Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The reading indicates that stockholders equity reports the total value the owners have contributed to a company plus the profits the company has generated, and

The reading indicates that stockholders equity reports the total value the owners have contributed to a company plus the profits the company has generated, and retained on behalf of stockholders.

Indicate the two accounts referred to in the sentence ((check all that apply.))

.

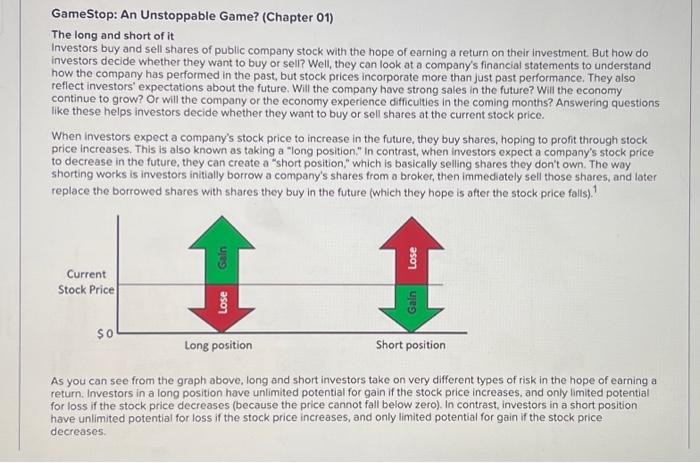

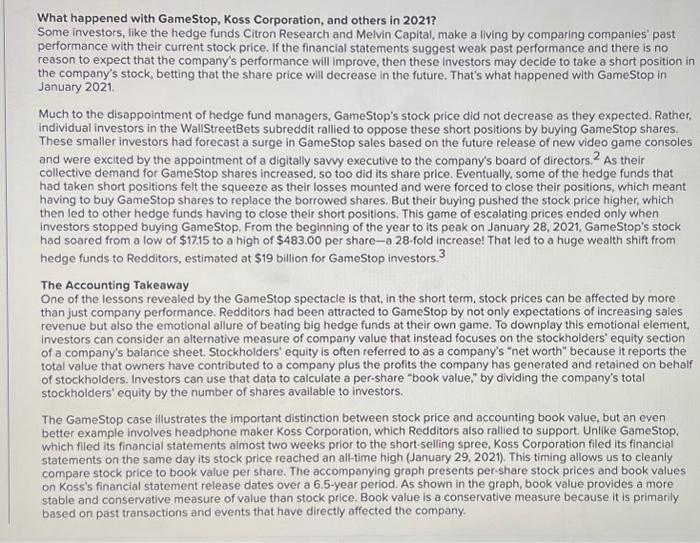

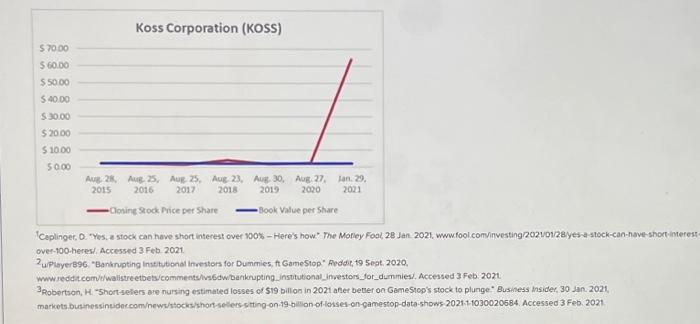

GameStop: An Unstoppable Game? (Chapter 01) The long and short of it Investors buy and sell shares of public company stock with the hope of earning a return on their investment. But how do investors decide whether they want to buy or sell? Well, they can look at a company's financial statements to understand how the company has performed in the past, but stock prices incorporate more than just past performance. They also reflect investors' expectations about the future. Will the company have strong sales in the future? Will the economy continue to grow? Or will the company or the economy experience difficulties in the coming months? Answering questions like these helps investors decide whether they want to buy or sell shares at the current stock price. When investors expect a company's stock price to increase in the future, they buy shares, hoping to profit through stock price increases. This is also known as taking a "long position," In contrast, when investors expect a company's stock price to decrease in the future, they can create a "short position," which is basically selling shares they don't own. The way shorting works is investors initially borrow a company's shares from a broker, then immediately sell those shares, and later replace the borrowed shares with shares they buy in the future (which they hope is after the stock price falls). 1 As you can see from the graph above, long and short investors take on very different types of risk in the hope of earning a return. Investors in a long position have unlimited potential for gain if the stock price increases, and only limited potential for loss if the stock price decreases (because the price cannot fall below zero). In contrast, investors in a short position have unlimited potential for loss if the stock price increases, and only limited potential for gain if the stock price decreases. What happened with GameStop, Koss Corporation, and others in 2021? Some investors, like the hedge funds Citron Research and Melvin Capital, make a living by comparing companies' past performance with their current stock price. If the financial statements suggest weak past performance and there is no reason to expect that the company's performance will improve, then these investors may decide to take a short position in the company's stock, betting that the share price will decrease in the future. That's what happened with GameStop in January 2021. Much to the disappointment of hedge fund managers, GameStop's stock price did not decrease as they expected. Rather, individual investors in the WallStreetBets subreddit rallied to oppose these short positions by buying GameStop shares. These smaller investors had forecast a surge in GameStop sales based on the future release of new video game consoles and were excited by the appointment of a digitally savy executive to the company's board of directors. 