Question

The rate of return for bonds issued by the Australian Commonwealth Government Treasury is given as 4% per annum. The expected return for the Australian

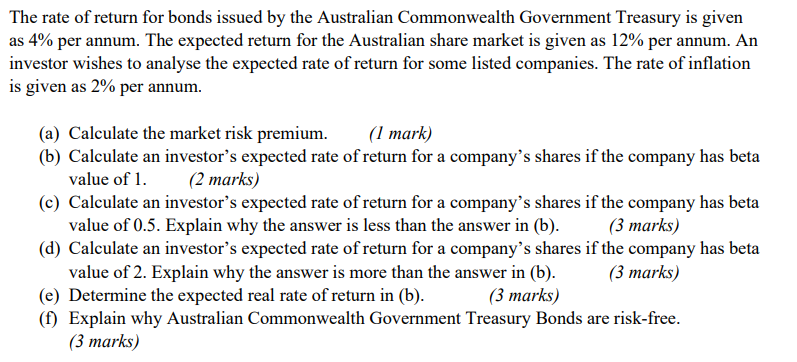

The rate of return for bonds issued by the Australian Commonwealth Government Treasury is given as 4% per annum. The expected return for the Australian share market is given as 12% per annum. An investor wishes to analyse the expected rate of return for some listed companies. The rate of inflation is given as 2% per annum.

(a) Calculate the market risk premium.

(b) Calculate an investors expected rate of return for a companys shares if the company has beta value of 1.

(c) Calculate an investors expected rate of return for a companys shares if the company has beta value of 0.5. Explain why the answer is less than the answer in (b).

(d) Calculate an investors expected rate of return for a companys shares if the company has beta value of 2. Explain why the answer is more than the answer in (b).

(e) Determine the expected real rate of return in (b). (3 marks) (f) Explain why Australian Commonwealth Government Treasury Bonds are risk-free.

The rate of return for bonds issued by the Australian Commonwealth Government Treasury is given as 4% per annum. The expected return for the Australian share market is given as 12% per annum. An investor wishes to analyse the expected rate of return for some listed companies. The rate of inflation is given as 2% per annum. (a) Calculate the market risk premium. (I mark) (b) Calculate an investor's expected rate of return for a company's shares if the company has beta value of 1. (2 marks) (c) Calculate an investor's expected rate of return for a company's shares if the company has beta value of 0.5. Explain why the answer is less than the answer in (b). (3 marks) (d) Calculate an investor's expected rate of return for a company's shares if the company has beta value of 2. Explain why the answer is more than the answer in (b). (e) Determine the expected real rate of return in (b). (3 marks) (3 marks) (f) Explain why Australian Commonwealth Government Treasury Bonds are risk-free

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started