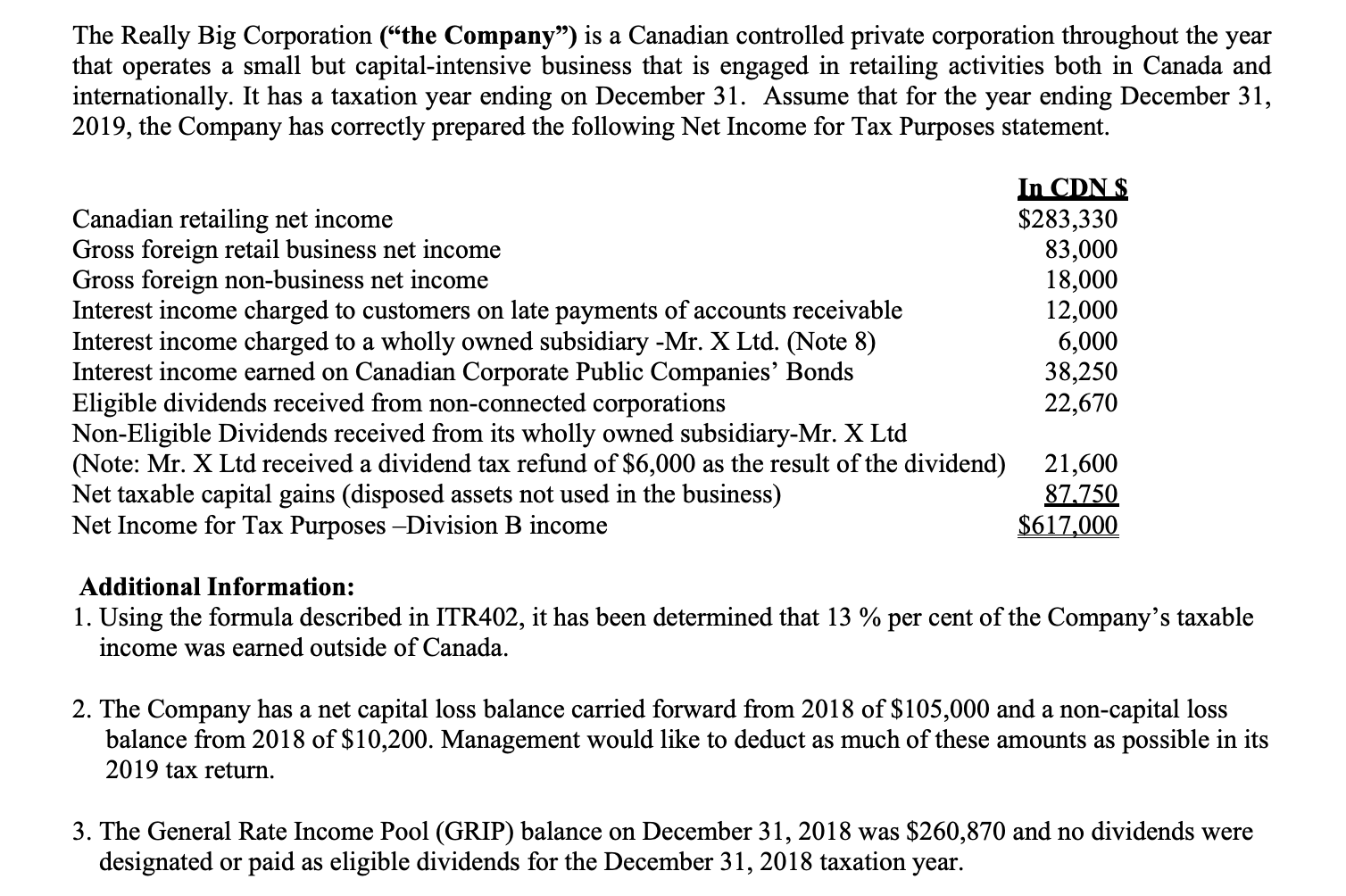

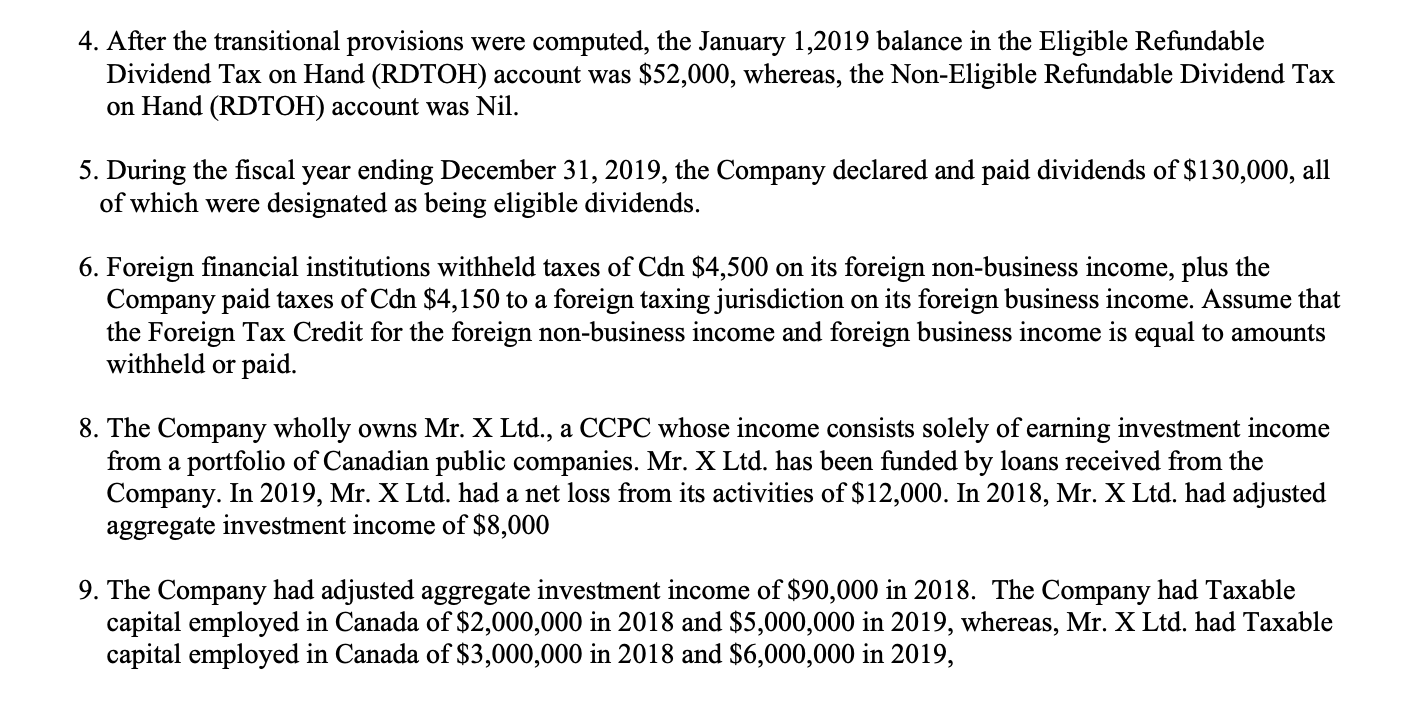

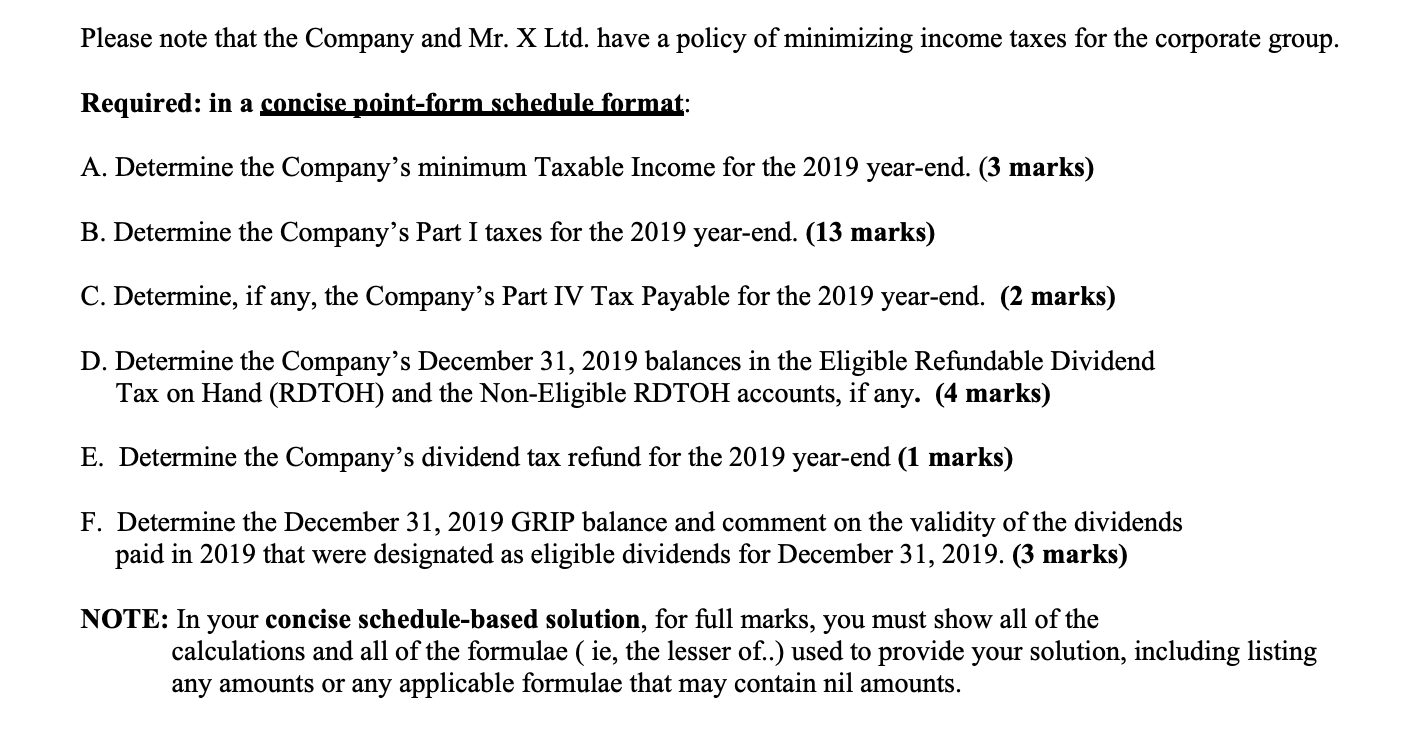

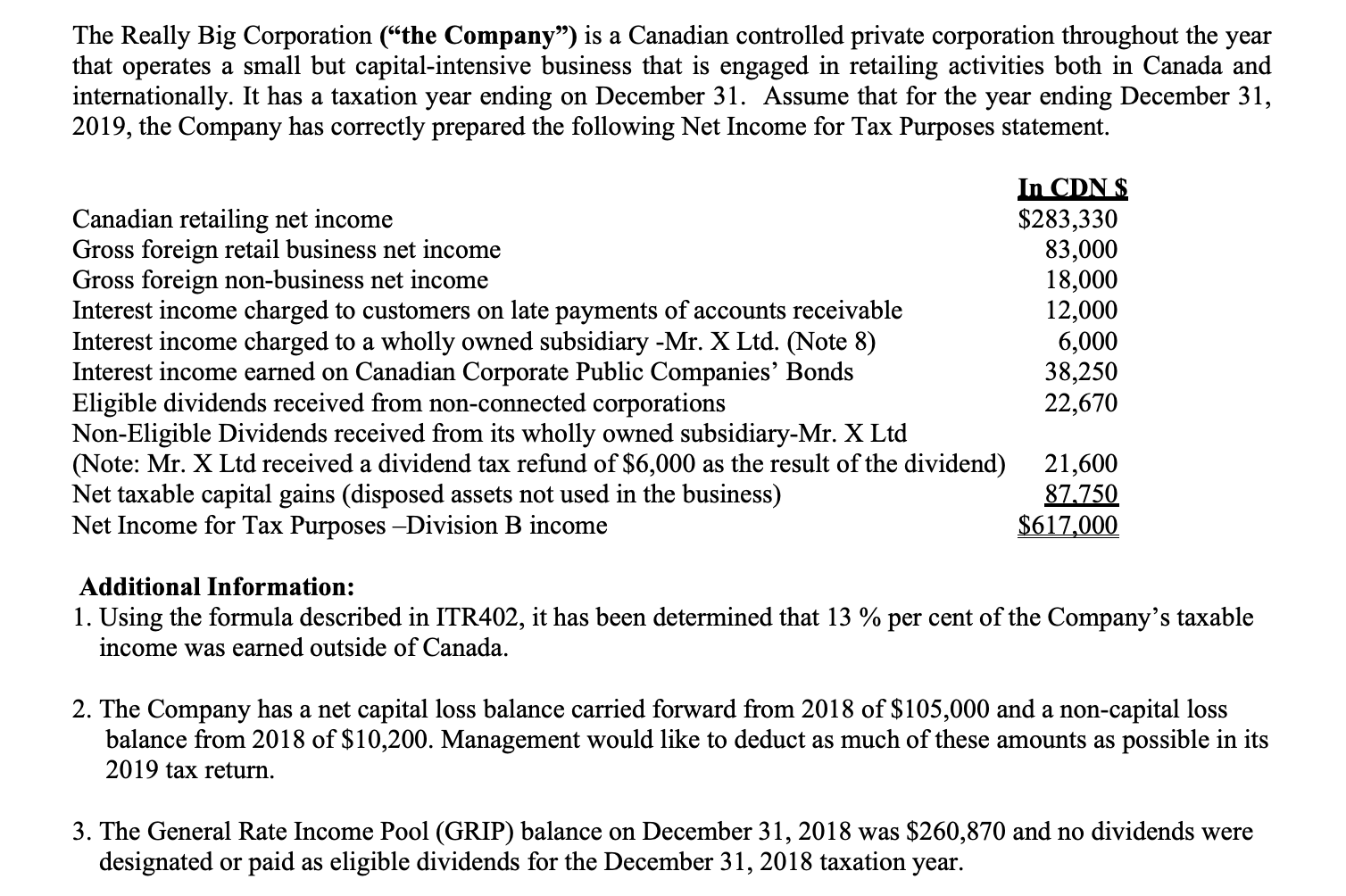

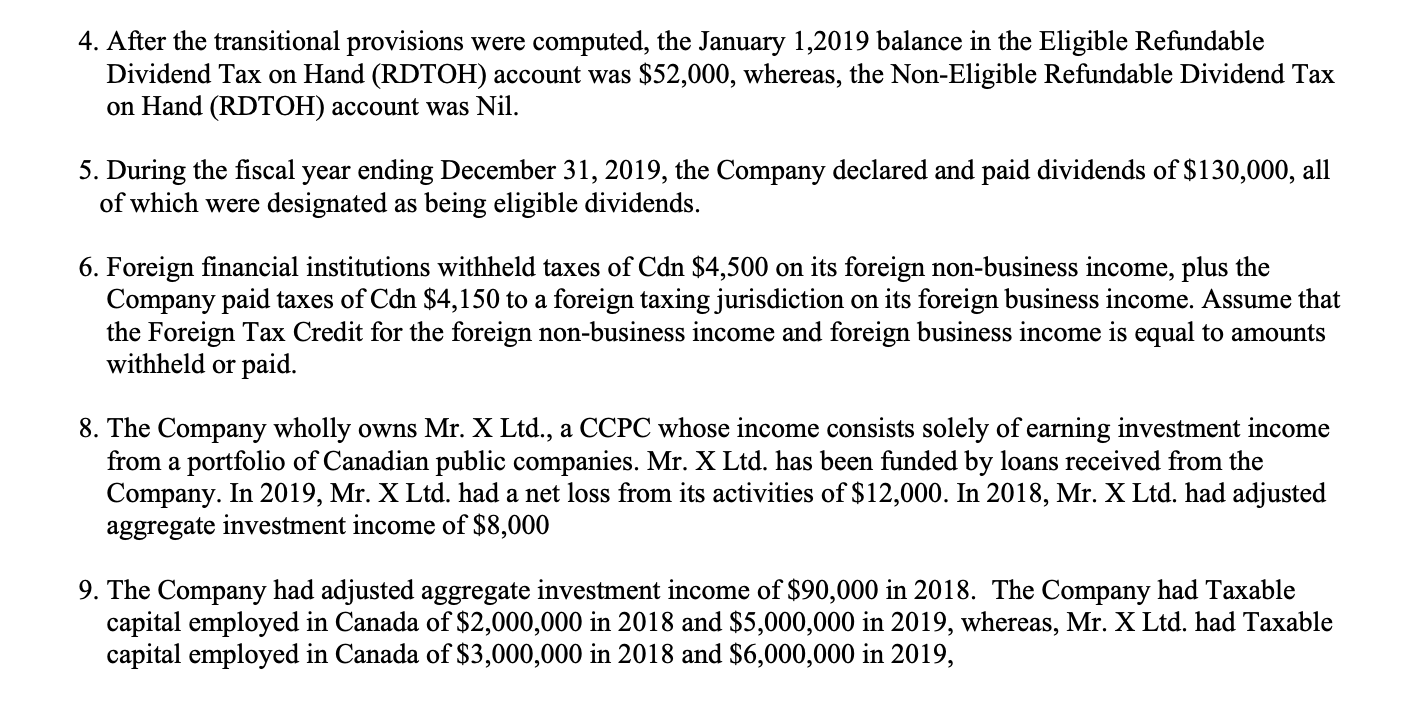

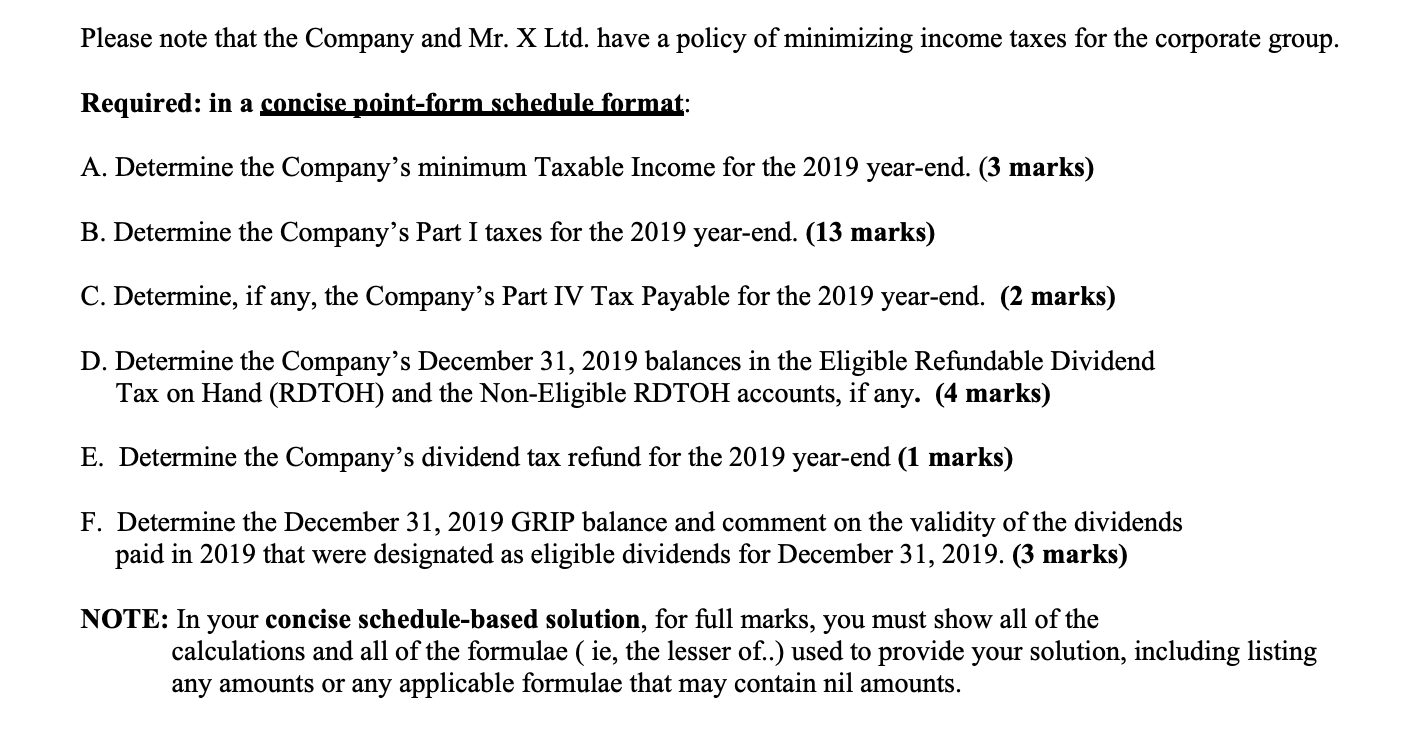

The Really Big Corporation (the Company) is a Canadian controlled private corporation throughout the year that operates a small but capital-intensive business that is engaged in retailing activities both in Canada and internationally. It has a taxation year ending on December 31. Assume that for the year ending December 31, 2019, the Company has correctly prepared the following Net Income for Tax Purposes statement. In CDNS Canadian retailing net income $283,330 Gross foreign retail business net income 83,000 Gross foreign non-business net income 18,000 Interest income charged to customers on late payments of accounts receivable 12,000 Interest income charged to a wholly owned subsidiary -Mr. X Ltd. (Note 8) 6,000 Interest income earned on Canadian Corporate Public Companies' Bonds 38,250 Eligible dividends received from non-connected corporations 22,670 Non-Eligible Dividends received from its wholly owned subsidiary-Mr. X Ltd (Note: Mr. X Ltd received a dividend tax refund of $6,000 as the result of the dividend) 21,600 Net taxable capital gains (disposed assets not used in the business) 87.750 Net Income for Tax Purposes -Division B income $617,000 Additional Information: 1. Using the formula described in ITR402, it has been determined that 13 % per cent of the Company's taxable income was earned outside of Canada. 2. The Company has a net capital loss balance carried forward from 2018 of $105,000 and a non-capital loss balance from 2018 of $10,200. Management would like to deduct as much of these amounts as possible in its 2019 tax return. 3. The General Rate Income Pool (GRIP) balance on December 31, 2018 was $260,870 and no dividends were designated or paid as eligible dividends for the December 31, 2018 taxation year. 4. After the transitional provisions were computed, the January 1,2019 balance in the Eligible Refundable Dividend Tax on Hand (RDTOH) account was $52,000, whereas, the Non-Eligible Refundable Dividend Tax on Hand (RDTOH) account was Nil. 5. During the fiscal year ending December 31, 2019, the Company declared and paid dividends of $130,000, all of which were designated as being eligible dividends. 6. Foreign financial institutions withheld taxes of Cdn $4,500 on its foreign non-business income, plus the Company paid taxes of Cdn $4,150 to a foreign taxing jurisdiction on its foreign business income. Assume that the Foreign Tax Credit for the foreign non-business income and foreign business income is equal to amounts withheld or paid. 8. The Company wholly owns Mr. X Ltd., a CCPC whose income consists solely of earning investment income from a portfolio of Canadian public companies. Mr. X Ltd. has been funded by loans received from the Company. In 2019, Mr. X Ltd. had a net loss from its activities of $12,000. In 2018, Mr. X Ltd. had adjusted aggregate investment income of $8,000 9. The Company had adjusted aggregate investment income of $90,000 in 2018. The Company had Taxable capital employed in Canada of $2,000,000 in 2018 and $5,000,000 in 2019, whereas, Mr. X Ltd. had Taxable capital employed in Canada of $3,000,000 in 2018 and $6,000,000 in 2019, Please note that the Company and Mr. X Ltd. have a policy of minimizing income taxes for the corporate group. Required: in a concise point-form schedule format: A. Determine the Company's minimum Taxable Income for the 2019 year-end. (3 marks) B. Determine the Company's Part I taxes for the 2019 year-end. (13 marks) C. Determine, if any, the Company's