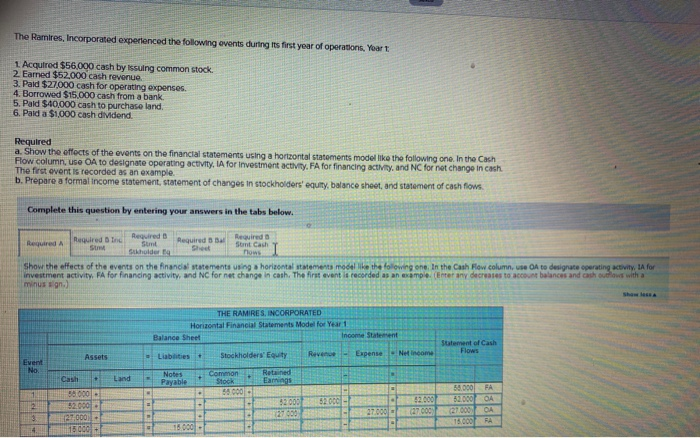

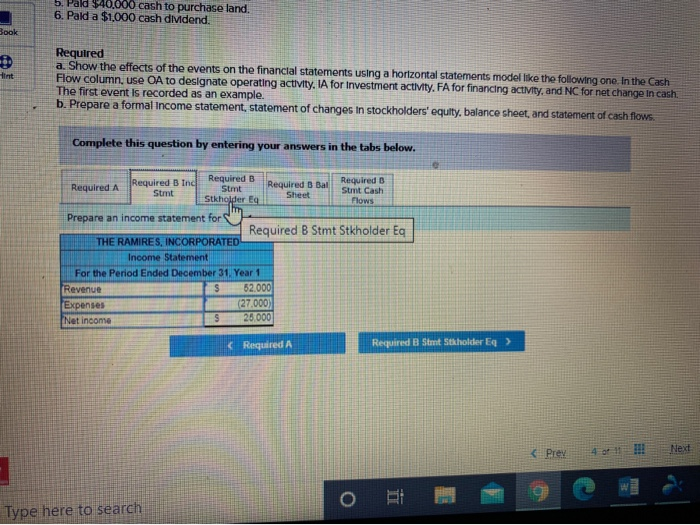

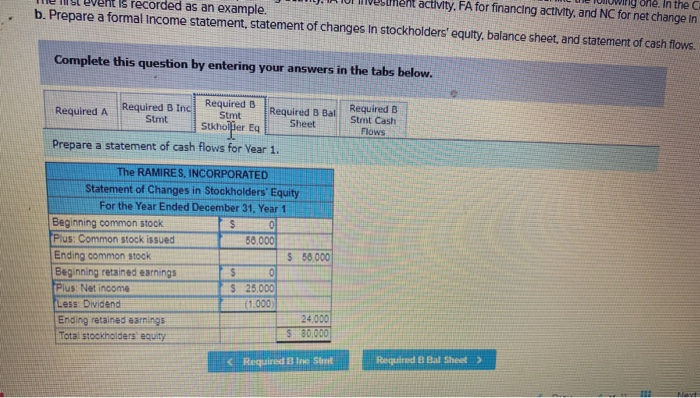

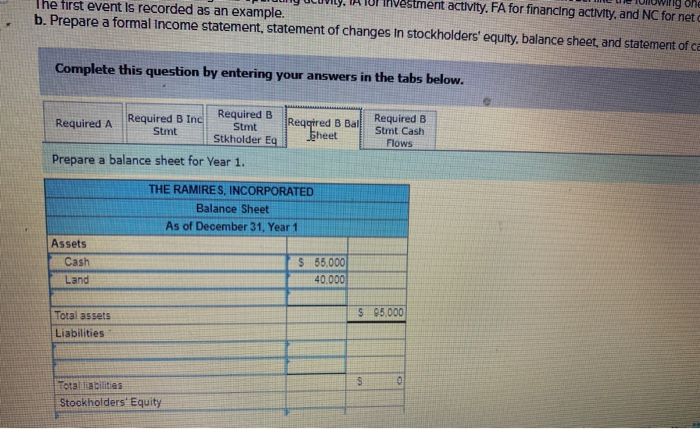

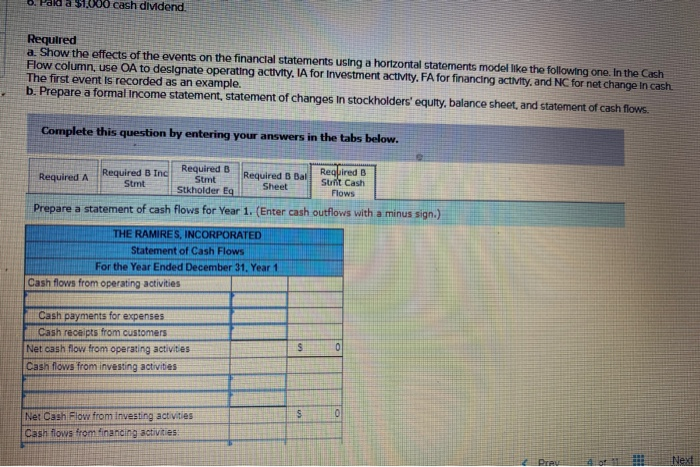

The Ramires, Incorporated experienced the following events during its first year of operations, Yoart 1. Acquired $56,000 cash by Issuing common stock 2. Earned $52.000 cash revenue 3. Paid $27,000 cash for operating expenses 4. Borrowed $15.000 cash from a bank. 5. Paid $40,000 cash to purchase land 6. Pald a $1,000 cash didend. Required a. Show the effects of the events on the financial statements using a hortzontal statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for not change in cash. The first event is recorded as an example. b. Prepare a formal income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows Complete this question by entering your answers in the tabs below. Required Required Required A Required Required su Samt Cash holder How Show the effects of the events on the financial statements using horisontal statements model like the following one. In the Cash Flow column, use of to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. The first event is recorded as an example. (Enter any decreases to account balances and cash outlows with a minus sgn.) THE RAMIRES, INCORPORATED Horizontal Financial Statements Model for Year 1 Balance Sheet Income Statement Liabilities Stockholders' Equity Reven Expense Net income Statement of Cash Flows Assets Event No. Land Notes Payable Common Stock Retained Earings 30 000 . 2 Cashi 50.000 52.000 27.000 15600 52000 27600 $2.000 (27.000 50.000 52.000 27.600 75.000 FA OA FA - 27.000 4 16.000 5. Pald $40.000 cash to purchase land. 6. Pald a $1,000 cash didend. Book Hint Required a. Show the effects of the events on the financial statements using a horizontal statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA for investment activity. FA for financing activity, and NC for net change in cash. The first event is recorded as an example. b. Prepare a formal Income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows. Complete this question by entering your answers in the tabs below. Required B Inc Required B Required A Required B Stmt Required s Bal Stmt Sheet Stkholder Eq Stm Cash Flows Prepare an income statement for Required B Stmt Stkholder Eq THE RAMIRES, INCORPORATED Income Statement For the Period Ended December 31 Year 1 Revenue $ 52.000 Expenses (27.000) Net income $ 25,000 (Required