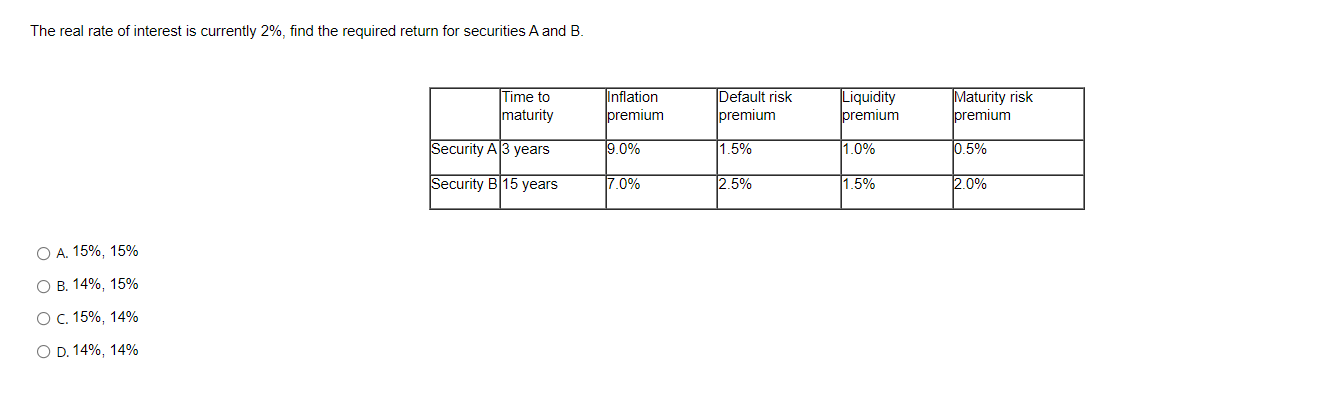

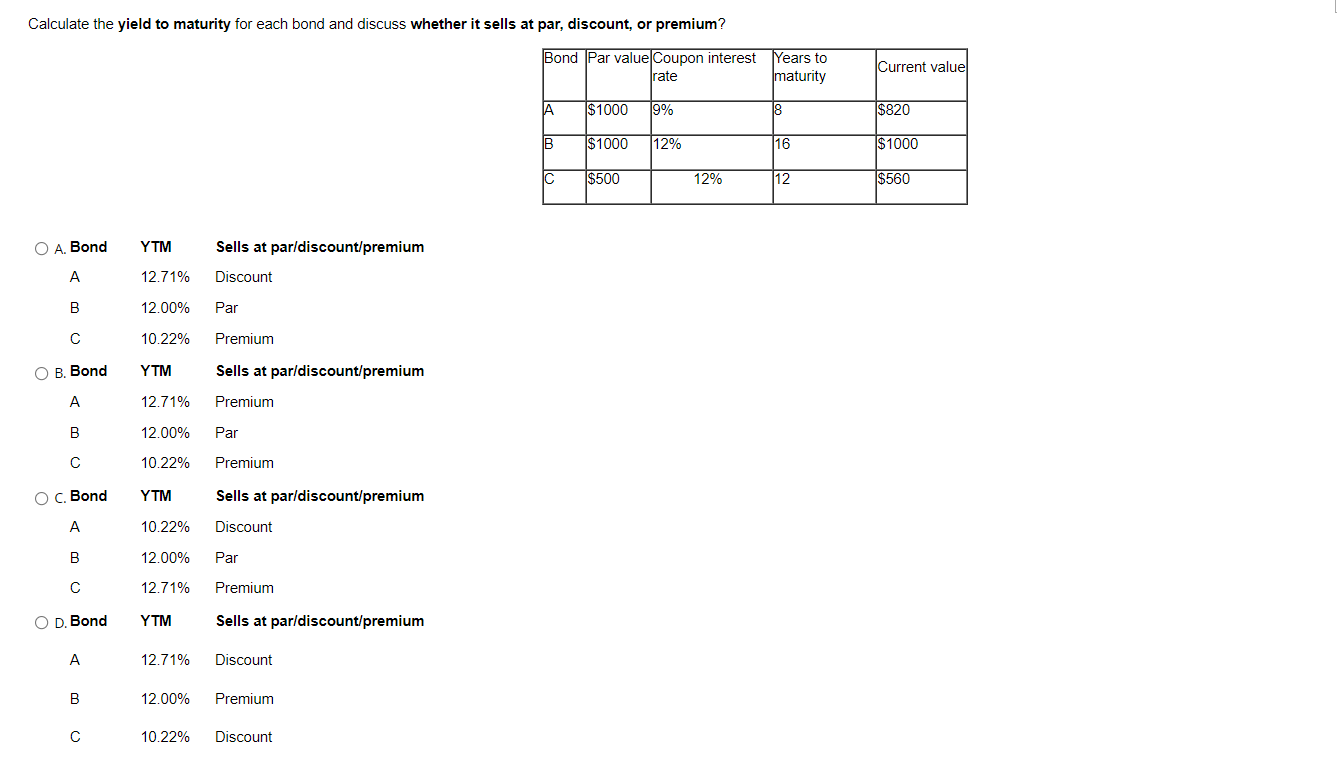

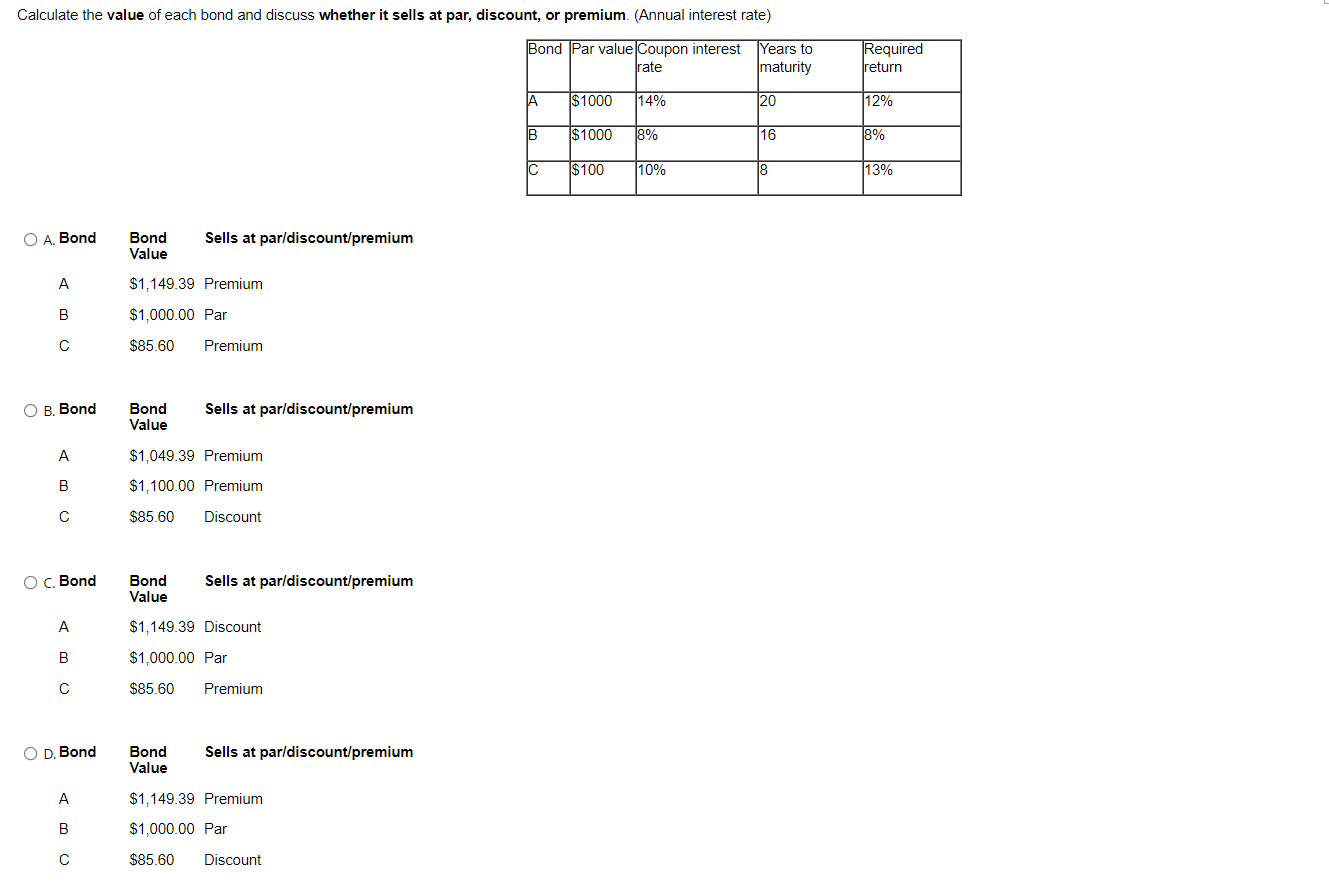

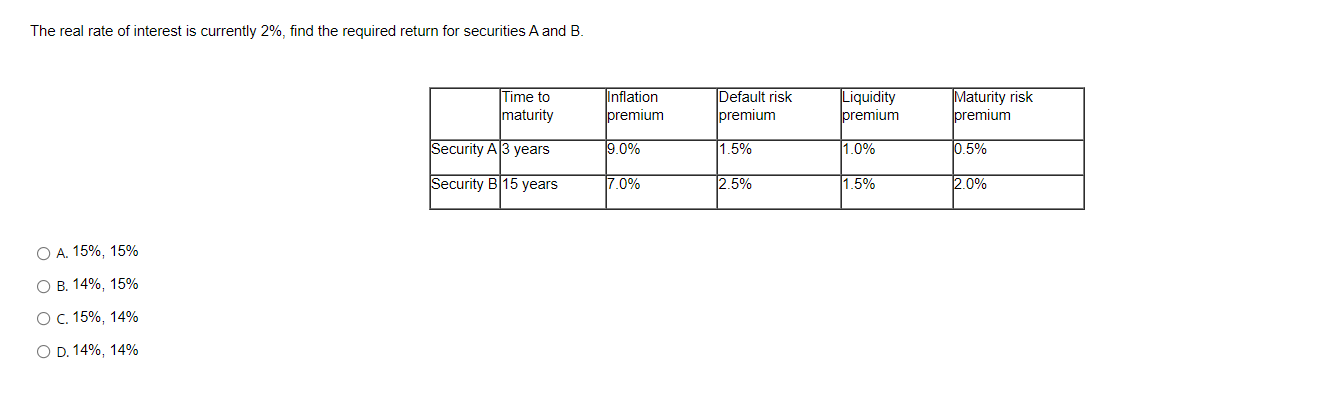

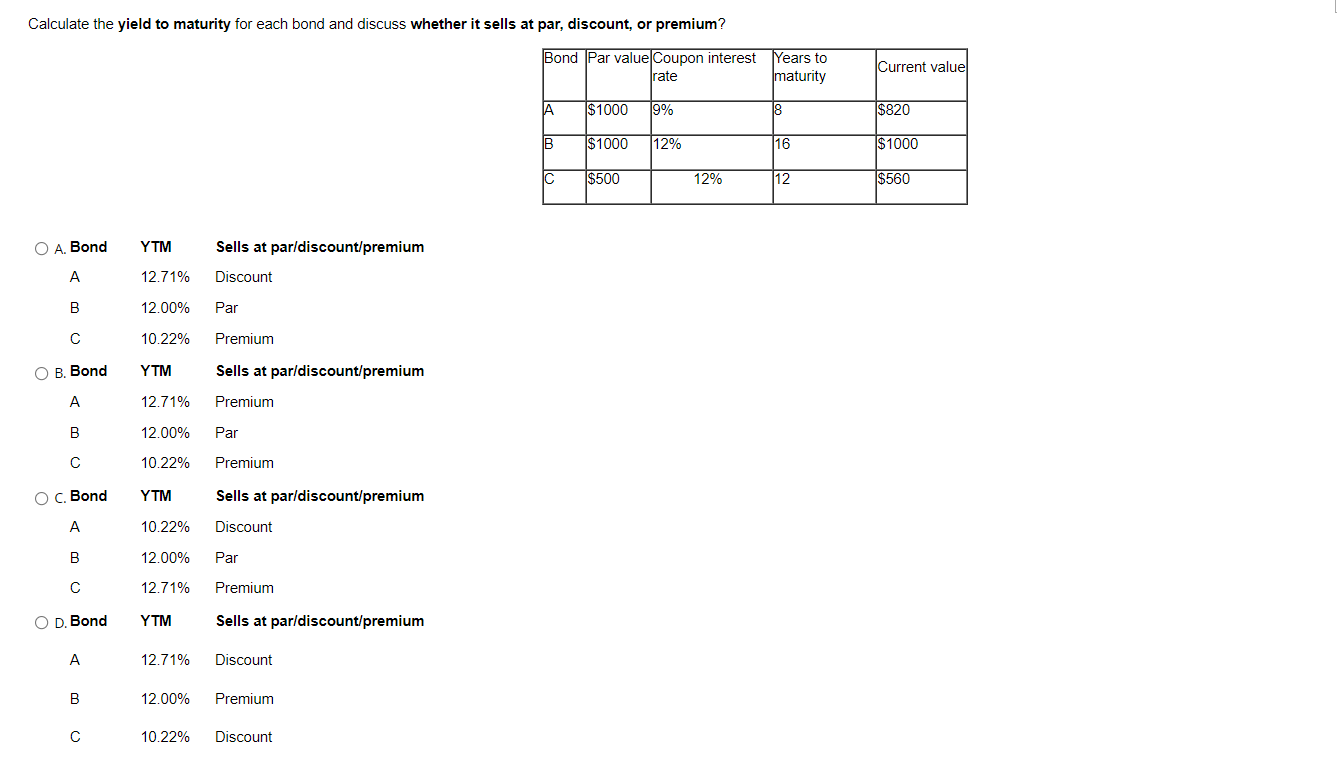

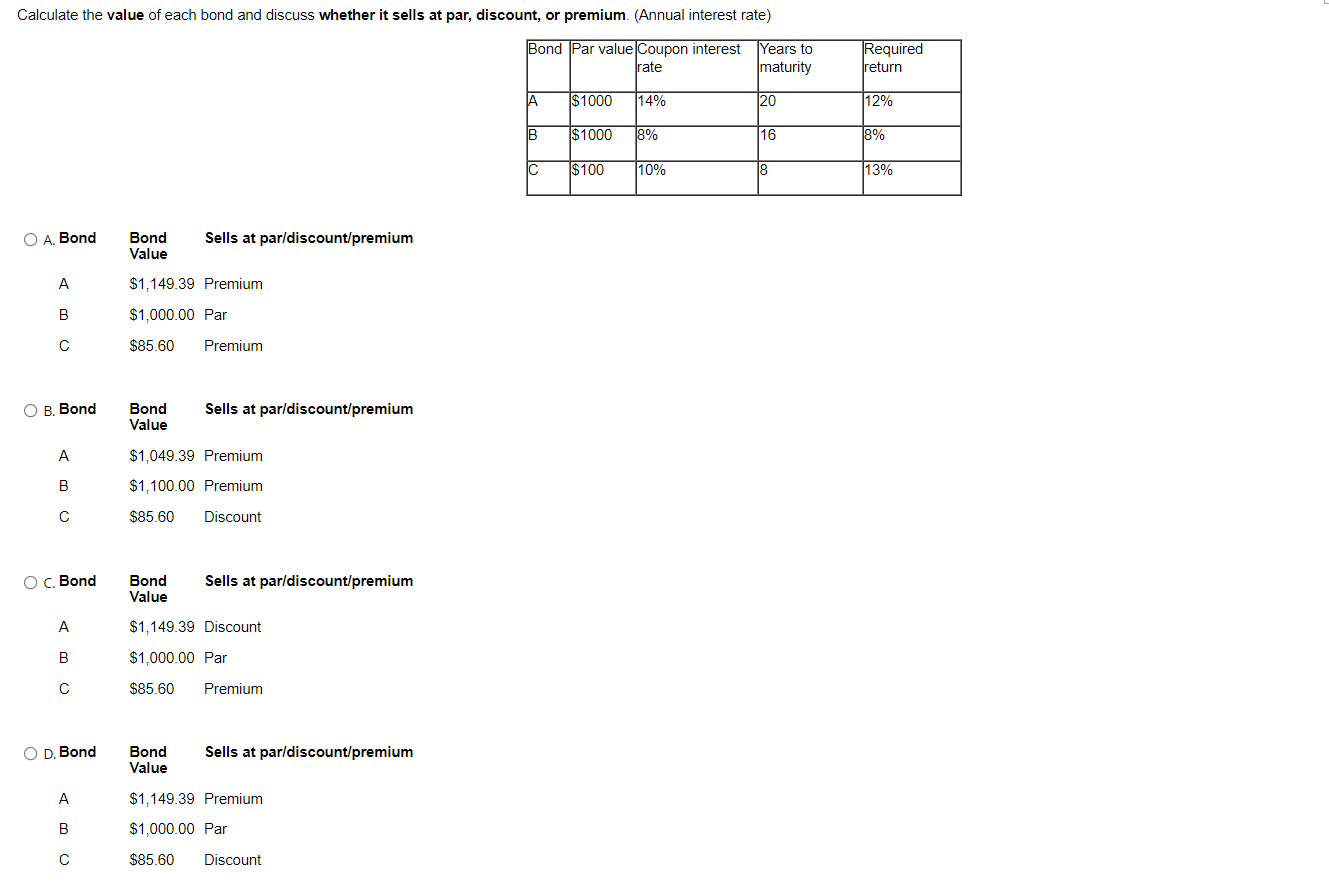

The real rate of interest is currently 2%, find the required return for securities A and B. Time to maturity Inflation Ipremium Default risk Ipremium Liquidity premium Maturity risk Ipremium Security A3 years 19.0% 1.5% 1.0% 10.5% Security B 15 years 17.0% 2.5% 1.5% 12.0% O A. 15%, 15% O B. 14%, 15% O C. 15%, 14% O D. 14%, 14% Calculate the yield to maturity for each bond and discuss whether it sells at par, discount, or