Answered step by step

Verified Expert Solution

Question

1 Approved Answer

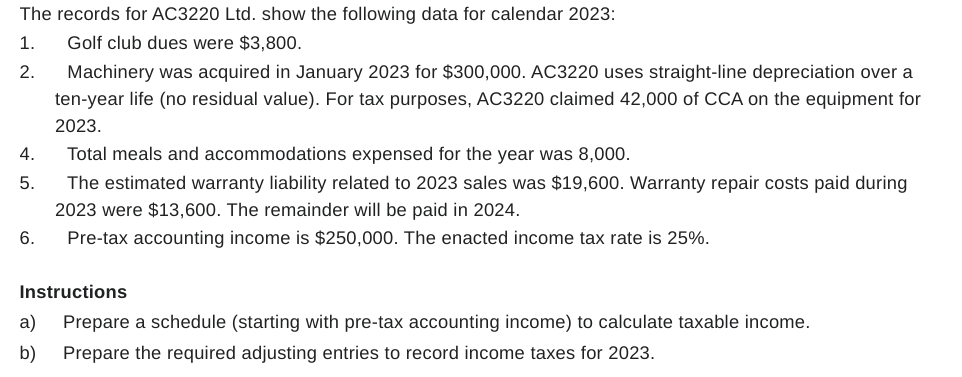

The records for AC 3 2 2 0 Ltd . show the following data for calendar 2 0 2 3 : Golf club dues were

The records for AC Ltd show the following data for calendar :

Golf club dues were $

Machinery was acquired in January for $ AC uses straightline depreciation over a

tenyear life no residual value For tax purposes, AC claimed of CCA on the equipment for

Total meals and accommodations expensed for the year was

The estimated warranty liability related to sales was $ Warranty repair costs paid during

were $ The remainder will be paid in

Pretax accounting income is $ The enacted income tax rate is

Instructions

a Prepare a schedule starting with pretax accounting income to calculate taxable income.

b Prepare the required adjusting entries to record income taxes for The records for AC Ltd show the following data for calendar :

Golf club dues were $

Machinery was acquired in January for $ AC uses straightline depreciation over a tenyear life no residual value For tax purposes, AC claimed of CCA on the equipment for

Total meals and accommodations expensed for the year was

The estimated warranty liability related to sales was $ Warranty repair costs paid during were $ The remainder will be paid in

Pretax accounting income is $ The enacted income tax rate is

Instructions

a Prepare a schedule starting with pretax accounting income to calculate taxable income.

b Prepare the required adjusting entries to record income taxes for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started