Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The recession has hit hard and your widget corporation business is bleeding cash. You have decided to close the business and you have found other

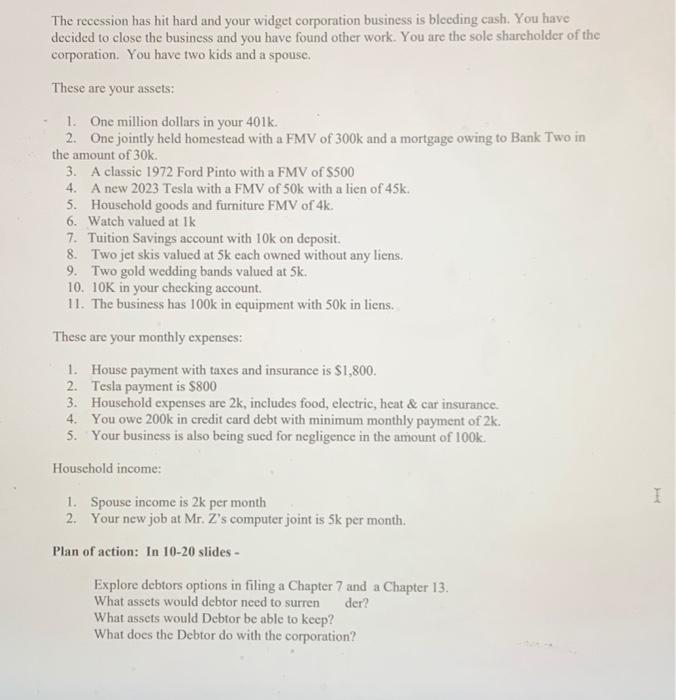

The recession has hit hard and your widget corporation business is bleeding cash. You have decided to close the business and you have found other work. You are the sole shareholder of the corporation. You have two kids and a spouse. These are your assets: 1. One million dollars in your 401k. 2. One jointly held homestead with a FMV of 300k and a mortgage owing to Bank Two in the amount of 30k. 3. A classic 1972 Ford Pinto with a FMV of $500 4. A new 2023 Tesla with a FMV of 50k with a lien of 45k. 5. Household goods and furniture FMV of 4k. 6. Watch valued at 1k 7. Tuition Savings account with 10k on deposit. 8. Two jet skis valued at 5k each owned without any liens. 9. Two gold wedding bands valued at 5k. 10. 10K in your checking account. 11. The business has 100k in equipment with 50k in liens. These are your monthly expenses: 1. House payment with taxes and insurance is $1,800. 2. Tesla payment is $800 3. Household expenses are 2k, includes food, electric, heat & car insurance. 4. You owe 200k in credit card debt with minimum monthly payment of 2k. 5. Your business is also being sued for negligence in the amount of 100k. Household income: 1. Spouse income is 2k per month 2. Your new job at Mr. Z's computer joint is 5k per month. Plan of action: In 10-20 slides - Explore debtors options in filing a Chapter 7 and a Chapter 13. What assets would debtor need to surren der? What assets would Debtor be able to keep? What does the Debtor do with the corporation?

IMPORTANT: The client is now unemployed, Household incone has to 2k plus unemployment of 1200 dollars a month for a total of 3200 dollars. What assets would be surrendered if i filed for chapter 7 and what would be protected. What assets would be surrendered and what would be protected if i file chapter 13. What is the better option to choose, how much debt do i have after j file for chapter 7 or 13, and how long would it take to pay off this debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started