premium? Bond Par valueCoupon interest rate Years to maturity Current value JA $1000 19% 8 $820 B $1000 12% 16 $ 1000 $500 12% 12 $560 O A. Bond YTM Sells at par/discount/premium A 12.71% Discount B 12.00% Par 10.22% Premium O B. Bond YTM Sells at par/discount/premium A 12.71% Premium B 12.00% Par C 10. mium O c. Bond YTM Sells at par/discount/premium A 10.22% Discount B 12.00% Par C 12.71% Premium O D. Bond YTM Sells at par/discount/premium A 12.71% Discount B 12.00% Premium C 10.22% Discount Calculate the value of each bond and discuss whether it sells at par, discount, or premium. (Annual interest rate) Years to Bond Par value Coupon interest rate Required return maturity A $1000 14% 20 12% B $1000 18% 16 18% C $100 10% 13% O A Bond Bond Value Sells at par/discount/premium A $1,149.39 Premium B $1,000.00 Par $85.60 Premium O B. Bond Bond Value Sells at par/discount/premium A $1,049.39 Premium B $1,100.00 Premium $85.60 Discount O c. Bond Bond Value Sells at par/discount/premium A $1,149.39 Discount B $1,000.00 Par $85.60 Premium OD Bond Bond Value Sells at par/discount/premium $1,149.39 Premium $1,000.00 Par B $85.60 Discount The real rate of interest is currently 2%, find the required return for securities A and B. Time to maturity Inflation Ipremium Default risk Ipremium Liquidity premium Maturity risk Ipremium Security A3 years 19.0% 