Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the red form As a professional analyst you are responsible for valuing stocks. After gathering data on the Bluth Company you have estimated that its

the red form

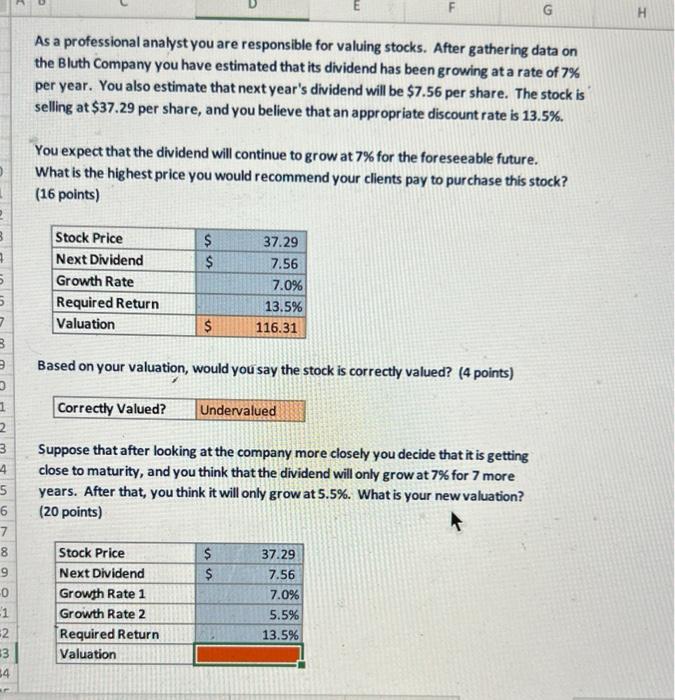

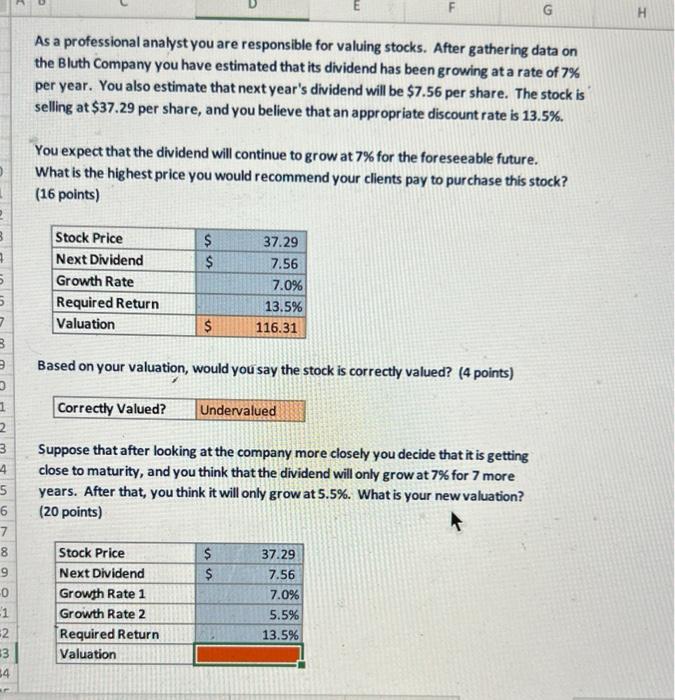

As a professional analyst you are responsible for valuing stocks. After gathering data on the Bluth Company you have estimated that its dividend has been growing at a rate of 7% per year. You also estimate that next year's dividend will be $7.56 per share. The stock is selling at $37.29 per share, and you believe that an appropriate discount rate is 13.5%. You expect that the dividend will continue to grow at 7% for the for eseeable future. What is the highest price you would recommend your clients pay to purchase this stock? (16 points) Based on your valuation, would you say the stock is correctly valued? (4 points) Suppose that after looking at the company more closely you decide that it is getting close to maturity, and you think that the dividend will only grow at 7% for 7 more years. After that, you think it will only grow at 5.5%. What is your new valuation? (20 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started