Part IV Tax Payable for the 2019 year-end. (2 marks) D. Determine the Company's December 31, 2019 balances in the Eligible Refundable Dividend Tax on Hand (RDTOH) and the Non-Eligible RDTOH accounts, if any. (4 marks) E. Determine the Company's dividend tax refund for the 2019 year-end (1 marks) F. Determine the December 31, 2019 GRIP balance and comment on the validity of the dividends paid in 2019 that were designated as eligible dividends for December 31, 2019. (3 marks) NOTE: In your concise schedule-based solution, for full marks, you must show all of the calculations and all of the formulae ( ie, the lesser of..) used to provide your solution, including listing any amounts or any applicable formulae that may contain nil amounts. The Really Big Corporation (the Company) is a Canadian controlled private corporation throughout the year that operates a small but capital-intensive business that is engaged in retailing activities both in Canada and internationally. It has a taxation year ending on December 31. Assume that for the year ending December 31, 2019, the Company has correctly prepared the following Net Income for Tax Purposes statement. In CDNS Canadian retailing net income $283,330 Gross foreign retail business net income 83,000 Gross foreign non-business net income 18,000 Interest income charged to customers on late payments of accounts receivable 12,000 Interest income charged to a wholly owned subsidiary -Mr. X Ltd. (Note 8) 6,000 Interest income earned on Canadian Corporate Public Companies' Bonds 38,250 Eligible dividends received from non-connected corporations 22,670 Non-Eligible Dividends received from its wholly owned subsidiary-Mr. X Ltd (Note: Mr. X Ltd received a dividend tax refund of $6,000 as the result of the dividend) 21,600 Net taxable capital gains (disposed assets not used in the business) 87.750 Net Income for Tax Purposes -Division B income $617,000 Additional Information: 1. Using the formula described in ITR402, it has been determined that 13 % per cent of the Company's taxable income was earned outside of Canada. 2. The Company has a net capital loss balance carried forward from 2018 of $105,000 and a non-capital loss balance from 2018 of $10,200. Management would like to deduct as much of these amounts as possible in its 2019 tax return. 