Answered step by step

Verified Expert Solution

Question

1 Approved Answer

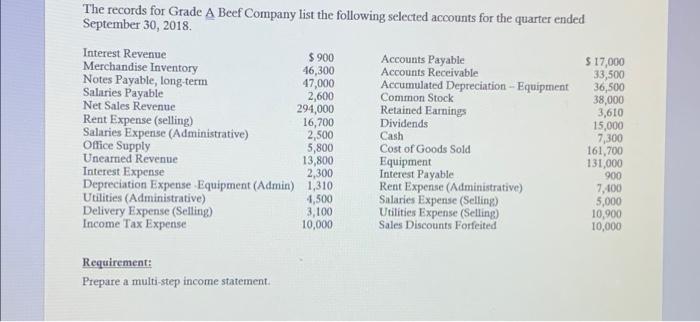

The records for Grade A Beef Company list the following selected accounts for the quarter ended September 30, 2018. Interest Revenue Merchandise Inventory Notes Payable,

The records for Grade A Beef Company list the following selected accounts for the quarter ended September 30, 2018. Interest Revenue Merchandise Inventory Notes Payable, long-term Salaries Payable Net Sales Revenue Rent Expense (selling) Salaries Expense (Administrative) Office Supply Unearned Revenue Interest Expense 2,300 Depreciation Expense -Equipment (Admin) 1,310 4,500 3,100 10,000 Utilities (Administrative) Delivery Expense (Selling) Income Tax Expense $ 900 46,300 47,000 2,600 294,000 16,700 2,500 5,800 13,800 Requirement: Prepare a multi-step income statement. Accounts Payable Accounts Receivable Accumulated Depreciation - Equipment Common Stock Retained Earnings Dividends Cash Cost of Goods Sold Equipment Interest Payable Rent Expense (Administrative) Salaries Expense (Selling) Utilities Expense (Selling) Sales Discounts Forfeited $ 17,000 33,500 36,500 38,000 3,610 15,000 7,300 161,700 131,000 900 7,400 5,000 10,900 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started