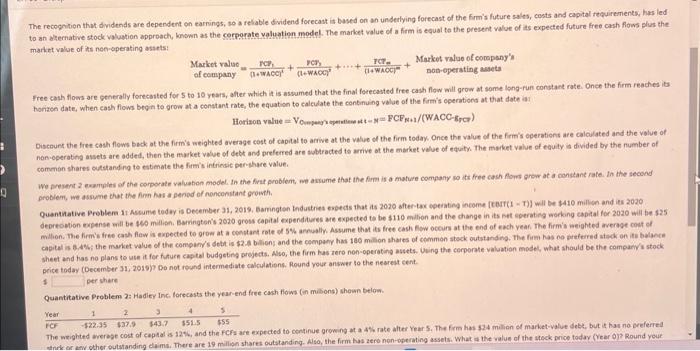

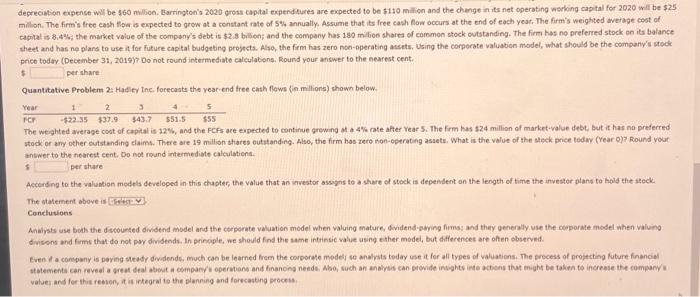

The recognilion that dividends are dependent on earnings, so a relable dividend forecast is based on an underlying forecast of the frmis future sales, costs and capital tequirenents, has led to an aternative stock valuation approach, known as the cerporate valuation model. The market value of a firm is equal te the present value of as expected future free cash fioms plus the market value of is nen-operating assets: Free cash flows are generally forecanted for 5 to 10 years, atter which it is assumed that the final forecasted free cash flow will grow at some long-run constant rate. Once the firm reaches its horizen date, when cash flows begin to grow at a constant rate, the equation to calculate the continuing walue of the firmis operations at that date ia! Oucount the free cash flows buck at the firm's weighted average cost of capital to acive at the value of the firm today Once the value of the firm's operations are calcilated and the value of non-operating assets are added, then the maket value of debt and preferred are sobracted to arrive of the market value of equith. The maket value of equity it divided by the number of common shares cutstanding to estemate the fitm's intriesic perahare value. We present 2 exarwites of the comporate valuation model, In the firt problemt, ne arimume that the fimm is a mature company wo itt free cash Alows arow at a constant rate. In the second problem, we assume that the firm hab a penod of nonconstant growth. Quanthative Broblem It Ascume todey is December 31, 2019, Eamngten bhdustnet espeds that is 2020 sttem-wx operatieg income [tert(1 - T)] wil be \$410 millon and ies 2020 deoreomion expense mill be 400 milishi. Bamngton's 2020 grows capital expenditures are expected to be $110 million and the change in its pet eperating aorking capial for 2020 will be 325 milton. The firm's free cash flew in expected to grow at a conbtant rote of 5% arnually. Assume that th tret cash fow oceurs at the end of cach vear. The firmi aeighted average cost af sheet and thas no plans to use it for futurh capital budgeting projects. Also, the firm kas rero non-operating astets, Using the cerporate valuation model, what should be the comparif i stock price today (December 31, 2019)? Do not round intemediate calculations. Round your answer to the nearest cent. per share Quantitatiwe Problem ?: Hadier inc. forecasts the year-end free cash flows (in mibons) shown below. The weighted wrerese cost of cepsal is 32%, and the FCrs are expected to continue orowing at a 4hic rate alter Year 5, The firm has 524 milion of market-value debe, but is hat no breferied The weighted wrerese cost of cepad os 22%, and the FCra are expected to cosinue grownt anta de. depreciution expense will be $60 milion. Barrington's 2020 gross capital expendtures are expected to be $11 mo million and the chunge in its net operating warking capital for 2020 wil be $25 millon. The firm's free cash flow is expected to grow at a constant rate of 5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of caphal is 8.4%; the market value of the company's debt is $2.8 billion; and the company has 180m tion shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has ne plans to use it for future captal budgeting projects. Also, the frm has zero non-operating ascets, Using the corperate valuation model, what should be the company's stock price todar (December 31, 2019)) Do not round intermediate calculations. Round your answer to the nearest cent. per share Quantitative Problem 2: Hatier tne, forecasts the yearend free eish flows (in millions) shown below. The weighted wverage coat of capital is 12%, and the FCFs are expected to continue grewng at a 4% rate after vear 5 . The frm has $24 million of market-value debt, But it has no preferred stodk or any other sutstanding disims. There are 19 million shares outstanding. Also, the firm has zero non-operating assets. What is the value of the steck price lodwy (Year of)? Round your answer to the neareat cent, Do eot round intermediate calculations. per share According to the valuabion models develoged in this chaoter, the value that an investor assigns to a share of stock is dependent on the length of time the investor olans to hold the steck The statement above is Conctuvions Analysts use boab the discourted dividend model and the cerporate valuation model when valuing mature, dividend.bwing fims: and they generally use the coeporale model when valuing dvisons and frms that do not pyy dividends, In prinople, we should find the same intrinsie value using eather model, but differences are often sbserved. Even t a company is pering steady dwidende, much can be learned from the corporate modely so analvats today use it for all types of valuations. The process of projecting future financial vatue: and for this rebion, tt it inteoral to the planning and forecasting proceis