Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The ratio of the price of GM to next year's expected dividend (E[D1]) is 16. GM's beta is 1.5. The risk-free rate is 3.25%

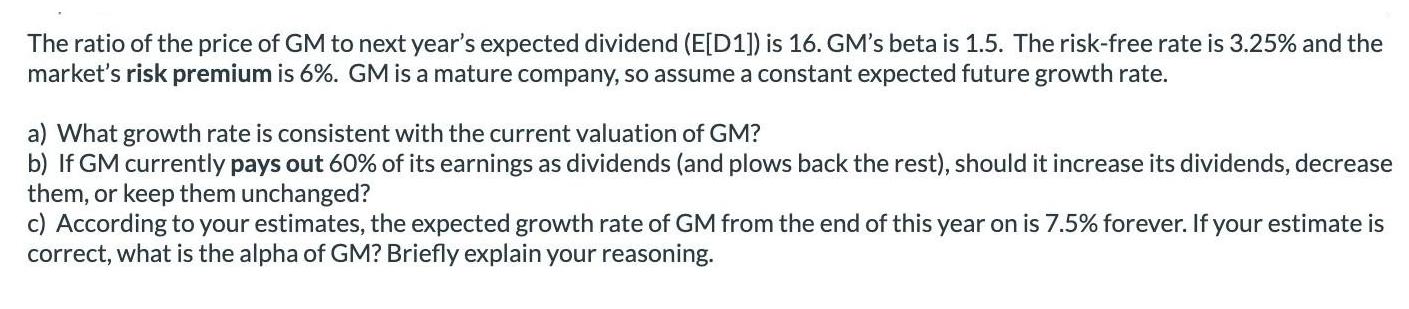

The ratio of the price of GM to next year's expected dividend (E[D1]) is 16. GM's beta is 1.5. The risk-free rate is 3.25% and the market's risk premium is 6%. GM is a mature company, so assume a constant expected future growth rate. a) What growth rate is consistent with the current valuation of GM? b) If GM currently pays out 60% of its earnings as dividends (and plows back the rest), should it increase its dividends, decrease them, or keep them unchanged? c) According to your estimates, the expected growth rate of GM from the end of this year on is 7.5% forever. If your estimate is correct, what is the alpha of GM? Briefly explain your reasoning.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To answer these questions well use the Gordon Growth Model also known as the Dividend Discount Model and the Capital Asset Pricing Model CAPM a The Go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started