Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The rate of return on short-term T-bills (perceived to be risk-free) is 5%. The current market price of stock H is $40. The stock

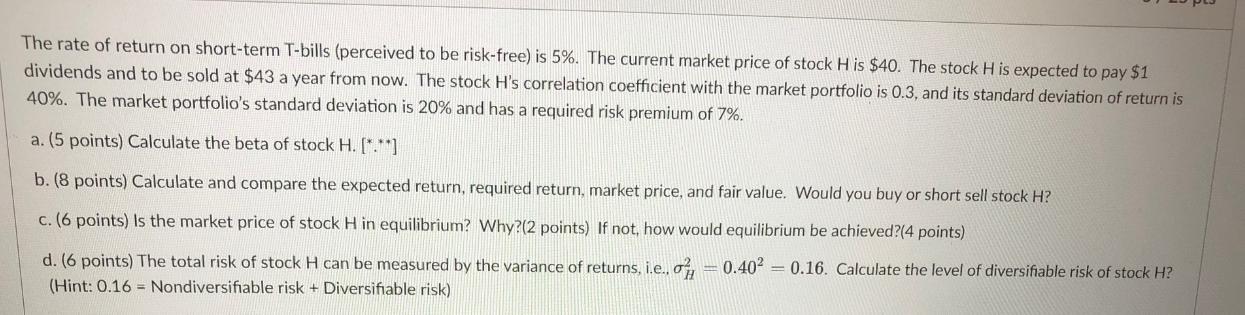

The rate of return on short-term T-bills (perceived to be risk-free) is 5%. The current market price of stock H is $40. The stock H is expected to pay $1 dividends and to be sold at $43 a year from now. The stock H's correlation coefficient with the market portfolio is 0.3, and its standard deviation of return is 40%. The market portfolio's standard deviation is 20% and has a required risk premium of 7%. a. (5 points) Calculate the beta of stock H. [*.**] b. (8 points) Calculate and compare the expected return, required return, market price, and fair value. Would you buy or short sell stock H? c. (6 points) Is the market price of stock H in equilibrium? Why?(2 points) If not, how would equilibrium be achieved?(4 points) d. (6 points) The total risk of stock H can be measured by the variance of returns, i.e.. o (Hint: 0.16 Nondiversifiable risk + Diversifiable risk) 0.40 = 0.16. Calculate the level of diversifiable risk of stock H?

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The beta of stock H is calculated as beta correlation coefficient stock H standard deviation marke...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started