Answered step by step

Verified Expert Solution

Question

1 Approved Answer

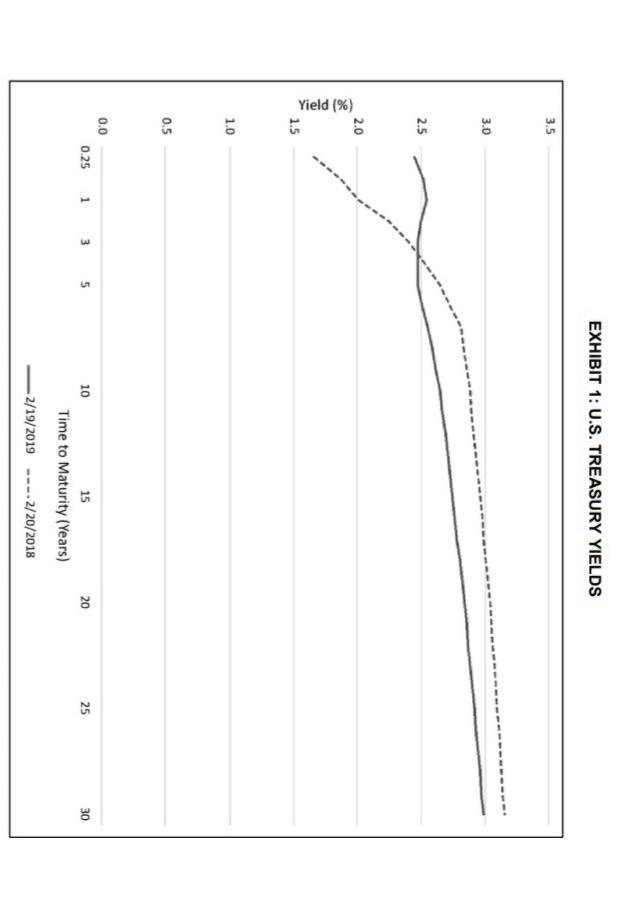

The rate in the yield curve in the first picture, is this the rate the company can borrow? Explain the shape of the yield curve

The rate in the yield curve in the first picture, is this the rate the company can borrow? Explain the shape of the yield curve under unbiased expectations theory and liquidity preference theory.