A Required B Stmt Stkholder Eq> Prey Next 1 O RI Type here to search 19 one. In the C activity. FA for financing activity, and NC for net change in Is recorded as an example. b. Prepare a formal Income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows. Complete this question by entering your answers in the tabs below. Required A Required B Inc Stmt Required B Stmt Required B Bal Sheet Stkhoifier Eq Required B Stm Cash Flows Prepare a statement of cash flows for Year 1. The RAMIRES, INCORPORATED Statement of Changes in Stockholders' Equity For the Year Ended December 31. Year 1 Beginning common stock $ 0 Plus: Common stock issued 56,000 Ending common stock $ 38,000 Beginning retained earnings $ 0 Plus: Net income $ 25,000 Less: Dividend (1.000 Ending retained earnings 24.000 Total stockholders' equity S 80.000 Mant Ivestment activity. FA for financing activity, and NC for net The first event is recorded as an example. b. Prepare a formal income statement, statement of changes in stockholders' equity, balance sheet, and statement of ca nig one Complete this question by entering your answers in the tabs below. Required A Required B Inc Required B Reqqred B Ball Stmt Stmt Stkholder Eq sheet Prepare a balance sheet for Year 1. Required B Sumt Cash Flows THE RAMIRES, INCORPORATED Balance Sheet As of December 31, Year 1 Assets Cash $ 55,000 40.000 Land S 95.000 Total assets Liabilities Total liabilities Stockholders' Equity a $1,000 cash dividend. Required a. Show the effects of the events on the financial statements using a hortzontal statements model like the following one. In the Cash Flow column, use OA to designate operating activity, IA for Investment activity. FA for financing activity, and NC for net change in cash The first event is recorded as an example. b. Prepare a formal income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows. Complete this question by entering your answers in the tabs below. Required A Required B Inc Required B Required s Bal Required B Stmt Stmt Suit Cash Stkholder Eq Sheet Flows Prepare a statement of cash flows for Year 1. (Enter cash outflows with a minus sign.) THE RAMIRES, INCORPORATED Statement of Cash Flows For the Year Ended December 31. Year 1 Cash flows from operating activities Cash payments for expenses Cash receipts from customers Net cash flow from operating activities Cash flows from investing activities $ 0 $ 0 Net Cash Flow from investing activities Cash flows from financing activities Preu :: Next