Answered step by step

Verified Expert Solution

Question

1 Approved Answer

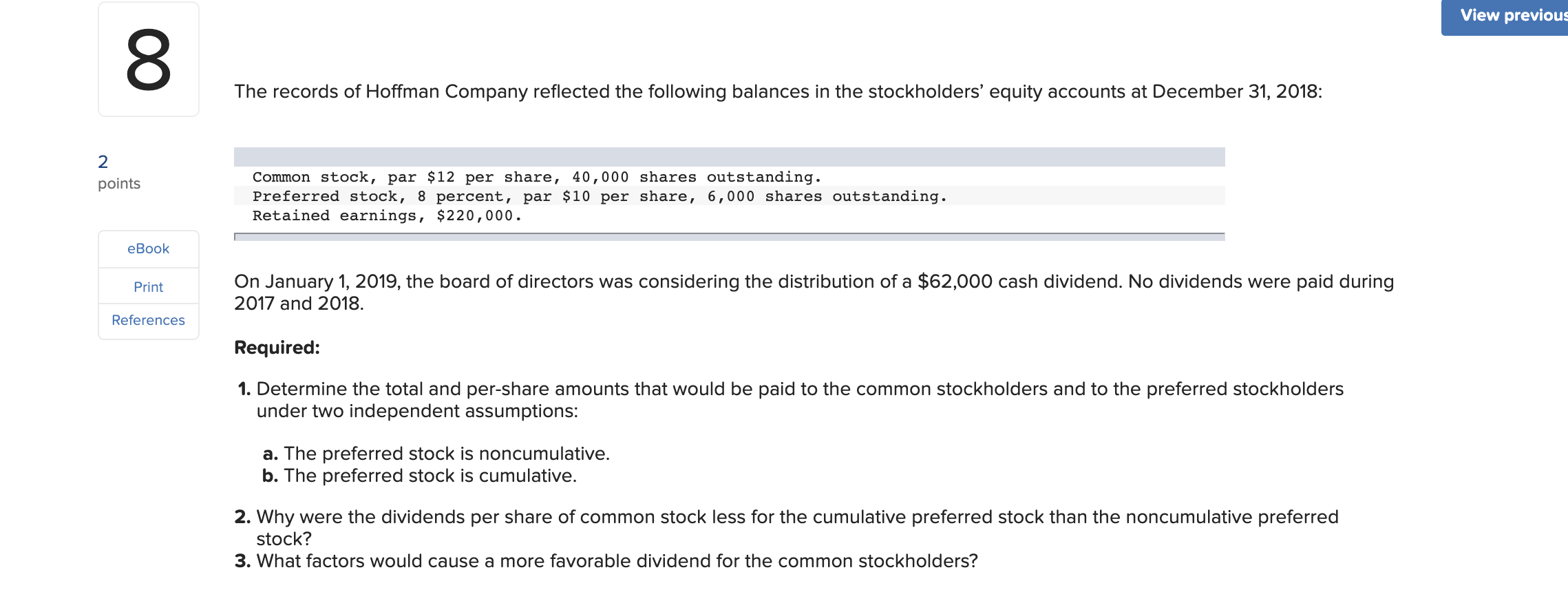

The records of Hoffman Company reflected the following balances in the stockholders equity accounts at December 31, 2018: Common stock, par $12 per share, 40,000

The records of Hoffman Company reflected the following balances in the stockholders equity accounts at December 31, 2018:

| Common stock, par $12 per share, 40,000 shares outstanding. | |||

| Preferred stock, 8 percent, par $10 per share, 6,000 shares outstanding. | |||

| Retained earnings, $220,000. | |||

On January 1, 2019, the board of directors was considering the distribution of a $62,000 cash dividend. No dividends were paid during 2017 and 2018.