2 As their collective demand for GameStop shares increased, so too did its share price. Eventually, some of the hedge funds that had taken short positions felt the squeeze as their losses mounted and were forced to close their positions, which meant having to buy GameStop shares to replace the borrowed shares. But their buying pushed the stock price higher, which then led to other hedge funds having to close their short positions. This game of escalating prices ended only when investors stopped buying GameStop. From the beginning of the year to its peak on January 28, 2021, GameStop's stock had soared from a low of $17.15 to a high of $483.00 per share-a 28 -fold increase! That led to a huge wealth shift from hedge funds to Redditors, estimated at $19 billion for GameStop investors. 3 The Accounting Takeaway One of the lessons revealed by the GameStop spectacle is that, in the short term, stock prices can be affected by more than just company performance. Redditors had been attracted to GameStop by not only expectations of increasing sales revenue but also the emotional allure of beating big hedge funds at their own game. To downplay this emotional element, investors can consider an alternative measure of company value that instead focuses on the stockholders' equity section of a company's balance sheet. Stockholders' equity is often referred to as a company's "net worth" because it reports the total value that owners have contributed to a company plus the profits the company has generated and retained on behalf of stockholders. Investors can use that data to calculate a per-share "book value," by dividing the company's total stockholders' equity by the number of shares available to investors. The GameStop case illustrates the important distinction between stock price and accounting book value, but an even better example involves headphone maker Koss Corporation, which Redditors also rallied to support. Unlike GameStop. which filed its financial statements almost two weeks prior to the short-selling spree, Koss Corporation filed its financial statements on the same day its stock price reached an all-time high (January 29, 2021). This timing allows us to cleanly compare stock price to book value per share. The accompanying graph presents per-share stock prices and book values on Koss's financial statement release dates over a 6.5-year period. As shown in the graph, book value provides a more stable and conservative measure of value than stock price. Book value is a conservative measure because it is primarily based on past transactions and events that have directly affected the company. over-100heres/: Accessed 3 Feb 2021. 2 uployer896, "Bankinpting intetutonal investors for Dummies, ft GameStop" Aloddit, 19 5eat. 2020. 3 pobertson, H. -Short-selers are nursing estimated losses of 519 billon in 2021 afer betser on GameStop's stock to plunge* Business insider, 30 jan. 2021 , The reading indicates that stockholders' equity "reports the total value that owners have contributed to a company plus the profits the company has generated and retained on behalf of stockholders." Indicate the two accounts referred to in this sentence. (Check all that apply.) Check All That Apply Cash. Commen Stock Retained Earnings. Sales Revenue. Cash Flows from Investing Activities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started