1.5% 1.0% 10.5% Security B 15 years 17.0% 2.5% 1.5% 12.0% O A. 15%, 15% O B. 14%, 15% O C. 15%, 14% O D. 14%, 14% Calculate the yield to maturity for each bond and discuss whether it sells at par, discount, or premium? Bond Par valueCoupon interest rate Years to maturity Current value JA $1000 19% 8 $820 B $1000 12% 16 $ 1000 $500 12% 12 $560 O A. Bond YTM Sells at par/discount/premium A 12.71% Discount B 12.00% Par 10.22% Premium O B. Bond YTM Sells at par/discount/premium A 12.71% Premium B 12.00% Par C 10. mium O c. Bond YTM Sells at par/discount/premium A 10.22% Discount B 12.00% Par C 12.71% Premium O D. Bond YTM Sells at par/discount/premium A 12.71% Discount B 12.00% Premium C 10.22% Discount Calculate the value of each bond and discuss whether it sells at par, discount, or premium. (Annual interest rate) Years to Bond Par value Coupon interest rate Required return maturity A $1000 14% 20 12% B $1000 18% 16 18% C $100 10% 13% O A Bond Bond Value Sells at par/discount/premium A $1,149.39 Premium B $1,000.00 Par $85.60 Premium O B. Bond Bond Value Sells at par/discount/premium A $1,049.39 Premium B $1,100.00 Premium $85.60 Discount O c. Bond Bond Value Sells at par/discount/premium A $1,149.39 Discount B $1,000.00 Par $85.60 Premium OD Bond Bond Value Sells at par/discount/premium $1,149.39 Premium $1,000.00 Par B $85.60 Discount