Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The reasons are explained below: c30 (1) Credit sales and other related matters (such as, sales returns, bad debts, discount allowed, etc.) The Branch Account

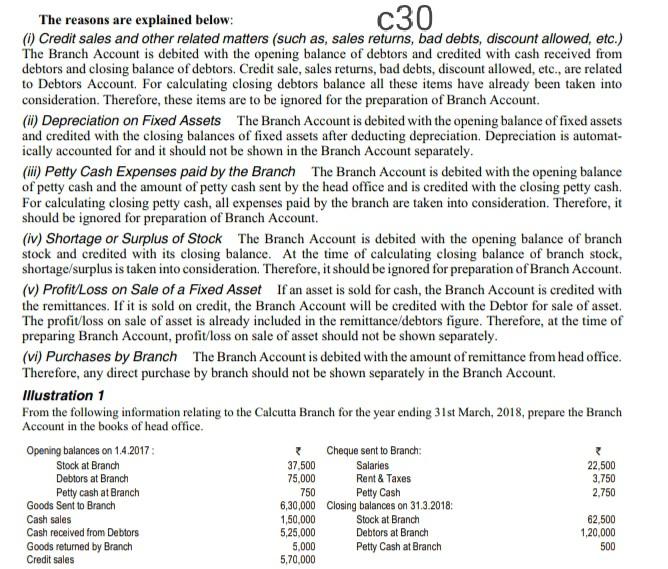

The reasons are explained below: c30 (1) Credit sales and other related matters (such as, sales returns, bad debts, discount allowed, etc.) The Branch Account is debited with the opening balance of debtors and credited with cash received from debtors and closing balance of debtors, Credit sale, sales returns, bad debts, discount allowed, etc., are related to Debtors Account. For calculating closing debtors balance all these items have already been taken into consideration. Therefore, these items are to be ignored for the preparation of Branch Account (i) Depreciation on Fixed Assets The Branch Account is debited with the opening balance of fixed assets and credited with the closing balances of fixed assets after deducting depreciation. Depreciation is automat- ically accounted for and it should not be shown in the Branch Account separately. (iii) Petty Cash Expenses paid by the Branch The Branch Account is debited with the opening balance of petty cash and the amount of petty cash sent by the head office and is credited with the closing petty cash. For calculating closing petty cash, all expenses paid by the branch are taken into consideration. Therefore, it should be ignored for preparation of Branch Account. (iv) Shortage or Surplus of Stock The Branch Account is debited with the opening balance of branch stock and credited with its closing balance. At the time of calculating closing balance of branch stock, shortage/surplus is taken into consideration. Therefore, it should be ignored for preparation of Branch Account (V) Profit/Loss on Sale of a Fixed Asset If an asset is sold for cash, the Branch Account is credited with the remittances. If it is sold on credit, the Branch Account will be credited with the Debtor for sale of asset. The profit/loss on sale of asset is already included in the remittance/debtors figure. Therefore, at the time of preparing Branch Account, profit/loss on sale of asset should not be shown separately. (vi) Purchases by Branch The Branch Account is debited with the amount of remittance from head office. Therefore, any direct purchase by branch should not be shown separately in the Branch Account Illustration 1 From the following information relating to the Calcutta Branch for the year ending 31st March, 2018, prepare the Branch Account in the books of head office. Opening balances on 1.4.2017: Cheque sent to Branch Stock at Branch 37,500 Salaries 22,500 Debtors at Branch 75,000 Rent & Taxes Petty cash at Branch 750 Petty Cash 2.750 Goods Sent to Branch 6,30,000 Closing balances on 31.3.2018 Cash sales Stock at Branch 62,500 Cash received from Debtors 5,25,000 Debtors at Branch 1,20,000 Goods returned by Branch Petty Cash at Branch Credit sales 3,750 1,50,000 500 5,000 5,70,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started