Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The receivables and payables were maintained at a constant level throughout the year, and all transactions were on credit basis. (a) Explain why the concept

The receivables and payables were maintained at a constant level throughout the year, and all transactions were on credit basis. (a) Explain why the concept of operating cash cycle is important in the financial management of a business. (4 marks)

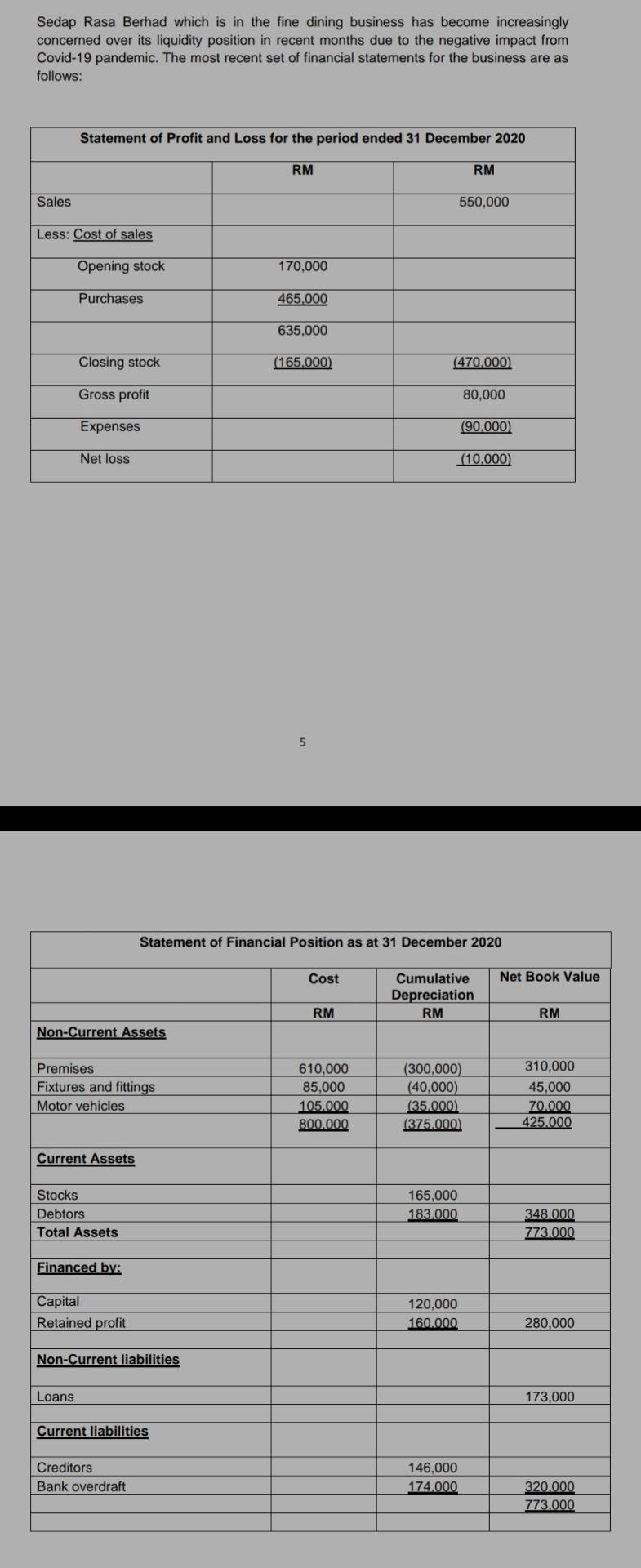

Sedap Rasa Berhad which is in the fine dining business has become increasingly concerned over its liquidity position in recent months due to the negative impact from Covid-19 pandemic. The most recent set of financial statements for the business are as follows: Statement of Profit and Loss for the period ended 31 December 2020 RM RM Sales 550,000 Less: Cost of sales Opening stock 170,000 Purchases 465.000 635,000 Closing stock (165,000) (470.000) Gross profit 80,000 Expenses (90.000) Net loss (10,000) 5 Statement of Financial Position as at 31 December 2020 Cost Net Book Value Cumulative Depreciation RM RM RM Non-Current Assets Premises Fixtures and fittings Motor vehicles 610,000 85.000 105.000 800.000 (300,000) (40,000) (35.000 (375.000 310,000 45,000 70.000 425.000 Current Assets Stocks Debtors Total Assets 165,000 183.000 348.000 773.000 Financed by: Capital Retained profit 120,000 160.000 280,000 Non-Current liabilities Loans 173,000 Current liabilities Creditors Bank overdraft 146,000 174.000 320.000 773.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started