3. The General Rate Income Pool (GRIP) balance on December 31, 2018 was $260,870 and no dividends were designated or paid as eligible dividends for the December 31, 2018 taxation year. 4. After the transitional provisions were computed, the January 1,2019 balance in the Eligible Refundable Dividend Tax on Hand (RDTOH) account was $52,000, whereas, the Non-Eligible Refundable Dividend Tax on Hand (RDTOH) account was Nil. 5. During the fiscal year ending December 31, 2019, the Company declared and paid dividends of $130,000, all of which were designated as being eligible dividends. 6. Foreign financial institutions withheld taxes of Cdn $4,500 on its foreign non-business income, plus the Company paid taxes of Cdn $4,150 to a foreign taxing jurisdiction on its foreign business income. Assume that the Foreign Tax Credit for the foreign non-business income and foreign business income is equal to amounts withheld or paid. 8. The Company wholly owns Mr. X Ltd., a CCPC whose income consists solely of earning investment income from a portfolio of Canadian public companies. Mr. X Ltd. has been funded by loans received from the Company. In 2019, Mr. X Ltd. had a net loss from its activities of $12,000. In 2018, Mr. X Ltd. had adjusted aggregate investment income of $8,000 9. The Company had adjusted aggregate investment income of $90,000 in 2018. The Company had Taxable capital employed in Canada of $2,000,000 in 2018 and $5,000,000 in 2019, whereas, Mr. X Ltd. had Taxable capital employed in Canada of $3,000,000 in 2018 and $6,000,000 in 2019, Please note that the Company and Mr. X Ltd. have a policy of minimizing income taxes for the corporate group. Required: in a concise point-form schedule format: A. Determine the Company's minimum Taxable Income for the 2019 year-end. (3 marks) B. Determine the Company's Part I taxes for the 2019 year-end. (13 marks) C. Determine, if any, the Company's Part IV Tax Payable for the 2019 year-end. (2 marks) D. Determine the Company's December 31, 2019 balances in the Eligible Refundable Dividend Tax on Hand (RDTOH) and the Non-Eligible RDTOH accounts, if any. (4 marks) E. Determine the Company's dividend tax refund for the 2019 year-end (1 marks) F. Determine the December 31, 2019 GRIP balance and comment on the validity of the dividends paid in 2019 that were designated as eligible dividends for December 31, 2019. (3 marks) NOTE: In your concise schedule-based solution, for full marks, you must show all of the calculations and all of the formulae ( ie, the lesser of..) used to provide your solution, including listing any amounts or any applicable formulae that may contain nil amounts