Required:

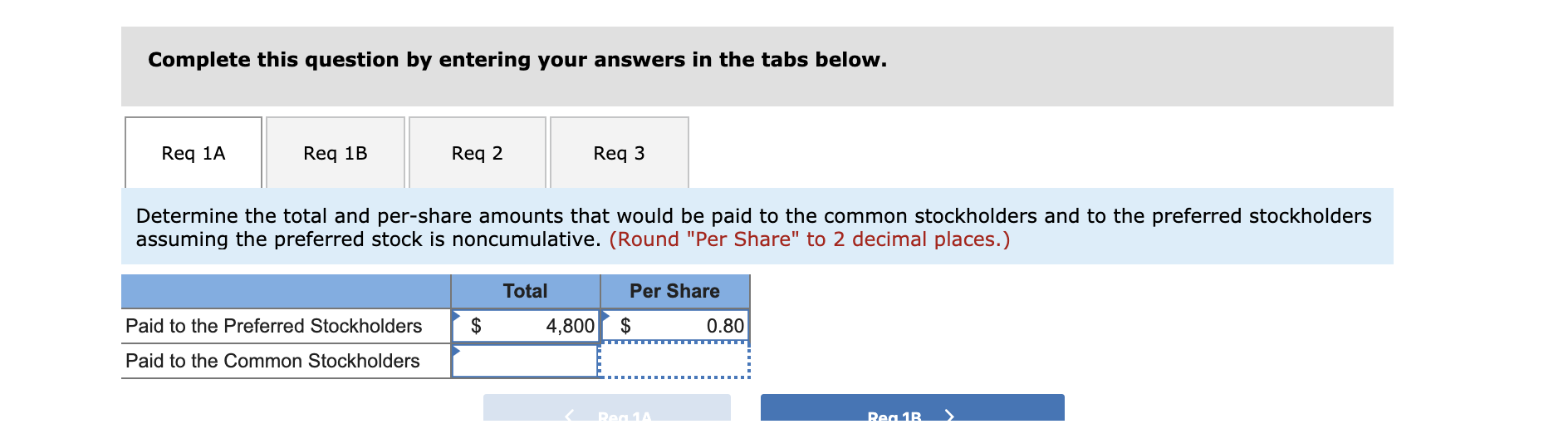

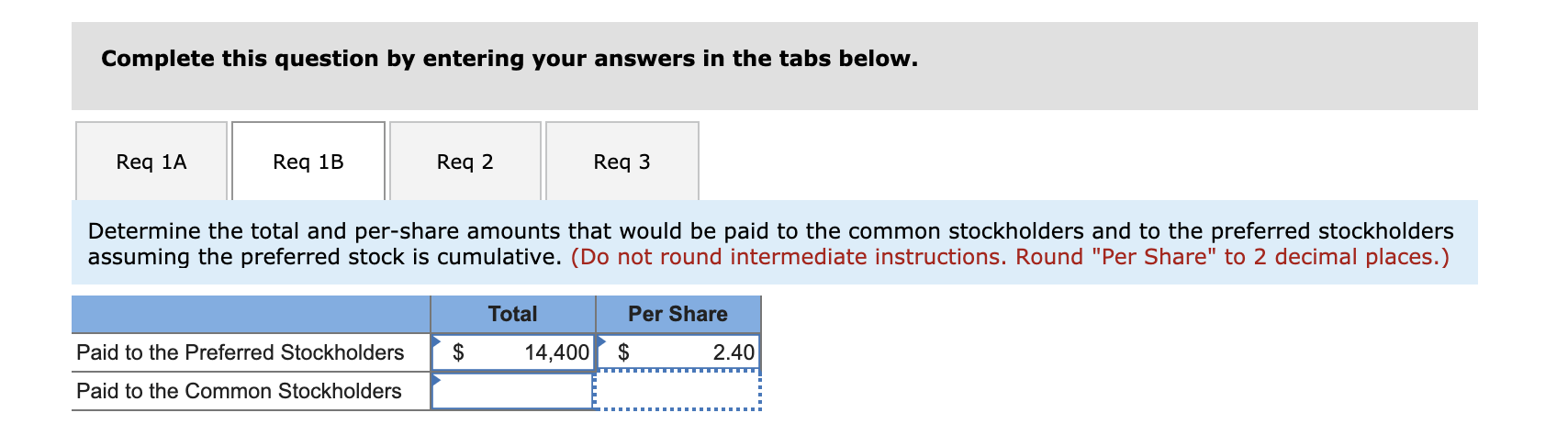

- Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions:

- The preferred stock is noncumulative.

- The preferred stock is cumulative.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started