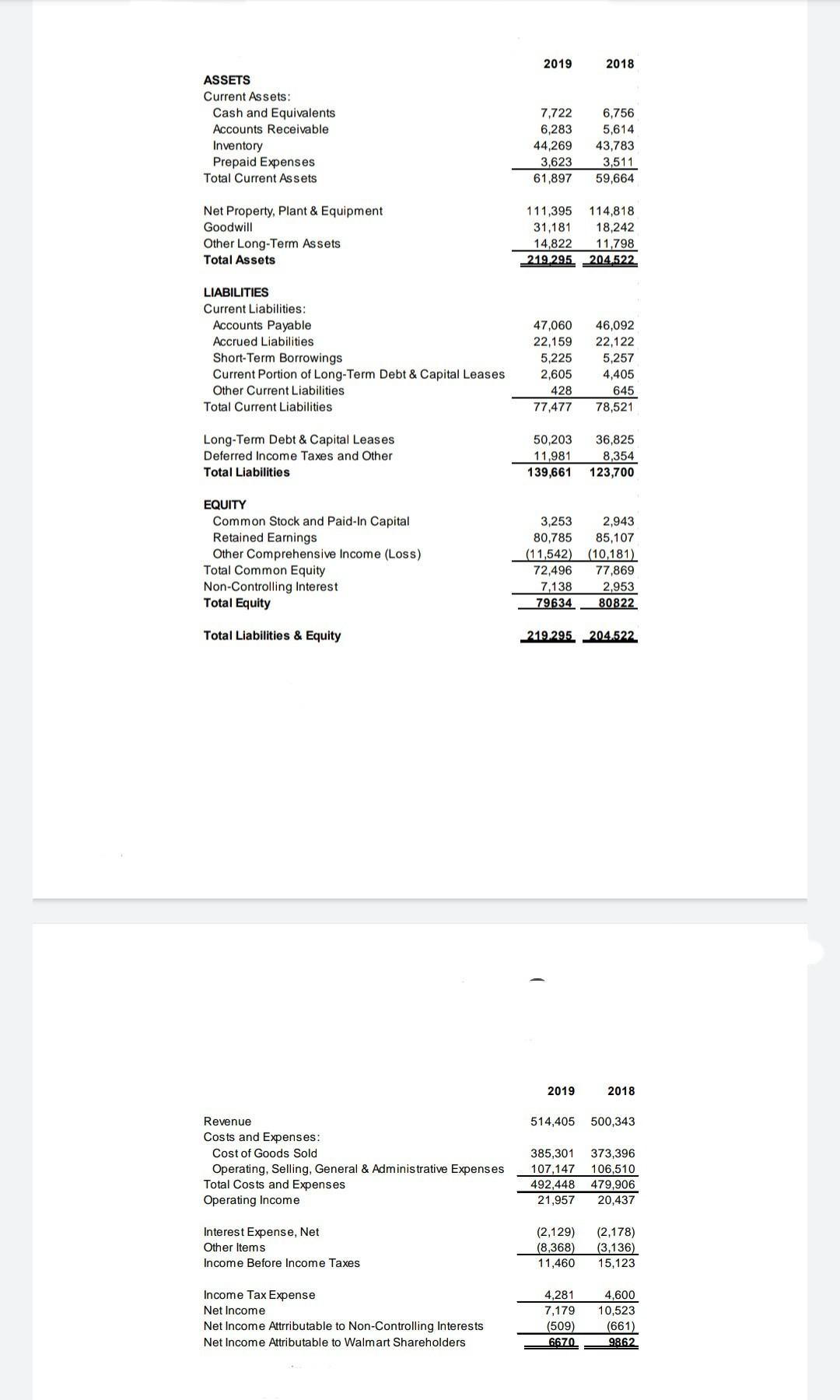

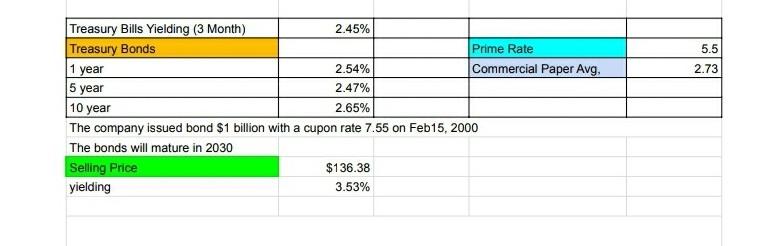

EXHIBIT 1: U.S. TREASURY YIELDS ASSETS Current Assets: Cash and Equivalents Accounts Receivable Inventory Prepaid Expenses Total Current Assets Net Property, Plant \& Equipme Goodwill Other Long-Term Assets Total Assets \begin{tabular}{rr} 2019 & 2018 \\ & \\ 7,722 & 6,756 \\ 6,283 & 5,614 \\ 44,269 & 43,783 \\ 3,623 & 3,511 \\ \hline 61,897 & 59,664 \\ 111,395 & 114,818 \\ 31,181 & 18,242 \\ 14,822 & 11,798 \\ \hline 219,295 & 204,522 \\ \hline \end{tabular} LIABILITIES Current Liabilities: Accounts Payable Accrued Liabilities Short-Term Borrowings Current Portion of Long-Ter Other Current Liabilities Total Current Liabilities Long-Term Debt \& Capital Deferred Income Taxes an Total Liabilities EQUITY Common Stock and Paid-1r. Retained Earnings Other Comprehensive In Total Common Equity Non-Controlling Interest Total Equity Total Liabilities \& Equity 204.522219.295 \begin{tabular}{|l|r|l|l|l|} \hline Treasury Bills Yielding (3 Month) & 2.45% & & & \\ \hline Treasury Bonds & & & Prime Rate & \\ \hline 1 year & 2.54% & & Commercial Paper Avg, & \\ \hline 5 year & 2.47% & & & \\ \hline 10 year & 2.65% & & & \\ \hline \end{tabular} The company issued bond $1 billion with a cupon rate 7.55 on Feb15, 2000 The bonds will mature in 2030 \begin{tabular}{|l|r|} \hline Selling Price & $136.38 \\ \hline yielding & 3.53% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started